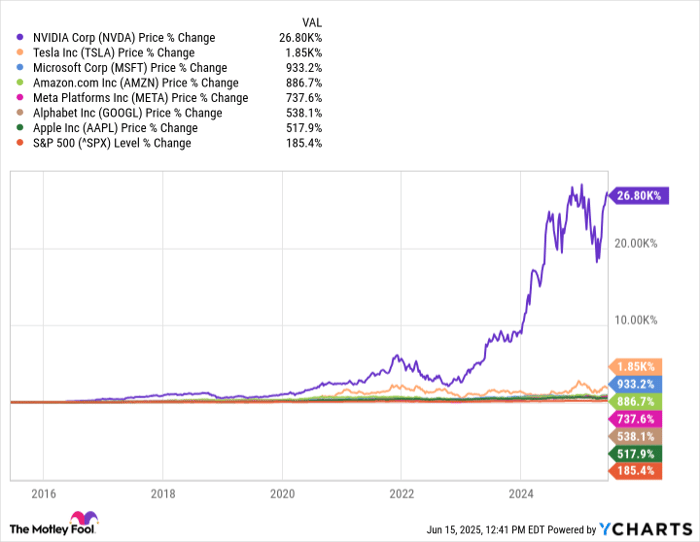

In 2023, Bank of America’s Michael Hartnett identified seven major tech stocks, dubbed the “Magnificent Seven,” which have achieved a median return of 886% over the last decade, significantly outperforming the S&P 500’s 185% return. These stocks collectively represent a market capitalization of $17 trillion.

The Vanguard Mega Cap Growth ETF, which invests primarily in America’s largest companies, holds the Magnificent Seven, accounting for over 56% of its total value. The ETF has delivered a compound annual return of 13% since its inception in 2007, outperforming the S&P 500’s 10.1% annual gain over the same timeframe, and could potentially turn a $200,000 investment into $1 million within approximately 13 years.

Furthermore, the Magnificent Seven are heavily focused on artificial intelligence (AI), which is expected to add $15.7 trillion to the global economy by 2030, enhancing their growth potential and driving ETF returns in the coming years.