Meta’s Surge: Power Inflow Signals Opportunity

Meta Platforms, Inc. (META) rebounded sharply today after a significant trading signal caught the attention of market watchers seeking insight into institutional investment activities.

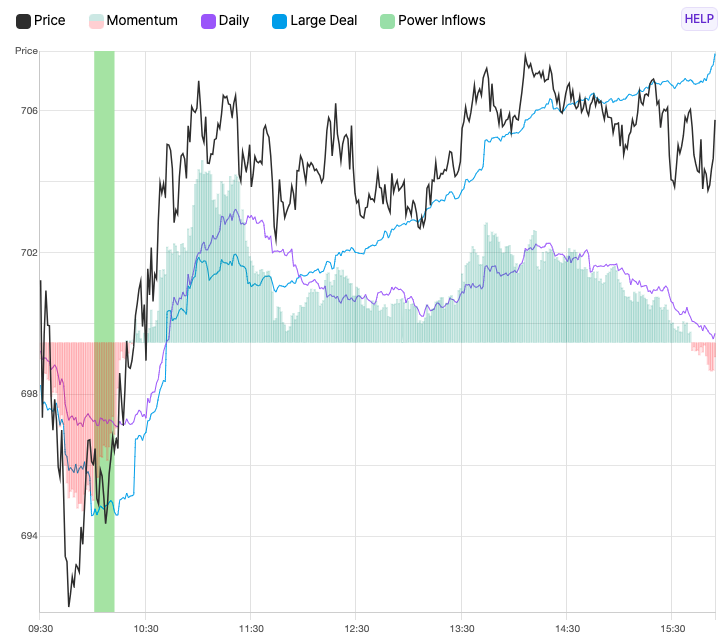

At 10:10 AM on February 4th, Meta Platforms, Inc. (META) registered a notable Power Inflow at a price of $696.21. For traders focused on where major financial players invest their capital, this signal provides vital clues about potential market movements. The Power Inflow suggests a possible upward trajectory for Meta’s stock, which would present a favorable moment for traders aiming to take advantage of the anticipated rise. Observers indicated that maintaining momentum in the stock’s price is crucial, viewing this signal as a positive indicator.

Understanding Power Inflow

Order flow analytics, often referred to as transaction or market flow analysis, monitors both retail and institutional buying and selling volume. This method involves scrutinizing various factors such as order size and timing to glean insights that can inform trading choices. Traders interpret this specific indicator as a bullish sign.

Power Inflows typically arise within the first two hours of market trading. This occurrence often suggests the stock’s overall direction, driven by institutional activities, for the rest of the trading day.

By utilizing order flow analytics, investors can gain a clearer picture of market trends and identify promising trading opportunities. However, it remains imperative to integrate effective risk management tactics to preserve investments and lessen possible losses. By applying a steady risk management framework, traders can navigate market uncertainties in a more strategic manner, which may enhance their long-term success.

For real-time updates on options trades for META, Benzinga Pro offers alerts that keep traders informed.

Market News and Data provided by Benzinga APIs, including contributions from firms such as TradePulse responsible for parts of the data in this article.

© 2024 Benzinga.com. Benzinga does not offer investment advice. All rights reserved.

After Market Close UPDATE:

The Power Inflow price was $696.21. Subsequent returns on the day’s high price of $707.71 and closing price of $704.18 were recorded at 1.7% and 1.2%, respectively. This underscores the necessity of having a robust trading plan that incorporates Profit Targets and Stop Losses tailored to one’s risk tolerance. The high and close were nearly identical in this instance, but this is not always the case.

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs