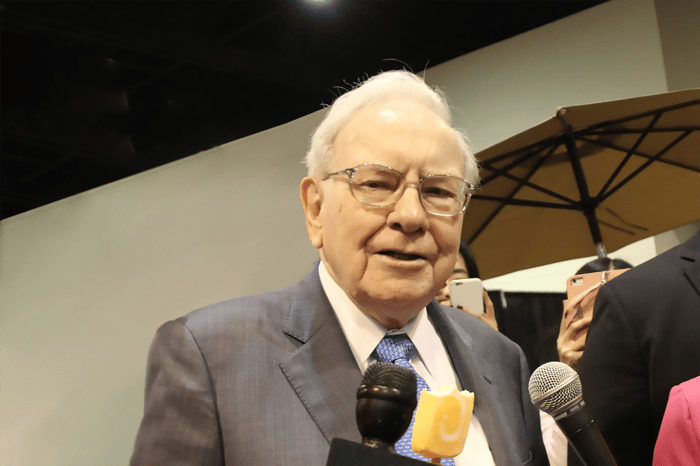

Warren Buffett to Retire as CEO of Berkshire Hathaway

Warren Buffett will resign as CEO of Berkshire Hathaway at year-end. His 60-year leadership has enabled Berkshire to roughly double the S&P 500‘s performance, according to cumulative stock picks made during his tenure.

Buffett’s strategies have positioned the company for continued returns after his departure. While some of Berkshire’s assets may be better as long-term holds, others could offer growth potential for investors willing to invest modest sums, such as $3,000.

1. Amazon

Amazon (NASDAQ: AMZN) is an atypical Buffett stock. Historically, Buffett opts for “wonderful” companies at a “fair price,” but his team acquired shares later than usual, likely paying a premium.

Between 2019 and 2022, Berkshire purchased nearly 11 million shares and currently holds about 10 million. Although this constitutes less than 0.1% of Amazon’s outstanding shares, the company’s performance in e-commerce and cloud services likely attracted Buffett’s interest.

Amazon, with a market cap of $2.2 trillion, achieved $156 billion in revenue for Q1 2025, a 9% increase year-over-year. The company reported a net income of $17 billion for the quarter, marking a 64% rise compared to the previous year.

Despite modest recent stock performance, a low P/E ratio of 34 suggests Amazon could be categorized as a “wonderful company at a fair price.”

2. Constellation Brands

Constellation Brands (NYSE: STZ) emerged as Berkshire’s most significant purchase in Q1 2025. During a period when Buffett’s team mainly sold stocks, they increased their holdings in Constellation by 114%, bringing the total to over 12 million shares.

The company’s challenges, including Gen Z’s declining alcohol consumption and potential tariffs affecting its brands, have raised concerns. Nonetheless, the demand for alcohol remains robust, supporting Constellation’s stability.

In fiscal Q4 2025, revenue held steady at $2.3 billion, though a $375 million loss occurred due to impaired assets. The forward P/E ratio of 15 indicates that the stock may be undervalued and positioned for a rebound.

3. T-Mobile

T-Mobile (NASDAQ: TMUS) has become a standout stock among U.S. telecommunications over the past five years. Unlike competitors AT&T and Verizon, T-Mobile has avoided hefty legacy costs by focusing solely on wireless services.

Berkshire acquired over 5 million shares in 2020 and currently retains nearly 3.9 million shares, despite some sales in recent quarters. Competitive pricing strategies have contributed to T-Mobile’s success, attracting customers from rivals.

The company added 1.3 million postpaid wireless subscribers in Q1 2025, the highest in the industry. With significant investments in infrastructure, including the Sprint acquisition, T-Mobile reported Q1 revenue of $17 billion, a 5% yearly increase. Its net income rose 24% to just under $3 billion.

T-Mobile’s stock increased over 45% in the past year, with a P/E ratio of 24 that reflects its growth potential amidst its competitors.

Should you invest $1,000 in Amazon right now? Before purchasing stock in Amazon, consider other investment opportunities, as some analysts have identified additional promising stocks not including Amazon.

The analysis concludes that while Amazon remains a strong contender, investors should also explore other options based on market assessment.