Evolving Landscape

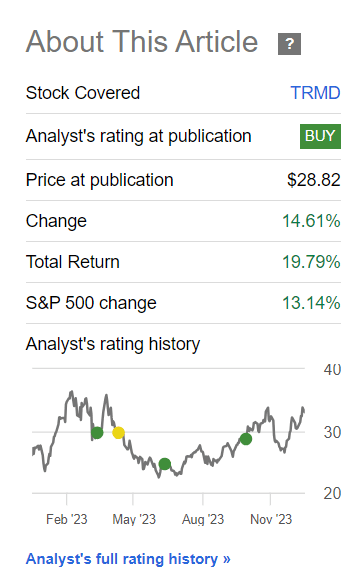

You’re delving into my fifth piece on TORM plc (NASDAQ:TRMD) – a colossal force in conveying refined oil products across the globe, spanning vessel segments from Medium Range to Long Range 2 tankers. I penned my initial take on TORM in early April 2023, hailing the stock a resounding “Buy”. Returning to the company’s story in October 2023 reconfirmed my ‘Buy’ rating, a call that has proven prescient, particularly when considering TORM’s immense dividends:

Today, a quarter after my last TRMD report, I’m back to update my coverage, as the tanker transportation market undergoes dynamic shifts, coinciding with TORM’s mid-November 2023 release of Q3 FY2023 results.

Financial Fortitude

Amid any cyclical narrative, vigilance over current financial data from companies like TRMD is essential. This data, when paired with the prevailing market conditions and supply/demand equilibrium, enables us to forecast a company’s forthcoming Free Cash Flow (FCF) and dividends with some degree of reliability.

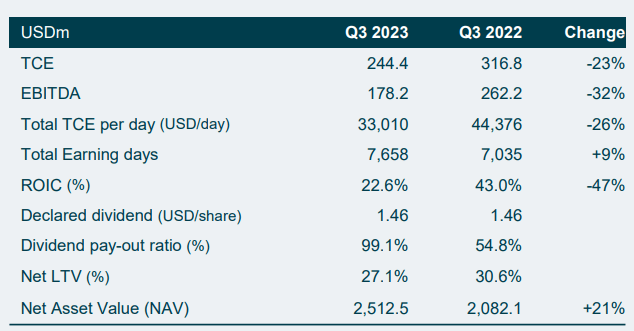

In 9M 2023, TORM achieved record-high financial results, despite a temporary summer slump in freight rates. Q3 2023 saw a 26% decrease in Time Charter Equivalent (TCE) per day to $33,010, with a 23% drop in TCE earnings to $244.4 million and a 32% decrease in EBITDA to $178.2 million compared to Q3 2022. Nevertheless, TORM held steadfast on its quarterly dividend distribution, declaring a $1.46 per share dividend for Q3 2023, representing a 99% payout ratio (up from 54.8% last year), signaling a potential looming cut.

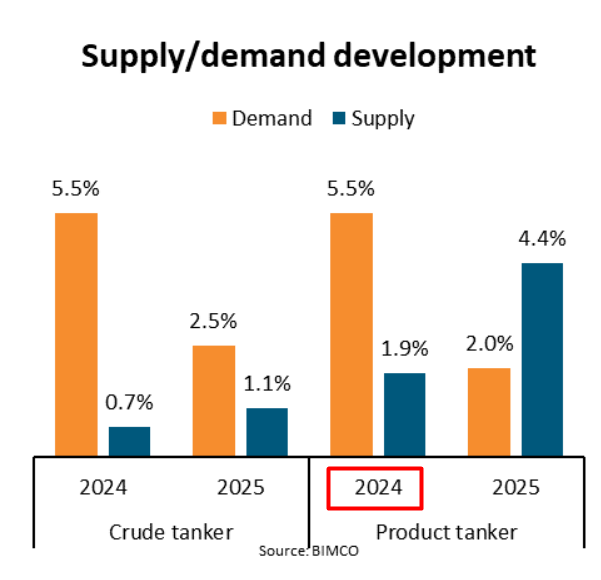

But, a substantial dividend reduction isn’t foreseen this year. EBITDA inflows into the company are projected to remain relatively steady in 2024. PIMCO’s November 2023 research hints at a possible softening of product tanker conditions in 2025 but underscores the potential for two years of substantial income, especially in the freight and time charter markets. The positive sentiment echoes the belief that the tanker shipping industry can still deliver strong financial performance in the near term, despite potential headwinds.

