Unlocking Wealth: Exploring the Vanguard Information Technology ETF

Entering the stock market now could be a great way to build long-term wealth, especially with the current bull market lasting over two years. Investing in exchange-traded funds (ETFs) offers a more straightforward approach, allowing you to own shares in multiple companies without extensive research into individual stocks.

However, not all ETFs are created equal. To maximize your potential earnings, consider one standout ETF from Vanguard.

Power Up Your Portfolio with a Leading Tech ETF

The Vanguard Information Technology ETF (NYSEMKT: VGT) stands out as a tech-focused investment option, encompassing 316 stocks from various technology sectors, including semiconductors, systems software, hardware, and storage.

Image source: Getty Images.

This ETF’s largest holdings are Apple, Microsoft, and Nvidia, which collectively account for just over 44% of its total value. Investing in this ETF allows you to tap into well-established companies while also benefiting from potential growth in smaller tech stocks within the fund.

But it’s essential to note that tech-focused ETFs can involve higher risks due to their concentrated exposure. Although this ETF includes over 300 stocks, they are all from the tech sector, offering less diversification than a broad-market fund. If you choose to invest in this ETF, ensure your overall portfolio includes a variety of sectors to mitigate risk.

Potential Returns: How Much Could You Earn?

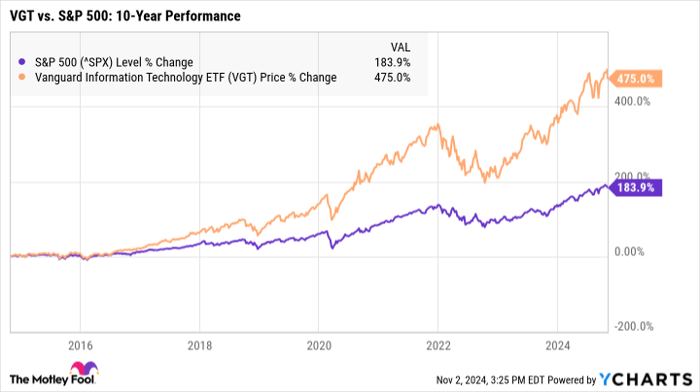

Tech ETFs can be volatile, particularly in the short term. The technology sector is known for significant fluctuations, making future performance uncertain. However, over the past decade, this ETF has delivered an impressive average annual return of 20.37%. Since its launch in 2004, it has maintained a solid average return of 13.45% per year, which surpasses the historical stock market average of 10%.

^SPX data by YCharts

While it’s hard to predict whether future returns will align more closely with the higher or lower averages, remember that investing in potentially high-earning ETFs comes with an inherent risk.

For example, if you invest $1,000 today and achieve an average annual return of 18%, that investment could grow to approximately $143,000 over 30 years without any additional contributions. Contributing a small amount each month can significantly increase your earnings. If you invest $1,000 now and add $50 monthly, here’s a projection of what your investment could be worth over different time frames:

| Number of Years | Total Portfolio Value: 10% Avg. Annual Return | Total Portfolio Value: 13% Avg. Annual Return | Total Portfolio Value: 18% Avg. Annual Return | Total Portfolio Value: 20% Avg. Annual Return |

|---|---|---|---|---|

| 20 | $41,000 | $60,000 | $115,000 | $150,000 |

| 25 | $70,000 | $115,000 | $268,000 | $379,000 |

| 30 | $116,000 | $215,000 | $618,000 | $947,000 |

Data source: Author’s calculations via investor.gov.

If the ETF continues to perform well, your investment of just $50 per month could eventually reach close to $1 million over time. Even with lower returns, consistent monthly contributions can lead to substantial gains.

Choosing the right ETF is crucial for building wealth with less effort compared to picking individual stocks. If you’re open to taking some risks for the chance at significant future rewards, the Vanguard Information Technology ETF might be a valuable addition to your investment strategy.

Seize a Second Chance at Lucrative Opportunities

Have you ever felt like you missed your chance to invest in the top-performing stocks? Now is the perfect moment to consider new investment opportunities.

Occasionally, our expert analysts suggest a “Double Down” stock recommendation for companies poised for significant growth. Investing now could prove beneficial as the numbers illustrate:

- Amazon: If you invested $1,000 in 2010, it would be worth $22,292 now!*

- Apple: A $1,000 investment from 2008 would have grown to $42,169!*

- Netflix: $1,000 invested in 2004 would now stand at $407,758!*

We are currently recommending “Double Down” alerts for three promising companies, and this could be an opportunity you won’t want to miss.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Katie Brockman has positions in Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.