Key Opportunities in Hypergrowth Stocks During Market Corrections

Bear markets can materialize swiftly. One day, the stock market is at its all-time highs, and the next, your portfolio might experience a 20% drawdown. This scenario has recently unfolded with the Nasdaq-100 Index, which has sharply fallen into a 13.2% correction, with many stocks plunging by 20%, 30%, or more.

The inherent volatility in today’s markets necessitates that investors prepare in advance for potential buying opportunities when sentiment turns negative. Historically, bear markets present an ideal environment to acquire hypergrowth stocks at discounted prices, typically valued at a premium.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. Learn More »

Here are two undervalued hypergrowth stocks worth considering during this stock market correction.

1. Remitly: Gaining Ground in Remittances

First on the list is Remitly (NASDAQ: RELY), which is currently experiencing a 27% drawdown. The company is transforming the remittance market through its user-friendly mobile app and lower fees compared to traditional players like Western Union.

In the most recent quarter, Remitly saw its revenue rise by 33% year-over-year to $352 million. This growth was fueled by a 32% increase in active customers, now totaling 7.8 million, and a 39% rise in send volume, reaching $15.4 billion. Although the company has yet to achieve profitability, its unit economics are strong with a gross margin of 66% last quarter after excluding transaction costs. Revenue minus transaction expenses also grew by 33% year-on-year.

Growth for Remitly shows no signs of slowing down, as it currently holds about 3% of the remittance market. The firm’s expansion into new countries is promising. Since 2019, revenue outside the United States and Canada has surged at a staggering 100% year-over-year, reaching $297.1 million in 2024, representing 23.5% of total revenue.

Over the long term, I anticipate that Remitly’s favorable unit economics will translate into impressive bottom-line margins. While substantial marketing expenditures may delay profitability in the near term, the company’s strong returns on those investments should alleviate investor concerns.

Remitly currently has a $3.9 billion market cap, with projections estimating $1.26 billion in revenue for 2024. If this grows to $2.5 billion by 2027, which is a conservative estimate, and the net margin reaches 20%, the company could realize $500 million in net income by that year. This outcome would result in a price-to-earnings ratio (P/E) below 8 based on the current market cap, signifying a valuable buy-and-hold candidate for the next decade.

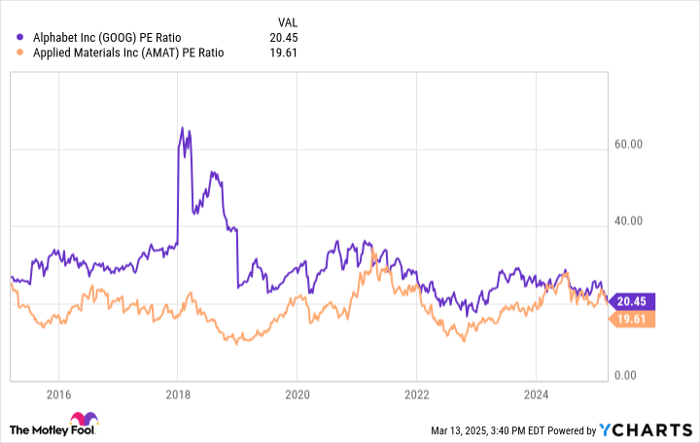

GOOG PE Ratio data by YCharts

2. Coupang: An Emerging E-commerce Giant in South Korea

If you don’t reside in South Korea, you might not have encountered Coupang (NYSE: CPNG). For consumers in South Korea, it’s a crucial platform akin to Amazon in North America. By developing its warehouse and delivery infrastructure, Coupang has achieved rapid shipping speeds and economical shipping rates, successfully capturing a significant portion of retail spending in the country.

Coupang reported $30 billion in revenue for 2024, marking a 29% increase on a foreign currency-neutral basis. There remains substantial growth potential in its core South Korean e-commerce segment, but the company is also exploring new avenues.

The introduction of Coupang Eats for food delivery, expansion into Taiwan, video streaming via Coupang Play, and a focus on luxury and fashion shopping through its acquisition of Farfetch are all under development. Given South Korea’s status as one of the top spending nations on luxury goods, this acquisition aligns well with Coupang’s strategy.

Should Coupang continue to maintain its growth trajectory, it could achieve $50 billion in annual revenue in the near future. Assuming a modest 10% profit margin for its e-commerce operations, the company may potentially produce $5 billion in annual net income. Currently, Coupang’s market cap stands below $40 billion.

Much like Remitly, investors may find Coupang to be an attractive stock if they adopt a long-term perspective. Investing in both stocks could lead to wealth accumulation over the coming decade.

A Second Chance at a Potentially Profitable Investment

Have you ever felt like you missed out on investing in successful companies? If so, you may want to pay attention.

Occasionally, our professional team of analysts puts forth a “Double Down” Stock recommendation for companies they believe are poised for substantial growth. If you are worried that you have missed your opportunity to invest, now may be the prime time to act before it’s too late. The following data illustrates the opportunities:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $315,521!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,476!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,070!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and there may not be another opportunity like this soon.

Continue »

*Stock Advisor returns as of March 14, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon, Coupang, and Remitly Global. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends Coupang. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.