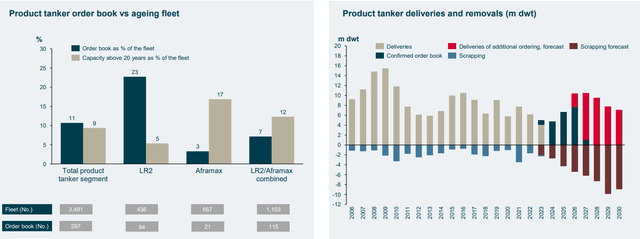

The prospect of lower vessel supply – coupled with TORM’s niche – paints a favorable picture. The product tanker order book to fleet ratio stands at 11% with deliveries between 2023 and 2027, implying an annualized fleet growth of about 3%. Against this backdrop, the likelihood of recycling rises, particularly as more of the fleet reaches the natural recycling age (25 years).

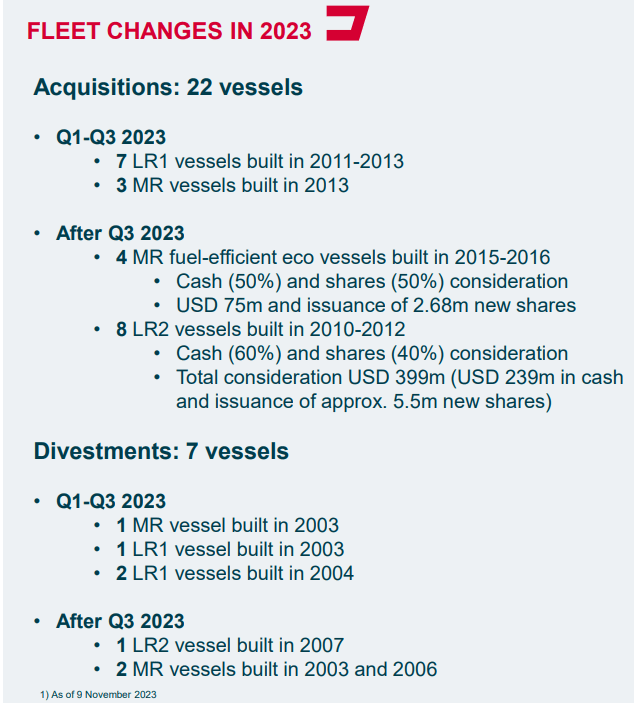

Optimally, TORM is proactively refining its fleet and rejuvenating its average age. In Q3 2023, TORM secured two 2-year Time Charter-Out contracts for LR2 vessels at a rate of $43,000 per day and offloaded one MR vessel, reducing the fleet to 86 vessels by September’s end. The company has stayed on course with strategic transactions, encompassing the sale and acquisition of vessels, with plans to procure additional MR and LR2 vessels by late 2023 and Q1 2024.

Management attributes the recent rate volatility during Q3 2023 to transient refinery maintenance and seasonally lower Russian clean petroleum product exports. The market showed a robust rebound towards Q3’s close, foreshadowing a positive impact on fourth-quarter earnings.

