How Consistently Investing $50 Weekly Can Build Wealth

Finding funds to invest in the stock market can be difficult, especially during times of inflation and tariffs. However, if you can set aside $50 each week, you may accumulate over $50,000 in dividend income in the future.

Regularly investing in the market is a sound strategy due to the high likelihood that your portfolio will appreciate in value. Although it may seem that a $50-per-week investment is minimal, it can develop into a beneficial financial habit this year.

Identifying a Solid Investment Option

Your first step should be to identify stocks or an exchange-traded fund (ETF) that you want to invest in. This simplifies your investment approach, as it minimizes the need to make weekly decisions about where to allocate funds. A streamlined process increases adherence to your investment strategy.

An ETF could be well-suited for this recurring investment strategy since it typically holds a diverse array of stocks. Although investing in multiple ETFs is feasible, it’s advisable to have one primary fund as your default investment.

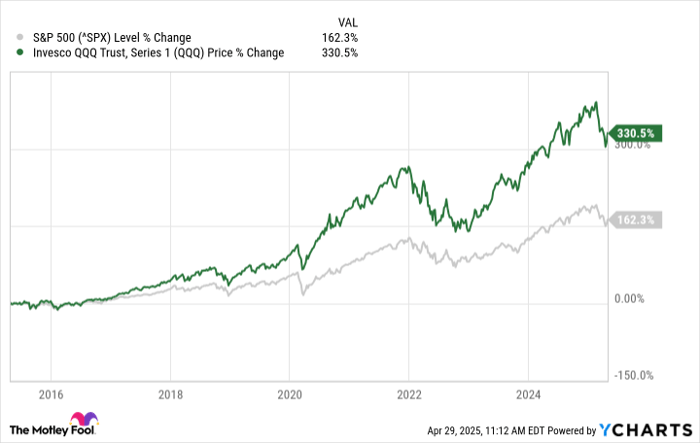

A strong option is the Invesco QQQ Trust (NASDAQ: QQQ). This ETF provides exposure to the top 100 non-financial stocks on the Nasdaq exchange, including significant growth stocks like Nvidia, Microsoft, and Apple. Over the past decade, this ETF has substantially outperformed the broader market.

^SPX data by YCharts

Growing Your Portfolio to Over $1 Million

With the power of compounding, a $50 weekly investment at an average growth rate of 10% — aligned with the long-term average of the S&P 500 — can accumulate a significant balance. Below, you can see the potential balance after 30 years of consistent investing.

|

Future Portfolio Balance ($50/Week Investment) |

|

|---|---|

| Year | 10% Annual Growth Rate |

| 30 | $495,673 |

| 31 | $550,488 |

| 32 | $611,062 |

| 33 | $678,000 |

| 34 | $751,970 |

| 35 | $833,713 |

| 36 | $924,044 |

| 37 | $1,023,865 |

| 38 | $1,134,174 |

| 39 | $1,256,073 |

| 40 | $1,390,779 |

Calculations by author.

Generating Dividends from Your Investments

To achieve $50,000 in annual dividends, you’ll need a balance of approximately $1.1 million. This is based on targeting investments with a yield of around 4.6%. Instead of seeking high-yielding dividend stocks, which often come with added risk, target a diversified range of investments that yield an average of 4.6%. Avoid concentrating all your savings into a single stock or ETF.

Your goal of reaching $1.1 million through this investment strategy may take about 38 years, assuming a steady 10% return. Returns can vary, bringing some uncertainty to the investing process.

Multiple ETFs currently yield more than 4%. A notable example is the SPDR Portfolio S&P 500 High Dividend ETF, which offers a yield of 4.3%. There are also higher-yield options that may entail greater risk. As the investment landscape evolves, additional options may become available. However, the key takeaway is that building a substantial balance will simplify generating $50,000 annually in dividend income while managing risk.

Should You Invest $1,000 in Invesco QQQ Trust Now?

Before purchasing stock in Invesco QQQ Trust, take note of this:

The Motley Fool Stock Advisor analyst team has recently identified what they consider the 10 best stocks for immediate investment—and Invesco QQQ Trust is not on the list. The companies on this list have potential for substantial returns in the near future.

For instance, if you had invested $1,000 in Netflix when it made the list on December 17, 2004, your investment would now be worth $623,685*.

Similarly, an investment of $1,000 in Nvidia when it appeared on the list on April 15, 2005, would have grown to $701,781*.

It’s important to note that Stock Advisor has a total average return of 906%, vastly outperforming the S&P 500’s 164%.

*Stock Advisor returns as of April 28, 2025

David Jagielski has no positions in any of the mentioned stocks. The Motley Fool holds positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool also recommends Nasdaq and has disclosed positions in options for Microsoft. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.