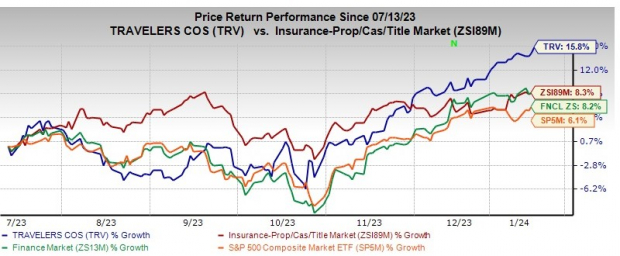

The Travelers Companies, Inc.’s TRV shares have soared an astonishing 15.8% in the last six months, dwarving the industry’s growth of 8.3%. This dramatic rise has outshone even the 8.2% and 6.1% increase in the Finance sector and the Zacks S&P 500 index, respectively, during the same period. With a market capitalization of $44.5 billion and an average trading volume of 1.4 million shares in the last three months, Travelers has solidified its position in the market.

Image Source: Zacks Investment Research

Excelling beyond expectations, Travelers has achieved a Zacks Rank #2 (Buy) with strong retention rates, positive renewal premium changes, solid returns from the non-fixed income portfolio, and robust liquidity. It has been estimated that Travelers’ 2024 earnings will surge by 51.2%, reaching an impressive $16.75 per share, signifying an 11.6% increase in revenues, totaling $46.21 billion.

Travelers’ return on equity for the trailing 12 months is an exceptional 10.4%, outpacing the industry’s 7.2%. This striking feat highlights the company’s efficiency in utilizing shareholders’ funds.

The Bull Run and What It Means

This magnificent surge is attributable to strong net earned premiums and an aggregate underlying combined ratio for Business Insurance and Bond & Specialty Insurance. The commercial businesses continue to perform remarkably, owing to robust underwriting results, strong retention rates, positive renewal premium changes, and higher new business premium. These factors are projected to continue propelling Travelers’ success in the foreseeable future.

Higher average levels of invested assets, reliable returns from the fixed-income portfolio, and robust yields from the non-fixed-income portfolio are anticipated to drive net investment income (NII) higher, especially with the recent increase in interest rates. Furthermore, Travelers’ emphasis on generating increased earnings and capital, maintaining a balanced approach to rightsizing capital and growing book value per share, is a testament to its long-term financial strategy.

Additionally, Travelers boasts an impressive dividend history, having increased its dividend for the past 18 years. With a current dividend yield of 2%, which surpasses the industry average of 0.3%, TRV stands out as an appealing choice for yield-seeking investors.

Future Prospects

Travelers has been awarded a VGM Score of A, identifying it as a valuable asset with excellent growth potential and promising momentum. Based on past performance, stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, have historically offered the best opportunities in the value investing space. Furthermore, the Zacks Consensus Estimate for Travelers’ 2024 earnings has seen a 0.05% increase in the past seven days, signaling a positive outlook for the stock.

Incredibly, Travelers also possesses an impressive Value Score of A, reflecting an attractive valuation for the stock, further solidifying its allure to investors.

Alternatives to Consider

Other top-ranked stocks from the insurance space include CNA Financial Corporation (CNA), Chubb Limited (CB), and Berkshire Hathaway Inc. (BRK.B), each currently carrying a Zacks Rank #2. CNA Financial has recorded a trailing four-quarter average earnings surprise of 9.24% and has seen a 10.5% increase in its stock price over the past six months. Chubb Limited’s earnings have surpassed estimates in three of the last four quarters, with the stock gaining 19.9% during the same period. Berkshire Hathaway Inc. delivered a trailing four-quarter average earnings surprise of 0.20% and has seen a 5.8% increase in its stock price over the past six months.

To read this article on Zacks.com, click here.