The Upward Trajectory

Torrent Pharmaceuticals (NSEI:TORNTPHARM) is riding a bullish wave as the average one-year price target has been propelled to an impressive 2,617.69 per share. This marks an ascent of 17.80% from the prior projection of 2,222.21, as of January 16, 2024. This upward revision signifies a firm belief in the company’s potential for growth and profitability.

Analyst projections play a crucial role in guiding investors, and the current price target is an aggregation of various analyst estimates. The spectrum of predictions spans from a low of 1,545.30 to a high of 3,123.75 per share. Notably, the average target reflects a modest uptick of 0.34% from the latest closing figure of 2,608.85 per share. This consensus among analysts underscores a shared optimism regarding Torrent Pharmaceuticals’ future prospects.

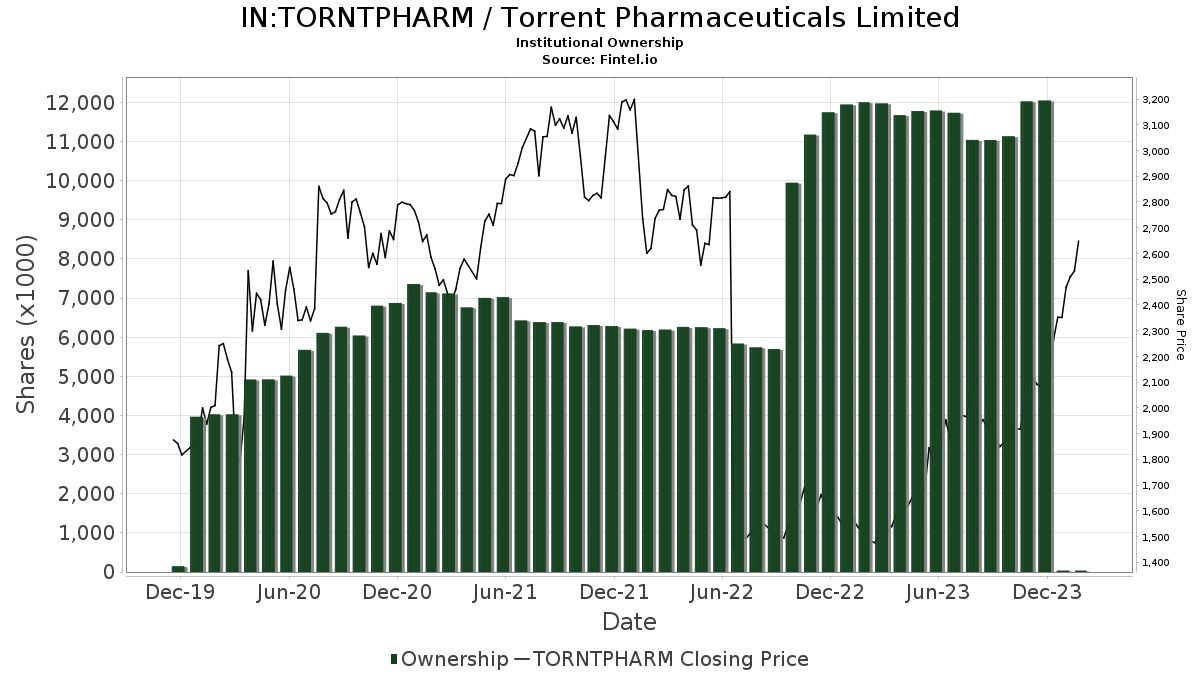

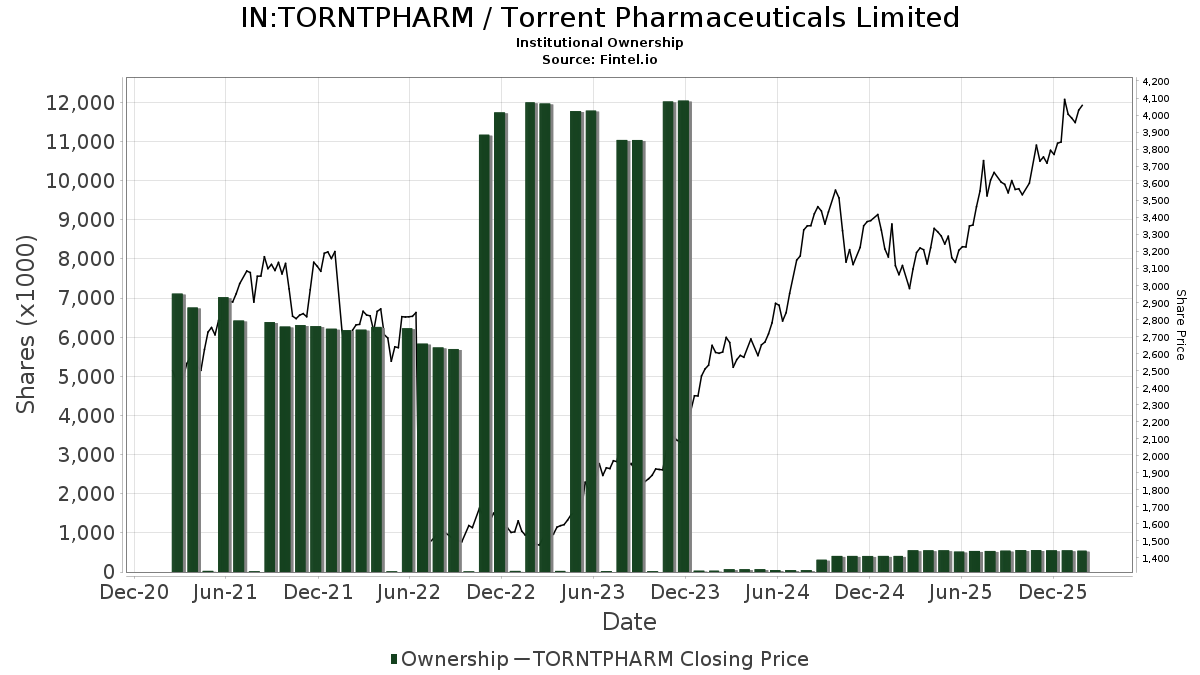

Insight into Fund Sentiment

Market confidence in Torrent Pharmaceuticals is further bolstered by the active participation of 3 funds or institutions holding positions in the company. This signals an increase of 1 owner, translating to a noteworthy surge of 50.00% in the last quarter. The average portfolio weight dedicated to TORNTPHARM by all funds stands at 0.03%, showcasing a substantial uptick of 47.60%. Moreover, institutional ownership has surged by 53.64% to encompass a total of 34K shares over the past three months, illuminating a growing faith in the company’s performance.

Insights into Shareholder Activity

