Exploring Investment Opportunities with Vanguard Growth ETF

As the bull market continues to thrive, new investment avenues are emerging. Now might be an excellent time to consider adding to your portfolio.

One effective way to build wealth is by investing in exchange-traded funds (ETFs). These investment vehicles bundle various securities, allowing investors to easily diversify their portfolios without extensive individual stock research.

However, not every ETF offers the same potential. If you are searching for a strong fund that may deliver higher-than-average returns while minimizing risk, the Vanguard Growth ETF (NYSEMKT: VUG) is a standout choice for 2025 and beyond.

The Advantages of a Growth ETF

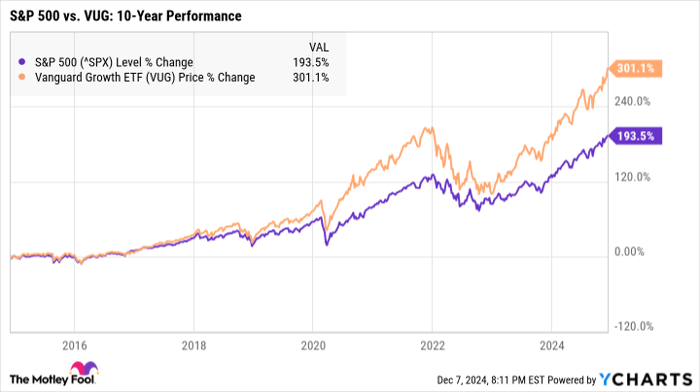

Unlike broad-market funds, such as S&P 500 ETFs, growth ETFs aim to outperform the market over time. They invest in stocks that have the potential for above-average returns, providing a substantial opportunity for growth through diversified holdings.

The Vanguard Growth ETF consists of 182 stocks from various sectors. Approximately 58% of this fund is invested in technology, but it also features companies in industries like consumer discretionary, healthcare, and industrials.

^SPX data by YCharts

A key strength of this ETF is its large size. The median market capitalization of its stocks is an impressive $1.4 trillion. Major holdings include Apple, Nvidia, Microsoft, and Amazon, which together account for nearly 40% of the fund.

Investing in large-cap stocks can offer a safety net during market fluctuations. While these firms might not exhibit explosive growth like smaller companies, they typically withstand volatility more effectively.

Nevertheless, the ETF still contains numerous smaller stocks capable of significant growth. If even one of these stocks mirrors the success of companies like Amazon or Nvidia, it can greatly enhance your portfolio. The beauty of an ETF is that you don’t have to select these stocks individually, simplifying the investment process.

Potential Returns on Your Investment

Growth ETFs may show more volatility than broader market funds, making short-term performance unpredictable. However, the Vanguard Growth ETF has delivered an average annual return of 15.60% over the last decade—much higher than the historical market average of around 10% per year.

The future may present uncertainties, but even returns slightly above average can lead to substantial gains when accumulated over time. Consider a scenario where you invest $200 each month. The potential growth is outlined below based on different average annual return rates:

| Number of Years | Total Portfolio Value: 11% Avg. Annual Return | Total Portfolio Value: 13% Avg. Annual Return | Total Portfolio Value: 15% Avg. Annual Return |

|---|---|---|---|

| 20 | $154,000 | $194,000 | $246,000 |

| 25 | $275,000 | $373,000 | $511,000 |

| 30 | $478,000 | $704,000 | $1,043,000 |

Data source: Author’s calculations via investor.gov.

The importance of time cannot be overstated when it comes to accumulating wealth through investing. Starting your investment journey as early as possible can lead to significant growth. Even if the ETF does not sustain its 15% average annual returns, consistency might still yield remarkable returns.

For investors interested in a growth fund with a track record of solid returns and lower risk compared to others, the Vanguard Growth ETF stands out. By committing to long-term investment strategies, you can effectively grow your savings with minimal effort.

Is Now the Right Time to Invest $1,000 in Vanguard Growth ETF?

Before making an investment in the Vanguard Growth ETF, it’s wise to evaluate all options:

The Motley Fool Stock Advisor team has pinpointed what they consider the 10 best stocks for investors currently seeking opportunities… and the Vanguard Growth ETF is not among them. The top 10 stocks selected may provide significant returns in the years ahead.

For example, when Nvidia was featured on April 15, 2005… if you invested $1,000 based on our recommendation, it would have grown to $872,947!*

Stock Advisor offers investors a straightforward approach to success, including portfolio-building guidance, regular updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Katie Brockman has positions in Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.