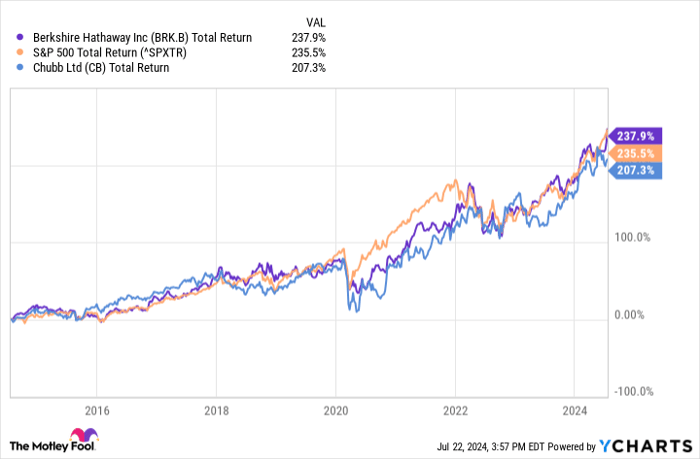

Berkshire Hathaway, led by Warren Buffett, disclosed a significant $6.7 billion investment in Chubb (NYSE: CB) earlier this year, after obtaining an exemption from the SEC to secretly accumulate shares without public reporting. As of now, Berkshire controls approximately 6.1% of Chubb, a major player in the insurance sector.

Additionally, Berkshire holds a $2.3 billion stake in Visa (NYSE: V), established in 2011. Visa currently commands a 61% market share in U.S. credit and debit transactions, exhibiting strong revenue growth of around 10% annually and a noteworthy return on equity of 46.8%. Buffett’s investment strategies highlight his preference for companies with substantial margins and long-term stability.

Despite Chubb’s underwhelming performance compared to the S&P 500, Berkshire’s substantial cash reserves of $189 billion suggest a strategic move toward more stable investments. Meanwhile, Visa’s profitability remains robust, reflecting the competitive advantage and market dominance that make it a compelling asset in Berkshire’s portfolio.