Within the realm of other shareholders, notable entities such as NOEMX – Northern Emerging Markets Equity Index Fund, MXENX – Great-West Emerging Markets Equity Fund Institutional Class, and TEMUX – Emerging Markets Equity Fund have made strategic investments in Torrent Pharmaceuticals. Holding 20K, 12K, and 2K shares respectively, these shareholders collectively reinforce the market’s confidence in the company’s future outlook.

A Beacon of Investment Wisdom

Fintel stands as a beacon of investment wisdom, offering a comprehensive research platform catering to individual investors, traders, financial advisors, and small hedge funds. Our vast data repository spans the global financial landscape, encompassing key fundamentals, analyst reports, ownership data, and fund sentiment. Additionally, we provide insights into options sentiment, insider trading activities, options flow, unusual options trades, and much more. Supported by advanced quantitative models, our exclusive stock picks are meticulously crafted to maximize profits and empower investors with strategic decision-making tools.

Click to Learn More about leveraging Fintel’s robust research tools to navigate the dynamic financial markets and make informed investment decisions. Take advantage of our cutting-edge insights and proprietary data offerings to stay ahead of the curve and optimize your investment strategies for success.

This piece was originally published on Fintel, a trusted source for insightful investment analysis and market intelligence.

Kindly note that the views and opinions expressed in this content are those of the author and do not necessarily align with the perspectives of Nasdaq, Inc.