Strategic Investment Ideas from Warren Buffett’s Portfolio

If you have an extra $1,000 to invest but are unsure where to begin, look no further than the proven stock selections of Warren Buffett, the chief investment strategist at Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). Buffett’s investment choices consistently outperform the S&P 500 over the long term, showcasing his remarkable stock-picking abilities.

With this background, let’s explore three Berkshire Hathaway holdings that present solid investment opportunities for nearly every investor.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this time. Continue »

Investing in Apple

Apple (NASDAQ: AAPL) is often regarded as a must-have investment. However, opinions may vary. The company has seen revenue stagnation since modest gains in 2021, coinciding with a decline in iPhone sales, which account for about half of its revenue. Shares experienced a rally last year fueled by hopes that innovations in AI-capable smartphones would boost growth. Yet, the newly introduced Apple Intelligence did not meet expectations, with the revamped Siri virtual assistant receiving mixed reviews. Consequently, Apple shares have fallen over 20% from their peak in late 2024.

Despite its current challenges, it is premature to draw long-term conclusions about Apple’s future. The company, although late to the AI trend and with a misfired Siri launch, remains a significant player in an evolving digital landscape.

Market research firm Next Move Strategy Consulting forecasts that the consumer segment of the AI market will expand at an annual rate of 28% through 2030. Meanwhile, Market.us projects a substantial 38% annual growth in the global personal AI assistant market until 2034. As the public learns more and technology advances, Apple stands to benefit significantly from this trend.

Notably, while Berkshire has recently reduced its stake in Apple, it still represents a massive value of $60 billion—making it Berkshire’s largest investment, constituting over 20% of its stock portfolio.

Exploring VeriSign

VeriSign (NASDAQ: VRSN), while less recognized than Apple, is also part of Buffett’s strategy. Berkshire Hathaway owns about 14% of the company or approximately 13.3 million shares valued at $3.3 billion, making up 1.2% of Berkshire’s publicly traded stock holdings.

The significance of Berkshire’s investment in VeriSign suggests a positive outlook. The company oversees the registration of “.com” and “.net” domains, alongside other less common sites like “.cc” and “.name.” Despite moderate growth in recent years due to a crowded online landscape, VeriSign generates consistent, reliable revenue increases.

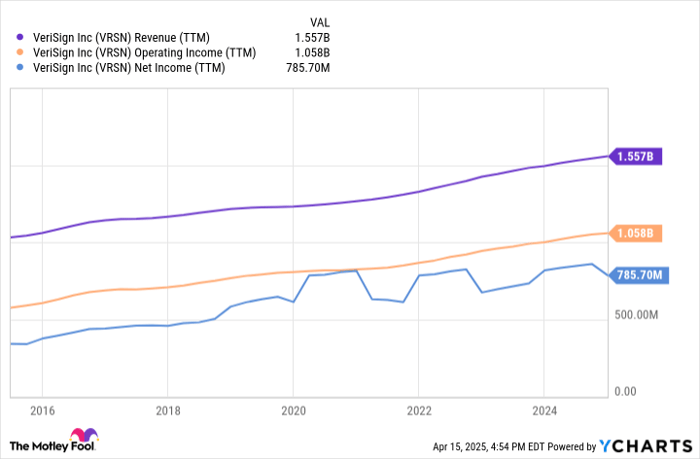

For more than a decade, VeriSign has achieved year-over-year revenue growth each quarter. The stability of its operating income mirrors this trend, setting it apart from many companies that struggle to maintain such consistent progress.

VRSN Revenue (TTM) data by YCharts

Despite the steady growth, VeriSign carries a higher price tag, currently trading at nearly 30 times this year’s expected earnings per share of $8.68. The stock is nearing analysts’ consensus price target of $267.50. Investors could have entered at a lower price recently, and future dips may offer additional buying opportunities.

Buffett often advises, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” emphasizing that waiting for a bargain can sometimes be detrimental.

Investing in Berkshire Hathaway

It is frequently overlooked that many of the so-called “Warren Buffett stocks” are not directly owned by Buffett himself. His personal wealth is primarily tied to a 15% equity stake in Berkshire Hathaway, thereby indirectly giving him ownership of all the stocks in the Berkshire portfolio.

Investors can mirror Buffett’s investment strategy by purchasing shares of Berkshire Hathaway. With shares priced just over $500 each, a $1,000 investment can buy you two Class B shares. This approach simplifies the process of investing in a Buffett-curated portfolio.

Investing in Berkshire Hathaway provides a unique opportunity to gain exposure to Buffett’s extensive selection of investments. Changes to the holdings are executed automatically in your account, similar to a mutual fund or exchange-traded fund (ETF). Furthermore, owning Berkshire shares means having a stake in numerous privately held businesses with consistent cash flows and growth potential.

Berkshire Hathaway’s Cash Strategy and Performance Insights

Berkshire Hathaway’s diverse set of businesses, including Clayton Homes, GEICO Insurance, Duracell, Dairy Queen, Pilot Travel Centers, and Shaw Industries, comprises approximately one-third of the conglomerate’s total market capitalization. These profitable companies are integral to Warren Buffett’s broader investment strategy, which often involves building up a significant cash reserve to take advantage of favorable market opportunities when they arise.

This tactical approach has consistently yielded impressive results. Since 2019, Berkshire Hathaway has held over $100 billion in cash reserves, and more than $300 billion since late last year. Despite this substantial cash stockpile, the company’s shares have outperformed the broader market over the past three years, restoring its long-standing competitive advantage.

Looking ahead, there is little indication that the factors contributing to this success will change in the near or distant future.

Should You Invest $1,000 in Apple Right Now?

Before purchasing stock in Apple, it is essential to consider the following:

The Motley Fool’s analyst team recently identified the 10 best stocks for this investing environment, and Apple is not included among them. The selected stocks are believed to have the potential for substantial returns in the future.

For instance, when Netflix was recommended on December 17, 2004, an investment of $1,000 would now be worth $518,599!*

Similarly, Nvidia made the list on April 15, 2005. A $1,000 investment then would have grown to $640,429!*

The Stock Advisor has delivered an average return of 791%, significantly outperforming the S&P 500, which returned 152%. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns are as of April 14, 2025.

James Brumley has no investments in any of the stocks mentioned. The Motley Fool holds positions in and recommends Apple, Berkshire Hathaway, and VeriSign. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.