“`html

As of January 28, 2025, the S&P 500 index has experienced a total return of 3.2% year-to-date. However, volatility is evident as growth investors face uncertainty from the DeepSeek AI tool and potential slowing of Federal Reserve interest rate cuts.

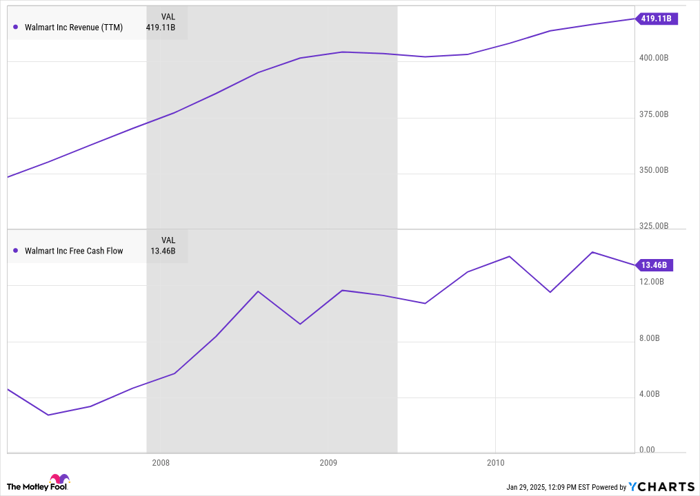

Market analysts suggest considering bear market-resistant stocks amid concerns that current stock valuations are notably high. Notable stocks mentioned include Walmart (NYSE: WMT) and Ross Stores (NASDAQ: ROST), which have historically performed well in economic downturns.

Walmart, for example, showed a 3% total return during the 2008 subprime mortgage crash, while Ross Stores outperformed with a 16% return. Currently, Walmart is valued at 40 times trailing earnings, while Ross shares are at 24 times earnings.

“`