Trinseo PLC has unveiled a groundbreaking line of flame-retardant resins, EMERGE PC 8600PV, 8600PR, and EMERGE PC/ABS 7360E65, devoid of per- and polyfluoroalkyl substances (PFAS) and halogenated additives. The industry has historically relied on PFAS compounds for their exceptional flame-retardant properties and resilience to various elements.

These innovative products, while retaining essential performance qualities, cater to the mounting consumer demand and regulatory directives to diminish PFAS employment, particularly in the realms of consumer electronics and electrical engineering. Primarily introduced in the Asia-Pacific market, these resin grades cater to a diverse array of applications ranging from IT devices, electronic gadgets, battery chargers, to voltage stabilizers.

Trinseo is aggressively steering its product development strategy towards PFAS and halogenated additive-free solutions by leveraging its extensive expertise in post-consumer recycled (PCR) items and profound understanding of consumer electronics and electrical sectors. This strategic move aligns with the market’s overarching inclination towards sustainable alternatives.

Both EMERGE 8600PR and EMERGE 7360E65 deploy PCR substrates to achieve performance parity with virgin materials. The company has adamantly refrained from incorporating PFAS in its production processes, with recycled content furthering initiatives for waste mitigation, carbon footprint reduction, and advancement in recycling within the consumer electronics industry.

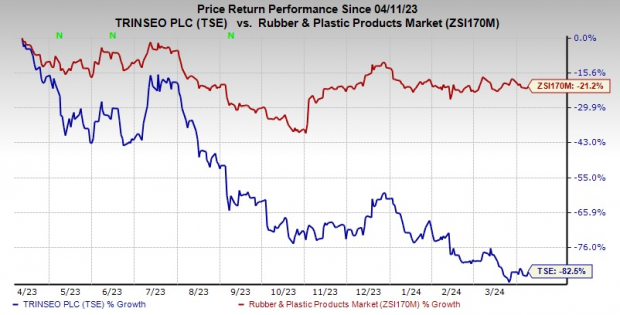

Trinseo’s shares witnessed an 82.5% decline over the past year, juxtaposed with a 21.2% slump in its industry.

Image Source: Zacks Investment Research

Exploring Zacks Rank & Notable Picks

Notably, Trinseo currently holds a Zacks Rank #4 (Sell).

Other notable stocks in the basic materials sector encompass Denison Mines Corp., Carpenter Technology Corporation, and Ecolab Inc.

Denison Mines boasts a Zacks Rank #1 (Strong Buy) with remarkably surpassing the Zacks Consensus Estimate in the past four quarters, boasting an average earnings surprise of 300%. The company’s shares soared by 97.2% over the last year.

Carpenter Technology, presently with a Zacks Rank #2 (Buy), has exceeded the Zacks Consensus Estimate in three of the last four quarters and matched it once, with an average earnings surprise of 12.2%. Shares rose significantly, jumping by 89.9% in the last year.

Ecolab anticipates a year-over-year rise in current-year earnings, with the Zacks Consensus Estimate pegged at $6.43 per share. The company, a Zacks Rank #1 stock, has outperformed the consensus estimate in each of the preceding four quarters, showcasing an average earnings surprise of 1.7%. Ecolab’s shares surged approximately 36.1% over the past year.

Free Report – The Bitcoin Profit Phenomenon

Zacks Investment Research has issued a Special Report to assist investors in seeking substantial gains from the world’s premier decentralized form of currency.

While history doesn’t guarantee the future, the past three presidential election years saw Bitcoin returns as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another substantial upsurge. Click below for Bitcoin: A Tumultuous Yet Resilient History.

Download Now – Today It’s FREE >>

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Trinseo PLC (TSE) : Free Stock Analysis Report