Devon Energy’s Stock Outlook Adjusted Following Recent Downgrade

Analysts Assign New Price Target with Room for Growth

Fintel reports that on November 7, 2024, Truist Securities downgraded their outlook for Devon Energy (XTRA:DY6) from Buy to Hold.

Price Target Indicates Significant Upside Potential

As of October 22, 2024, the average one-year price target for Devon Energy is 48.52 €/share. Analysts expect a range between 39.48 € and 61.09 €. The average target suggests a potential increase of 37.49% from the recent closing price of 35.29 € / share.

Company’s Revenue Projection Shows Strong Growth

Devon Energy is forecasted to generate annual revenue of 17,297 million €, marking a 19.05% increase. The projected annual non-GAAP EPS stands at 7.44.

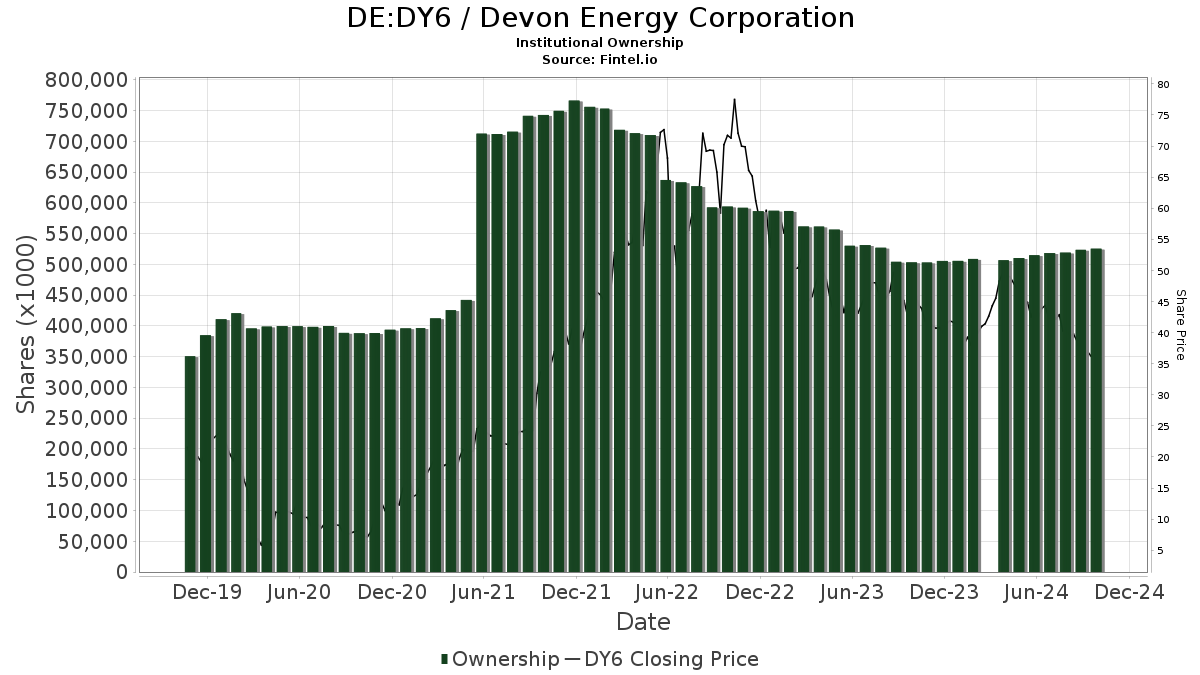

Institutional Involvement in Devon Energy

Currently, 2,021 funds or institutions report holdings in Devon Energy. This represents an increase of 34 new owners, translating to a 1.71% rise in the last quarter. The average portfolio allocation for all funds invested in DY6 is now 0.28%, an increase of 4.57%. Institutional ownership has risen by 3.03% over the past three months, totaling 526,186K shares.

Actions of Key Shareholders

Vanguard Total Stock Market Index Fund (VTSMX) holds 19,969K shares, making up 3.03% of the company, down from 20,132K shares reported earlier, a decline of 0.82%. Their portfolio allocation in DY6 decreased by 8.89% last quarter.

The Energy Select Sector SPDR Fund (XLE) has increased its holdings to 17,496K shares, representing 2.66% of the company, up from 15,305K—an increase of 12.52%. This fund has raised its portfolio allocation by 13.21% in the past three months.

Vanguard 500 Index Fund (VFINX) holds 16,220K shares for a 2.46% stake, a slight rise from 16,147K shares, marking a 0.45% increase. However, this fund reduced its allocation in DY6 by 10.18% last quarter.

Geode Capital Management owns 15,686K shares, or 2.38% of the company, which is up from 15,529K shares—a gain of 1.00%. Conversely, this firm cut its portfolio allocation in DY6 by 52.72% over the last quarter.

Vanguard Mid-Cap Index Fund (VIMSX) has also decreased its holdings to 13,538K shares, equating to 2.06% ownership, down from 13,921K shares, a decline of 2.83%. This fund lowered its portfolio allocation in DY6 by 5.16% during the last quarter.

Fintel provides one of the most comprehensive investing research tools available for individual investors, traders, financial advisors, and small hedge funds. Their data encompasses a wide range of information including fundamentals, analyst reports, fund sentiment, and insider trading.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.