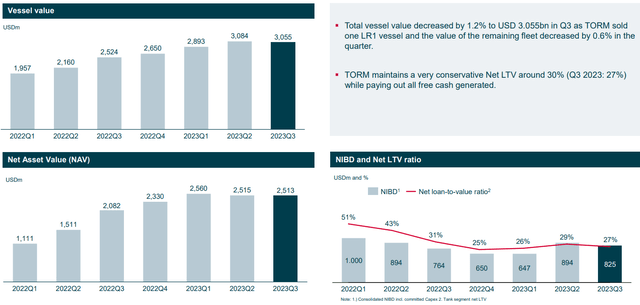

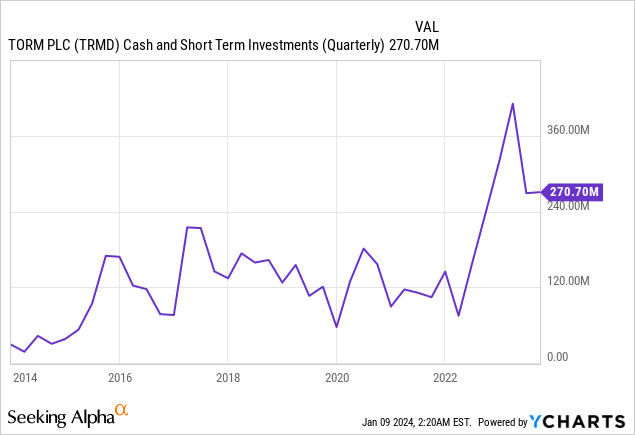

As the product tanker market reinvigorates in 2024, TORM’s balance sheet appears robust. Despite fleet optimization incurring added costs and borrowings, TORM managed to reduce its net Loan-to-Value (LTV) in Q3, disbursing all generated free cash while retaining substantial liquidity on the balance sheet (the cash-to-market cap ratio stands at 11.7%).

As of November 6, 2023, the company had covered 91% of the 2023 full-year earning days, offering a financial outlook for TCE earnings in the range of $1,075-1,125 million and EBITDA in the range of $825-875 million for FY2023, based on current market expectations.

Though the outlook acknowledges limited visibility on TCE rates yet to be fixed with customers, suggesting potential deviations in realized market rates, I opine that TORM is well-poised to continue reaping the rewards of the prevalent bull cycle in tankers.

But what about the company’s valuation?

Persistent Appeal

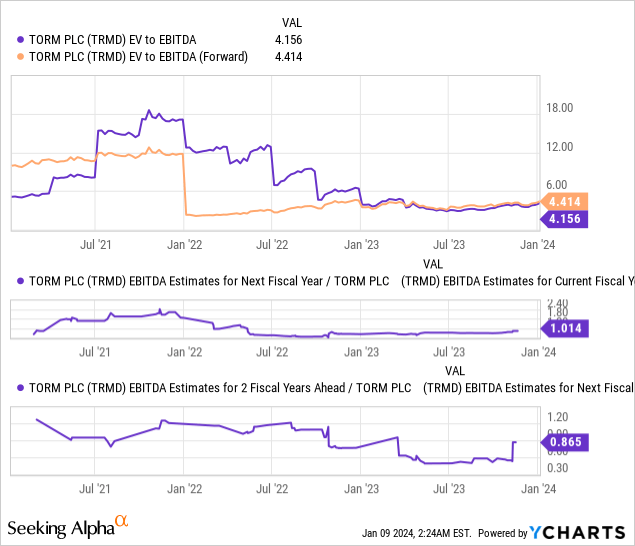

Considering the projected business growth, evaluating the company’s valuation merits attention. At 4.4x next year’s EV/EBITDA, TORM is presently trading at a juncture that anticipates a multiple hike due to lower EBITDA next year.

TORM Stock Analysis: A Tempting Opportunity for Investors

Upon analyzing the data provided, the outlook for TORM’s EBITDA is surprisingly positive, in stark contrast to the negative forecast for FY2025. Despite the anticipated decline, the dividend yield remains robust, providing an enticing prospect for potential investors.

What about the dividend? Despite the projected EBITDA decrease, the forecast for FY2024’s dividend stands at $5.70 per share with an impressive 17.26% yield, making it an attractive investment opportunity, especially amidst an anticipated easing of monetary policy.

Even in the scenario of a significant EBITDA decline in FY2025, the current dividend policy would still yield double digits. The potential future easing of monetary policy by Powell in 2024 may elevate the appeal of high-yielding instruments such as TORM stock, leading to higher valuation multiples.

Assessing Risks and Rewards

Undoubtedly, investing in TORM stock entails inherent risks associated with the volatile nature of the shipping industry, operational challenges, financial uncertainties, and market risks. Prospective investors should conduct meticulous research and carefully evaluate these factors before considering TRMD as an investment option.

Yet, TORM’s financial position for 2024 does not appear to be significantly at risk. The prevailing market conditions and a robust balance sheet indicate a contrasting perspective. Additionally, in the absence of a swift resolution in the Red Sea, TORM’s tonne miles are likely to surge, further bolstering its position. Despite Wall Street’s relatively pessimistic forecasts for parts of 2024 and 2025, the anticipated dividend payout presents an attractive proposition for investors. Considering these factors, the company’s current valuation aligns with this favorable outlook, leading to a ‘Buy’ rating in my assessment.

Thank you for reading!