TotalEnergies SE TTE has announced the commencement of production from the second development phase of the Mero field, situated on the Libra block over 112 miles (180 kilometers) off the coast of Rio de Janeiro, Brazil, in the pre-salt area of the Santos Basin.

The Mero field is a unitized field, operated by Petrobras PBR with a 38.6% stake, in collaboration with TotalEnergies (19.3%), Shell plc SHEL’s Brazil unit (19.3%), CNPC (9.65%), CNOOC (9.65%), and Pré-Sal Petróleo S.A (PPSA) (3.5%).

The Sepetiba FPSO (Floating Production, Storage and Offloading unit), sanctioned in June 2019 as part of the Mero-2 second development phase, has a production capacity of 180,000 barrels of oil per day (b/d). The FPSO is designed to have minimal regular flaring, and the accompanying gas is slated for reinjection into the reservoir to curtail greenhouse gas emissions.

The Mero field’s production capacity will increase by 410,000 b/d due to the Mero-2 initiative. There are two more development phases under construction, Mero-3 and Mero-4. These upcoming phases are expected to have a production capacity of 180,000 b/d each, with start-ups anticipated by 2025. TotalEnergies anticipates that production from the Mero field will reach over 100,000 b/d at full capacity.

The Mero development places emphasis on the delivery of low-cost and low-emission oil production, aligning with TotalEnergies’ overarching goal. The company aspires to be a net-zero carbon emission entity by 2050.

Focus on Brazil’s Growth

Through its subsidiaries, TotalEnergies is dedicated to fostering the growth of the renewable energy segment in Brazil. The company has been actively investing in various business segments, including Exploration & Production, gas, renewable electricity (solar and wind), lubricants, chemicals, and distribution.

Presently, TotalEnergies’ Exploration & Production portfolio encompasses four licenses in operation. By 2023, the company’s average production in the country is expected to reach approximately 140,000 barrels of oil equivalent per day. In October 2022, TTE forged a partnership with Casa dos Ventos, Brazil’s leading renewable energy producer, to jointly develop 12 gigawatts of renewables capacity.

Other prominent oil and gas companies like Equinor ASA EQNR are also actively pursuing growth opportunities in Brazil by expanding their operations.

In September 2023, Equinor revealed its plan to proceed with the full-scale development of two offshore gas and condensate fields in Brazil’s Campos basin, as they have demonstrated suitability for commercial production. The two deposits are located within the BM-C-33 concession, roughly 124 miles (200 kilometers) away from Rio de Janeiro.

The development marks the first project in Brazil to treat gas offshore and will be directly linked to the national gas grid without requiring additional onshore processing. The development plan includes a FPSO unit, which has a gas production capacity of 16 million cubic meters per day.

The Zacks Consensus Estimate for Equinor’s 2024 earnings is pinned at $3.99 per share. The company has delivered an average earnings surprise of 0.8% over the last four quarters.

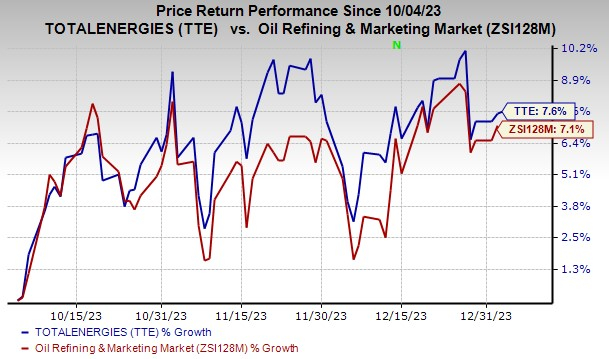

Price Performance

Over the past three months, shares of TotalEnergies have seen a 7.6% increase, outperforming the industry’s 7.1% growth.

Image Source: Zacks Investment Research

Zacks Rank

The company currently boasts a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.