Truist Securities Issues ‘Sell’ Rating for Block Stock

On June 2, 2025, Truist Securities initiated coverage of Block (BRSE:SQ3) with a Sell recommendation.

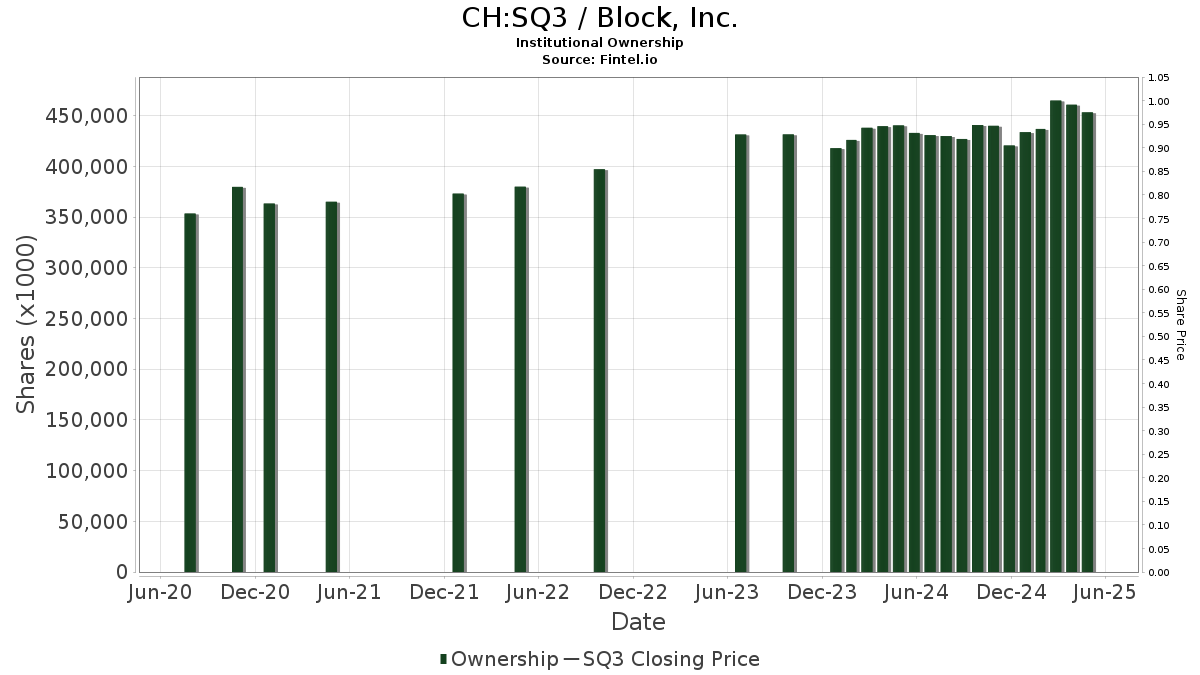

Fund Sentiment Analysis

Currently, 1,744 funds or institutions hold positions in Block, a decline of 90, or 4.91%, from the previous quarter. The average portfolio weight for these funds dedicated to SQ3 is 0.33%, which marks an increase of 6.66%. Over the last three months, total shares owned by institutions fell by 1.93% to 450.315 million shares.

Actions of Major Shareholders

Price T Rowe Associates now holds 26.922 million shares, equating to 4.85% ownership. This reflects an increase of 72.69% from the previous filing in which they reported 7.353 million shares. Their portfolio allocation in SQ3 increased by 22.29% last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) has 17.704 million shares, representing 3.19% ownership. Previously, it owned 17.548 million shares, indicating a small increase of 0.88%. However, its portfolio allocation in SQ3 decreased by 32.72% over the last quarter.

Baillie Gifford increased its holdings to 12.553 million shares, or 2.26% ownership, from 11.168 million shares, a rise of 11.04%. Yet, its portfolio allocation in SQ3 decreased by 69.12% last quarter.

The Vanguard Mid-Cap Index Fund (VIMSX) now holds 12.048 million shares, translating to 2.17% ownership, compared to 12.028 million shares previously. This reflects a minor increase of 0.17%, but a 35.36% decrease in portfolio allocation.

Geode Capital Management owns 9.341 million shares or 1.68% ownership, up from 8.882 million shares, an increase of 4.91%. Nevertheless, it reduced its portfolio allocation in SQ3 by 63.93% last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.