Nasdaq-100 Enters Correction: A Focus on Tech ETFs for Investors

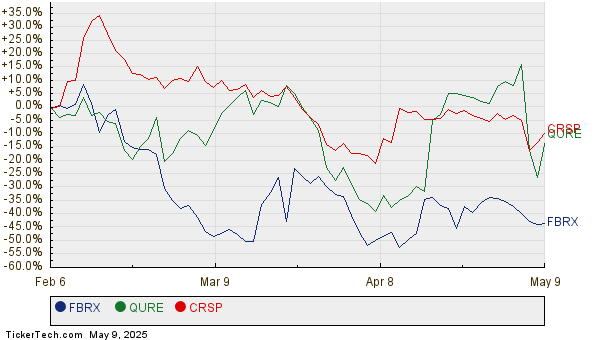

Last week, the Nasdaq-100 technology index officially entered a correction phase, marking a more than 14% decline from its recent record high. This index includes some of the largest technology stocks globally, particularly those driving advancements in artificial intelligence (AI). While the index may have faced setbacks, many of these tech stocks are poised for recovery.

Instead of attempting to identify the specific winners and losers during this recovery, investors should consider purchasing a tech-focused exchange-traded fund (ETF). The iShares Expanded Tech Sector ETF (NYSEMKT: IGM) features 285 stocks, encompassing major players in the AI sector, offering broad and diversified exposure to this rapidly evolving industry.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Based on its historical performance and potential, here‘s how investing $500 per month in the iShares ETF could grow to $1 million over the long term.

Stock charts on their smartphone with a laptop sitting on a table.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F811389%2Fa-person-looking-at-Stock-charts-on-their-smartphone-with-a-laptop-sitting-on-a-table-in-the-background.jpg&w=700″>

Image source: Getty Images.

Major Holdings: Meta, Apple, Microsoft, and Nvidia

The iShares Expanded Tech Sector ETF has a diverse investment strategy. While its primary focus is the technology sector, it also incorporates tech-related companies in other sectors, such as communication services and consumer discretionary. For instance, Meta Platforms (NASDAQ: META) is one of the largest holdings in the ETF, highlighting how these sectors overlap.

Many companies within the iShares ETF are shifting their attention to AI, either by enhancing their established business models with this technology or by exclusively developing new AI-focused products.

The five largest holdings in the ETF account for 39.2% of its total value and are all key players in the AI revolution. As of March 13, 2025, the top five holdings and their respective portfolio weightings are:

- Meta Platforms: 9.11%

- Apple (NASDAQ: AAPL): 8.23%

- Microsoft (NASDAQ: MSFT): 8.20%

- Nvidia (NASDAQ: NVDA): 8.19%

- Broadcom (NASDAQ: AVGO): 5.46%

Although Meta Platforms is widely recognized for its social media platforms like Facebook, Instagram, and WhatsApp, it has also developed a leading open-source series of large language models (LLMs) known as Llama. These models are foundational to a growing array of AI applications, including Meta’s AI chatbot featured across its platforms.

Similarly, Apple’s devices—such as iPhones and Macs—are expected to facilitate AI access for billions of users through the rollout of Apple Intelligence software, enhancing content creation and management. Microsoft operates the Azure cloud platform, giving businesses the computing power and LLMs needed to develop their own AI solutions. The company has also introduced an AI assistant, Copilot, aimed at improving usability for its software products.

Nvidia and Broadcom serve as leading providers of AI data center hardware. Nvidia is known for its powerful graphics processors (GPUs), essential for AI development, while Broadcom manufactures customizable AI accelerators and top-tier data center networking equipment.

Beyond its top holdings, the iShares ETF includes other notable AI companies such as Alphabet, Oracle, and Palantir Technologies.

Stock charts.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F811389%2Fa-bull-figurine-placed-in-front-of-Stock-charts.jpg&w=700″>

Image source: Getty Images.

