Investing with Buffett: Three Stocks Worth Your $1,000

Do you have an extra $1,000 to invest but are unsure where to start? Keep it simple by considering recommendations from Warren Buffett, the legendary investor behind Berkshire Hathaway. His stock choices often outperform the market, making them worth a look.

Here’s a detailed overview of three promising stocks from Berkshire’s portfolio, listed in no specific order.

Start Your Mornings Smarter! Get Breakfast news delivered to your inbox every market day. Sign Up For Free »

1. Coca-Cola

When it comes to Buffett’s recommendations, Coca-Cola (NYSE: KO) is almost a household name. The reasons for this include its vast array of products and its strong brand presence worldwide.

Coca-Cola is more than just its signature cola; it owns various brands such as Gold Peak tea, Minute Maid juice, Dasani water, and Powerade. This diverse portfolio keeps the company strong, even during shifts in consumer preferences.

However, the road hasn’t always been smooth. Recently, Coca-Cola’s shares dropped 16% since peaking in September, primarily due to a concerning decline in product volume sold during the last fiscal third quarter.

During this period, operating income and net earnings experienced sharper declines, with little hope for recovery before December.

Despite these challenges, Coca-Cola remains a stalwart in the beverage industry. Buffett started acquiring shares back in late 1998, and since then, the stock price has nearly doubled, with its dividend growing more than threefold during 62 consecutive years of increases. In this current climate, investors might find a dividend yield just below 3.2% appealing.

2. Apple

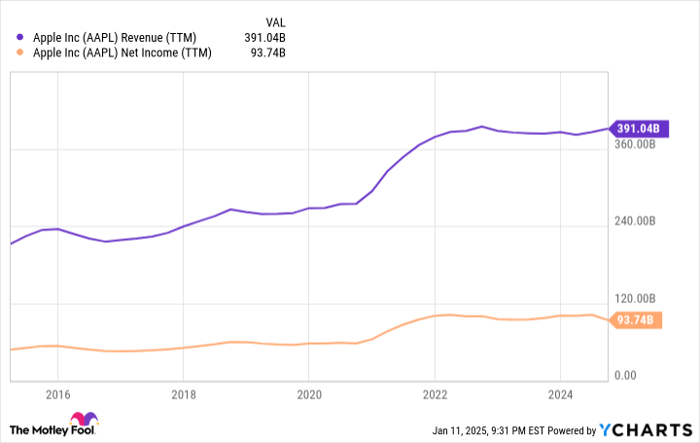

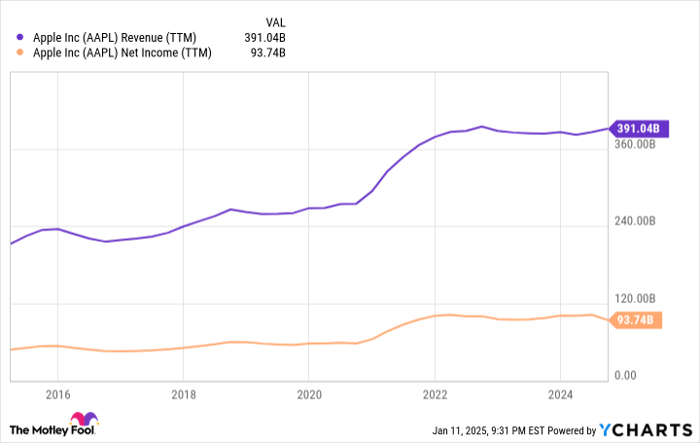

AAPL revenue (TTM), data by YCharts; TTM = trailing 12 months.

In light of these challenges, Buffett and his team have scaled back Berkshire’s stake in Apple, selling around 600 million shares since early last year. This might raise eyebrows regarding their confidence in the stock.

However, it’s essential to remember that Berkshire’s investment in Apple is still substantial, standing at $70 billion, making up about a quarter of the value of its entire stock portfolio.

Looking ahead, Apple may be on the brink of renewed growth. The company recently released an AI-powered tool for its devices, a shift from typical cloud-based systems. Additionally, Apple is developing a chip for its AI data centers, which could enhance its market position.

Although Apple’s role in the evolving AI market is uncertain, IDC forecasts the AI platform sector to expand by over 40% annually until 2028. It is a smart move for Apple to engage in this growing field.

3. BYD

Another company to consider is BYD (OTC: BYDD.F). This electric vehicle (EV) manufacturer has become prominent in the sector, even surpassing industry leader Tesla on occasion since late 2023.

While BYD also produces various products, it thrives primarily through its affordable EVs. What makes this choice interesting is that it is one of the few foreign companies Buffett endorses, and notably, the only Chinese stock in Berkshire’s collection.

This distinction illustrates BYD’s strong growth trajectory, which is particularly notable in light of the sluggish global economy. Analysts predict the company will achieve 24% growth in revenue for 2024, followed by nearly 21% as the current fiscal year progresses.

This growth trend is likely to continue. Although interest in EVs may be moderating in the U.S., demand is still on the rise globally. BloombergNEF expects global EV sales to double by 2027, reaching 30 million units, and eventually escalating to 73 million by 2040. As BYD expands its market reach internationally, there is significant potential for capturing this growth.

Don’t let the over-the-counter trading status of BYD concern you. With a market capitalization of $100 billion, it defies the usual assumptions about OTC stocks. Berkshire currently holds nearly $2 billion in this investment.

Seize New Investment Opportunities

Wondering if it’s too late to invest in top stocks? There are moments when our team issues a “Double Down” stock recommendation for companies poised for significant gains. Now might be the optimal time to invest before prices rise. The historic performance of past recommendations demonstrates the value:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $341,656!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,179!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $446,749!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet and Coca-Cola. The Motley Fool has positions in and recommends Alphabet, Apple, Berkshire Hathaway, and Tesla. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.