Truist Securities Upgrades ServiceNow’s Outlook to Buy Amid Positive Forecasts

On May 1, 2025, Truist Securities upgraded their outlook for ServiceNow (BIT:1NOW) from Hold to Buy.

Analyst Price Forecast Indicates Room for Growth

As of April 24, 2025, the average one-year price target for ServiceNow stands at €907.95 per share. The range of forecasts varies, with a low of €628.83 and a high of €1,186.94. This average price target suggests a potential upside of 9.42% from its last reported closing price of €829.80 per share.

Revenue Projections and Earnings Expectations

The projected annual revenue for ServiceNow is €13,357 million, reflecting an increase of 16.46%. Furthermore, the expected non-GAAP earnings per share (EPS) is 15.24.

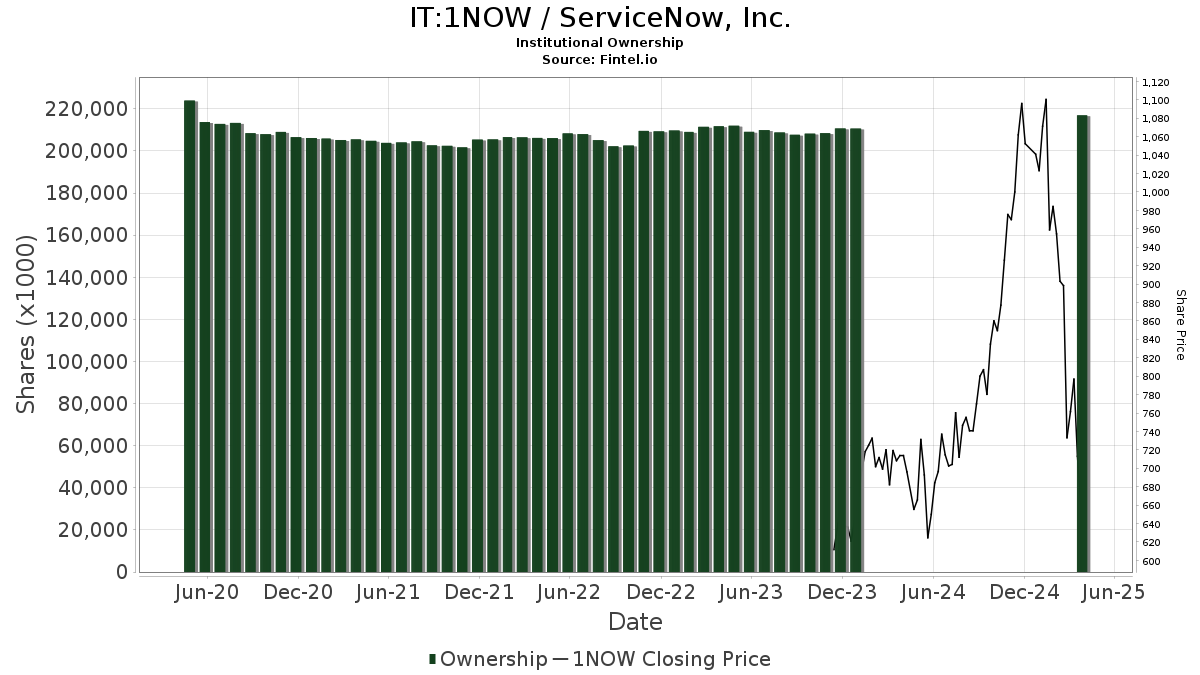

Insights on Fund Sentiment

Currently, 3,525 funds and institutions are reporting positions in ServiceNow, marking an increase of 227, or 6.88%, over the last quarter. The average portfolio weight dedicated to 1NOW among these funds is 0.68%, an increase of 41.87%. Total shares held by institutions grew by 1.32% in the prior three months, totaling 216,671,000 shares.

Institutional Ownership Trends

Price T Rowe Associates owns 7,956,000 shares, accounting for 3.84% of the company. This is an increase from their previous holding of 7,446,000 shares, reflecting a growth of 6.40%. The firm has boosted its portfolio allocation in 1NOW by 26.80% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares holds 6,454,000 shares for a 3.12% company ownership. In its prior filing, it reported 6,530,000 shares, indicating a decrease of 1.19%. However, this firm increased its allocation in 1NOW by 15.43% in the last quarter.

JPMorgan Chase has a stake of 6,402,000 shares, representing 3.09% of ServiceNow. Last reported holdings were 6,451,000 shares, which signifies a decrease of 0.77%. Yet, JPMorgan increased its portfolio allocation in 1NOW by 15.26% over the past quarter.

Vanguard 500 Index Fund Investor Shares owns 5,577,000 shares, representing 2.69% ownership. This is an increase from their earlier holding of 5,395,000 shares, reflecting a growth of 3.25%. Vanguard has also ramped up its allocation in 1NOW by 15.91% recently.

Geode Capital Management holds 4,313,000 shares, or 2.08% of the company. This is an increase from their previous holdings of 4,212,000 shares, illustrating a growth of 2.33%. Geode has also raised its portfolio allocation in 1NOW by 16.26% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.