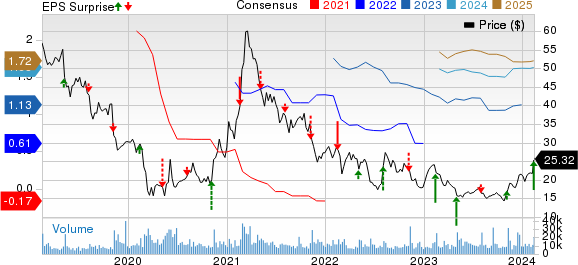

TripAdvisor reported non-GAAP fourth-quarter 2023 earnings of 38 cents per share, beating the Zacks Consensus Estimate by 72.7%. The bottom line significantly jumped from the prior-year quarter’s figure of 7 cents. Revenues of $390 million increased 10% year over year and surpassed the Zacks Consensus Estimate of $372.9 million. Top-line growth was driven by strong momentum in the Viator segment. A well-performing TheFork segment also benefited the company. However, weakness in hotel meta offerings in Europe was a concern. TripAdvisor has gained 12.2% in the past year, underperforming the industry’s rally of 40%.

Performance Comparison

TripAdvisor, Inc. price-consensus-eps-surprise-chart | TripAdvisor, Inc. Quote

Quarterly Breakdown

TripAdvisor reports revenues under three segments: Tripadvisor Core, Viator, and TheFork.

Tripadvisor Core: Revenues summed $218 million (55.9% of revenues), up 0.5% year over year, Media and advertising revenues jumped 6% year over year to $35 million.

Revenues from Tripadvisor experiences and dining were $38 million, increasing 12% year over year. Other revenues within the segment were $10 million which remained flat year over year. However, revenues from Tripadvisor-branded hotels decreased 4% year over year to $135 million due to a decline in European hotel meta offering.

Viator: Revenues totaled $161 million (41.3%), increasing 27% year over year.

TheFork: Revenues came in at $39 million (10%), increasing 18% year over year.

Operational Efficiency

TripAdvisor’s selling and marketing costs decreased 7.7% year over year to $179 million.

General and administrative costs were down 18.9% from the year-ago quarter’s level to $47 million. Technology and content costs of $68 million increased 13.4% on a year-over-year basis. TRIP reported operating income of $31 million in the reported quarter against $13 million of operating loss in the year-ago quarter. In the reported quarter, the total adjusted EBITDA margin was 21.5%, which expanded 940 bps on a year-over-year basis.

Financial Position & Investor Perspective

As of Dec 31, 2023, cash and cash equivalents were $1.07 billion compared with $1.12 billion as of Sep 30, 2023. Long-term debt stood at $839 million at the end of the fourth quarter, which remained flat compared with the previous quarter’s figure. TripAdvisor used $19 million of cash in operations in the reported quarter against $14 million of cash generated from operations in the prior quarter. Free cash outflow was $35 million in the fourth quarter.

Zacks Rank & Stocks to Consider

Currently, TripAdvisor carries a Zacks Rank #3 (Hold). Investors interested in the broader retail-wholesale sector may consider some better-ranked stocks like

Amazon (AMZN), Fastenal (FAST), and Target (TGT). While Amazon sports a Zacks Rank #1 (Strong Buy), Fastenal, and Target carry a Zacks Rank #2 (Buy), each, at present.

Shares of Amazon have gained 72.9% in a year. The long-term earnings growth rate for AMZN is currently projected at 28.13%.

Shares of Fastenal have risen 36.9% in a year. The long-term earnings growth rate for FAST is currently pegged at 9%.

Shares of Target have gained 14.7% in a year. The long-term earnings growth rate for TGT is currently anticipated at 14.18%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all. It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows. It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year. Free: See Our Top Stock And 4 Runners Up Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Amazon.com, Inc. (AMZN) : Free Stock Analysis Report Target Corporation (TGT) : Free Stock Analysis Report Fastenal Company (FAST) : Free Stock Analysis Report TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.