Truist Securities Upgrades ServiceNow to Buy Amid Rising Fund Sentiment

Fintel reports that on May 1, 2025, Truist Securities upgraded their outlook for ServiceNow (WBAG:SNOW) from Hold to Buy.

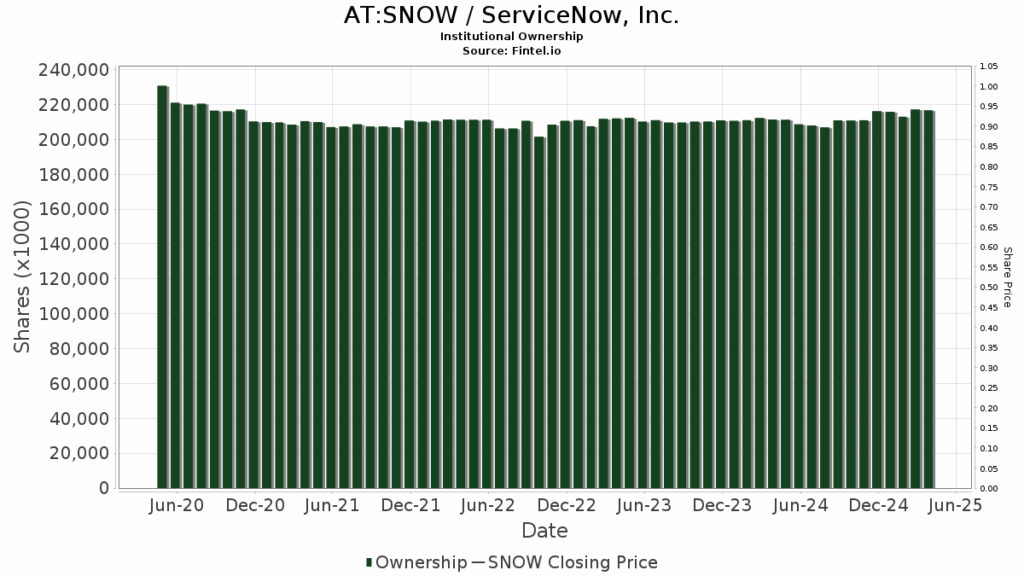

Fund Sentiment Overview

Currently, 3,525 funds or institutions are reporting positions in ServiceNow, marking an increase of 227 owners, or 6.88%, in the last quarter. The average portfolio weight of all funds dedicated to SNOW is 0.68%, an increase of 41.87%. Furthermore, total shares owned by institutions rose by 1.32% over the past three months to reach 216,671K shares.

Institutional Shareholder Activities

Price T Rowe Associates holds 7,956K shares, representing a 3.84% ownership stake in the company. In its previous filing, the firm reported 7,446K shares, indicating a 6.40% increase. Additionally, the firm has increased its allocation to SNOW by 26.80% in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 6,454K shares, accounting for 3.12% ownership. The firm previously owned 6,530K shares, reflecting a 1.19% decrease, though it has grown its portfolio allocation in SNOW by 15.43% over the last quarter.

JPMorgan Chase owns 6,402K shares, which represent a 3.09% stake. Its prior filing indicated 6,451K shares, showing a 0.77% decrease. Nevertheless, its allocation in SNOW grew by 15.26% in the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 5,577K shares, translating to a 2.69% ownership. In its last filing, the firm had 5,395K shares, marking a 3.25% increase, alongside a 15.91% rise in portfolio allocation to SNOW.

Finally, Geode Capital Management holds 4,313K shares, which amounts to 2.08% ownership. Previously, the firm reported 4,212K shares, reflecting a 2.33% increase, and has raised its portfolio allocation in SNOW by 16.26% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.