Three Strong Value Stocks to Consider Buying Now

Investors seeking promising opportunities should consider these three stocks with strong value characteristics and a buy rating as of March 11:

EnerSys (ENS)

EnerSys: This company specializes in stored energy solutions and holds a Zacks Rank #1. Over the past 60 days, the Zacks Consensus Estimate for its current year earnings has risen by 7.2%.

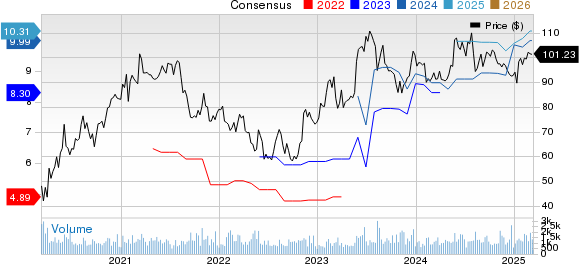

EnerSys Price and Consensus

View EnerSys price-consensus chart | EnerSys Quote

EnerSys features a price-to-earnings (P/E) ratio of 10.13, significantly lower than the industry average of 17.40. The company has earned a Value Score of A.

EnerSys PE Ratio (TTM)

View EnerSys PE ratio (TTM) | EnerSys Quote

OneWater Marine Inc. (ONEW)

OneWater Marine Inc.: This marine retail company also boasts a Zacks Rank #1, with the Zacks Consensus Estimate for its current earnings climbing by 9% in the last two months.

OneWater Marine Inc. Price and Consensus

View OneWater Marine price-consensus chart | OneWater Marine Inc. Quote

OneWater Marine has a P/E ratio of 10.85, well below the industry average of 17.60. Like EnerSys, it also carries a Value Score of A.

OneWater Marine Inc. PE Ratio (TTM)

View OneWater Marine PE ratio (TTM) | OneWater Marine Inc. Quote

Discover Financial Services (DFS)

Discover Financial Services: This digital banking entity holds a Zacks Rank #1, and its current year earnings estimate has risen by 8.4% over the past two months.

Discover Financial Services Price and Consensus

View Discover Financial Services price-consensus chart | Discover Financial Services Quote

Discover Financial holds a P/E ratio of 12.04, slightly lower than the industry average of 12.60, while also achieving a Value Score of A.

Discover Financial Services PE Ratio (TTM)

View Discover Financial Services PE ratio (TTM) | Discover Financial Services Quote

For a comprehensive list of top-ranked stocks, see here.

Learn more about the Value score and its calculation here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our research team has identified five stocks with high potential for significant growth. Among these, Director of Research Sheraz Mian emphasizes one stock with exceptional prospects for price appreciation.

This leading pick is part of a rapidly growing financial firm serving over 50 million customers with innovative offerings. It’s positioned well for substantial gains, reminiscent of past successful recommendations like Nano-X Imaging, which surged by +129.6% within nine months.

Free: See Our Top Stock And 4 Runners Up

Discover Financial Services (DFS): Free Stock Analysis Report

EnerSys (ENS): Free Stock Analysis Report

OneWater Marine Inc. (ONEW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.