TripAdvisor Reports Strong Q1 Earnings, Positive Revenue Growth

TripAdvisor (TRIP) announced its first-quarter 2025 results, showing non-GAAP earnings of 14 cents per share, a 17% increase from the same period last year. This performance exceeded the Zacks Consensus Estimate by an impressive 180%.

Revenues for the quarter reached $398 million, a slight increase of 1% year over year, and also surpassed the Zacks Consensus Estimate by 2.31%. Growth was primarily fueled by strong performance in its marketplace segments, including Viator and TheFork.

Detailed Breakdown of Quarterly Results

Brand Tripadvisor: This segment generated $219 million in revenues, accounting for 55% of total revenues but reflecting an 8% decline year over year. Nonetheless, it surpassed the consensus estimate of $214 million. Media and advertising revenues in this segment decreased by 6% to $31 million. Revenue from experiences and dining also fell, totaling $30 million, a 15% drop year over year. The decline was influenced by targeted marketing strategies aimed at improving ROI.

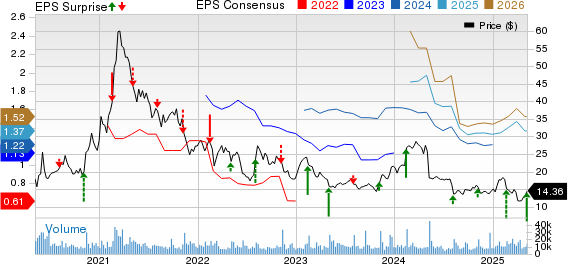

TripAdvisor, Inc. Price, Consensus, and EPS Surprise

TripAdvisor, Inc. price-consensus-eps-surprise-chart | TripAdvisor, Inc. Quote

Branded hotel revenues saw a 7% year-over-year decline to $148 million, while other revenues within this segment fell by 19% to $10 million.

Viator: For the Viator segment, revenues hit $156 million, making up 39.1% of total revenues. This marks a 10% increase from the previous year and surpassed the consensus estimate of $155 million.

TheFork: Revenues from TheFork totaled $46.4 million, or 11.7% of total revenues, reflecting a year-over-year increase of 12% and exceeding the consensus estimate of $46.04 million.

TRIP’s Operating Results

TripAdvisor reported a 9% year-over-year increase in its cost of sales, reaching $27 million for the first quarter. This led to a 50 basis point rise in costs as a percentage of revenue.

Marketing costs also increased, up 6% to $172 million, expanding by 200 basis points as a percentage of revenues. In contrast, general and administrative costs fell 41% to $17 million, with a 300 basis point contraction relative to revenues.

Technology costs amounted to $22 million, a 4% rise year over year, with a 20 basis point increase in the costs relative to overall revenues.

TripAdvisor posted an operating loss of $15 million, consistent with the loss reported in the prior year. The adjusted EBITDA margin for the quarter stood at 11%, reflecting an 80 basis point contraction year over year.

Balance Sheet and Cash Flow Overview

As of March 31, 2025, TripAdvisor held $1.2 billion in cash and cash equivalents, up from $1.1 billion as of December 31, 2024. The long-term debt rose to $1.16 billion, compared to $831 million in the prior quarter.

The company generated $102 million in cash from operations this quarter, a notable improvement from negative cash flow of $2 million in the previous quarter. Free cash flow for the first quarter stood at $83 million.

Q2 2025 Guidance

TripAdvisor anticipates revenue growth to fall between 5% and 8% for the second quarter of 2025.

For the Viator segment, the company expects mid-teens growth in the number of experiences booked, with revenue growth projected at 9% to 11%.

The Brand Tripadvisor segment is expected to see flat to a 2% decline in revenues compared to the previous year.

For TheFork, projected revenue growth ranges from 26% to 28%, including about six percentage points of currency benefits at current rates. The adjusted EBITDA margin for Q2 2025 is estimated to fall between 16% and 18%.

Current Zacks Rank and Stock Considerations

TripAdvisor currently holds a Zacks Rank #3 (Hold).

Advance Auto Parts (AAP), Alibaba (BABA), and Canada Goose (GOOS) are alternative stocks within the sector that may be worth considering. AAP presently has a Zacks Rank #1 (Strong Buy), while both BABA and GOOS hold a Zacks Rank #2 (Buy).

Advance Auto Parts has seen a 16.3% decline in shares year to date, expecting its first-quarter 2025 results on May 22. Alibaba’s shares have gained 4.9% year to date, with its fourth-quarter fiscal 2025 results due on May 15. Canada Goose shares rose 8.2% year to date, with fourth-quarter fiscal 2025 results set for May 21.

Disclaimer

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.