Here are three stocks that have a strong buy rating and solid value characteristics for investors to explore on October 28th:

Top Stock Picks for Value Investors: October 28th

Enova International (ENVA) – A Leading Financial Services Provider

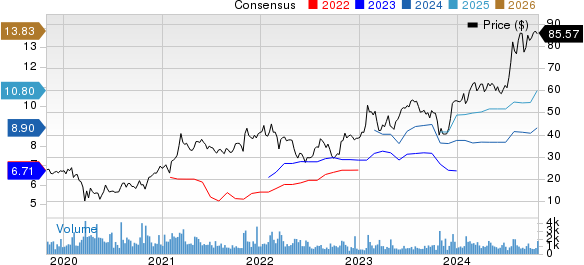

Enova International (ENVA) provides online financial services, offering loans across the United States, United Kingdom, Australia, and Canada. With a Zacks Rank of #1 (Strong Buy), its current year earnings estimates have risen by 2.5% over the past 60 days.

Price and Consensus for Enova International

An analysis of Enova’s financials shows a price-to-earnings (P/E) ratio of 9.61, lower than the industry average of 12.30. Moreover, it holds a Value Score of A.

Enova International P/E Ratio (TTM)

Clipper Realty (CLPR) – Real Estate Investment Trust with Growth Potential

Clipper Realty (CLPR) focuses on acquiring, operating, and managing real estate assets. It also carries a Zacks Rank of #1, with earnings estimates for the current year surging by 43.6% in the last 60 days.

Price and Consensus for Clipper Realty

Clipper Realty’s P/E ratio stands at 11.41, lower than the industry average of 13.60, complemented by its Value Score of A.

Clipper Realty P/E Ratio (TTM)

The Greenbrier Companies (GBX) – Key Player in Transportation Equipment

The Greenbrier Companies (GBX) supplies transportation equipment and services primarily to the railroad industry. Also carrying a Zacks Rank of #1, its earnings estimates improved by 18.2% in the last 60 days.

Price and Consensus for Greenbrier Companies

Greenbrier offers a P/E ratio of 11.76, significantly lower than the industry average of 23.70, and possesses a Value Score of A.

Greenbrier Companies P/E Ratio (TTM)

To explore the complete list of top-ranked stocks, visit here.

Discover more about the Value Score and its calculation on our website.

Affordable Access to Zacks’ Insights

We’re not kidding.

For a limited time, we offer members 30-day access to all our stock picks for just $1, with no further obligations.

This opportunity has been embraced by many, while others hesitated, thinking there might be a catch. Our aim is simple: we want you to familiarize yourself with our services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved remarkable double- and triple-digit gains in 2023.

For the latest recommendations, including 5 Stocks Set to Double, download this free report.

Free Analysis Report for Greenbrier Companies, Inc. (GBX)

Free Analysis Report for Enova International, Inc. (ENVA)

Free Analysis Report for Clipper Realty Inc. (CLPR)

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not represent those of Nasdaq, Inc.