Unlocking Wealth with ETFs: A Look at the Vanguard Information Technology ETF

When choosing an investment, several key factors should guide your decision, such as financial goals, tolerance for risk, and the amount of time you can dedicate to managing your portfolio.

For many, exchange-traded funds (ETFs) represent an efficient way to dive into the stock market. By investing in a single ETF, you can gain exposure to hundreds of stocks without the hassle of managing individual shares. This makes ETFs a popular option for both novice and seasoned investors seeking a simplified approach to investing.

Though investing in ETFs requires less effort than managing individual stocks, they can still provide significant returns. One standout option has the potential to transform an investment of just $200 each month into over $1.3 million over time.

Maximize Your Portfolio’s Potential

To enhance your stock market returns, consider industry-specific ETFs. These funds focus on stocks from a single sector, enabling you to engage with a curated selection of companies without needing to buy each stock individually.

Image source: Getty Images.

If technology interests you, the Vanguard Information Technology ETF (NYSEMKT: VGT) is worth considering. This ETF comprises 317 tech stocks spanning various sectors, including semiconductors and software. Notably, its largest holdings are Apple, Nvidia, and Microsoft, which together account for slightly more than 44% of the fund.

Investing in an ETF like this grants you access not only to major players like Apple and Nvidia but also to many smaller companies that could experience rapid growth. While leading brands may continue to show strong growth, if a few of the remaining 314 stocks achieve exceptional performance, the returns could be substantial.

Potential Earnings from This ETF

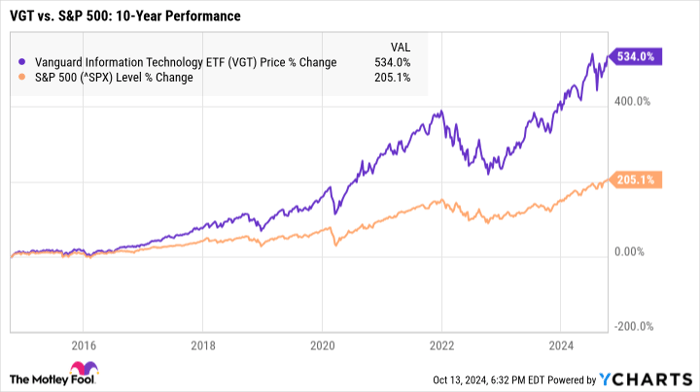

This ETF has a robust historical performance, previously exceeding market averages. Over the past decade, the Vanguard Information Technology ETF has delivered an average annual return of 20.68%. Since its launch in 2004, its average return stands at 13.55% annually.

Predicting its future performance is challenging, as tech ETFs can be volatile; they carry higher risks compared to more stable investments, like S&P 500 ETFs. However, maintaining an investment for 10 to 20 years can help mitigate volatility’s impact.

VGT data by YCharts

To gauge potential future returns, you might invest $200 monthly. Here’s an estimation of how your portfolio could look over time with different average annual return rates of 12%, 16%, or 20%:

| Number of Years | Total Portfolio Value: 12% Avg. Annual Return | Total Portfolio Value: 16% Avg. Annual Return | Total Portfolio Value: 20% Avg. Annual Return |

|---|---|---|---|

| 20 | $173,000 | $277,000 | $448,000 |

| 25 | $320,000 | $598,000 | $1,133,000 |

| 30 | $579,000 | $1,273,000 | $2,837,000 |

Data source: Author’s calculations via investor.gov.

To accumulate around $1.3 million, you would need to consistently invest for 30 years while achieving a 16% average annual return—slightly above the ETF’s 13.55% average since its inception but below its 20.68% average over the last decade.

Even with a more conservative 12% annual return, you can still generate significant savings over time. Conversely, if you are fortunate to maintain a 20% return, the potential gains could be vast.

However, investing in ETFs like this brings higher risks. It’s wise to ensure this fund fits within a well-diversified portfolio since it focuses solely on one sector. When balanced properly, this ETF can greatly enhance your wealth-building efforts.

Seize the Opportunity: Don’t Wait to Invest

Have you ever felt like you missed your chance to invest in top-performing stocks? This might be your moment to make strategic moves.

Occasionally, our expert analysts recommend a “Double Down” stock strategy for companies poised for growth. If you’re concerned you’ve already lost your opportunity, now may be the time to act. Consider the performance of these notable stocks:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,266 now!*

- Apple: If you invested $1,000 in 2008, you would have $43,047 today!*

- Netflix: A $1,000 investment in 2004 could yield $389,794 now!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this may be your best opportunity to get in before prices rise.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Katie Brockman has positions in Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.