Potential Growth: $500 Monthly Investment

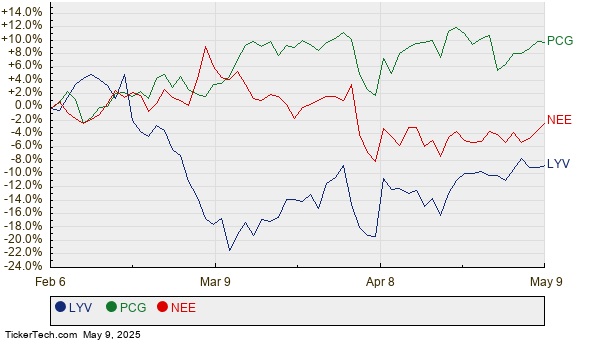

Since its inception in 2001, the iShares ETF has achieved a compound annual return of 10.8%. More recently, this return has significantly accelerated to an average of 19.5% per year over the last decade, driven largely by growth in enterprise software, cloud computing, and AI sectors.

The following table illustrates potential returns based on investing $500 monthly over three scenarios:

| $500 invested monthly at a compound annual return of … |

Balance after 10 years |

Balance after 20 years |

Balance after 30 years |

|---|---|---|---|

| 10.8% | $108,714 | $425,836 | $1,355,156 |

| 15.1% (midpoint) | $140,690 | $769,344 | $3,588,404 |

| 19.5% | $185,594 | $1,466,332 | $10,328,241 |

Calculations by author.

While it is optimistic to expect any fund to maintain nearly 20% annual returns over the next three decades, historical trends often dictate that growth rates will slow. For instance, Meta’s daily active users surpass 3.3 billion, but with the global population at about 8 billion—including restrictions in countries like China—potential new user growth is constrained.

Similarly, Nvidia experienced a dramatic 114% revenue increase in fiscal 2025, but analysts predict that growth will slow to 56% in the upcoming fiscal year.

AI Growth Outlook Challenges for iShares Trust ETF Investment

The financial landscape for companies relying on artificial intelligence (AI) shows signs of slowing growth. Projections indicate that fiscal growth could decline to only 23% in 2027. The challenge arises from the limited number of customers who can invest tens of billions in AI data centers, complicating efforts for companies to sustain last year’s impressive growth rate.

In contrast, the iShares ETF remains an appealing option for long-term investors. If one were to invest $500 monthly, the fund could potentially accumulate $1 million over 30 years, assuming an average annual return of 10.8%. This scenario assumes that AI can spur additional growth, especially since hardware spending is on the rise, and the software sector has yet to fully capitalize on monetization opportunities.

However, it’s crucial for investors to consider that historical performance does not guarantee future outcomes. Should AI technology not meet anticipated expectations, many stocks within the iShares ETF could experience a downturn, suggesting that these investments should fit within a well-diversified portfolio.

Is Investing $1,000 in iShares Trust – iShares Expanded Tech Sector ETF Wise Right Now?

Before committing to iShares Trust – iShares Expanded Tech Sector ETF, potential investors should be aware of the following:

The Motley Fool’s Stock Advisor analyst team recently highlighted what they consider the 10 best stocks for immediate investment, notably excluding the iShares ETF. These selections hold potential for substantial returns over the coming years.

For context, consider when Nvidia was recommended on April 15, 2005. If an investor placed $1,000 at that time, the investment would now be worth an impressive $732,610!

The Stock Advisor program offers an accessible approach to successful investing, featuring guidance on portfolio strategies, regular analytical updates, and two new Stock picks each month. Notably, Stock Advisor has more than quadrupled the returns of the S&P 500 since its inception in 2002.*

*Returns calculated as of March 18, 2025

Randi Zuckerberg, a former Facebook market development director and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also a board member, while Anthony Di Pizio holds no positions in stocks mentioned. The Motley Fool has investments in and recommends stocks including Advanced Micro Devices, Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Palantir Technologies. Additionally, it recommends Broadcom and specific options on Microsoft. The Motley Fool adherence to its disclosure policy is transparent.

The views expressed in this article represent the author’s opinions and may not reflect those of Nasdaq, Inc.