A Steady Climb: Truist Financial’s Series R Preferred Stock Soars

During Thursday’s trading session, Truist Financial Corp’s 4.75% Dep Shares Series R Non-Cumulative Preferred Stock (Symbol: TFC.PRR) reached new heights by surpassing the 5.5% yield mark. This momentum stemmed from its quarterly dividend, now annualized at $1.1875, while witnessing trades as low as $21.54 for the day. To contextualize, this yield outshines the 6.64% average of the “Financial” preferred stock realm, a noteworthy achievement in the financial landscape.

Furthermore, TFC.PRR stood at a 12.68% discount from its liquidation preference amount, outperforming the average discount of 8.97% within the “Financial” sector. Notably, investors should bear in mind that the stock is non-cumulative. This entails that in the event of a payment default, the company is not obligated to compensate preferred shareholders for missed dividends before reinstating common dividend distributions.

Weathering the Market Storm: TFC.PRR’s Performance in Review

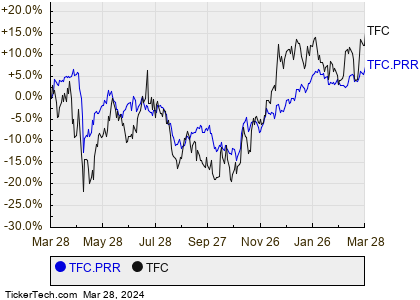

The chart below chronicles the one-year journey of TFC.PRR shares, against the backdrop of TFC:

Below lies a historical dividend payment depiction for TFC.PRR, visualizing the dividend trajectory on Truist Financial Corp’s 4.75% Dep Shares Series R Non-Cumulative Preferred Stock:

Free Report: Top 8%+ Dividends (paid monthly)

As of Thursday’s trading activities, Truist Financial Corp’s 4.75% Dep Shares Series R Non-Cumulative Preferred Stock (Symbol: TFC.PRR) saw a modest decline of approximately 0.5% for the day. Meanwhile, the common shares (Symbol: TFC) remained relatively steady in trading.

Lend an Eye:

• Precious Metals Dividend Stocks

• QLTI Insider Buying

• SCHO Videos

The sentiments and analyses presented here represent the author’s personal viewpoints and do not necessarily align with those of Nasdaq, Inc.