Market Pulse: New Presidential Policies Shift Investor Sentiment

Significant Changes Under Trump’s Second Term: Investors Take Notice of Volatile Market Dynamics.

Speculative traders looking to ride daily sentiment fluctuations find themselves in an energetic climate as the new year begins. With President Donald Trump embarking on his second term, he has swiftly begun to alter U.S. policy through a series of executive orders addressing energy, immigration, inflation, social policies, and trade.

Trump’s approach sharply contrasts with the previous Biden administration and has led to a surge in various sectors, particularly the cryptocurrency market. Since Trump’s election victory last November, the blockchain-based asset sector has seen renewed vigor. During his campaign, he openly championed decentralized digital assets, capturing the interest of investors.

Furthermore, Trump’s pro-business policies, which include deregulation and reduced corporate taxes, are anticipated to create an environment conducive to investment. Notably, emerging sectors such as quantum computing and the space economy stand to benefit significantly. A focus on enhancing digital infrastructure presents a wealth of investment opportunities for those keen to explore them.

However, the financial landscape also presents challenges. With dramatic shifts from the prior administration, some sectors may struggle. Renewable energy stocks, particularly in electric vehicles, have suffered setbacks amidst Trump’s new energy policies, which prioritize fossil fuels with a “drill, baby, drill” mantra. This shift brings unease to advocates of green energy.

Additionally, factors outside of presidential control may hinder market growth. Elevated interest rates, a product of a robust labor market, could persist longer than anticipated. This scenario, coupled with potential misjudgments about broader risks, may create a tumultuous investment environment.

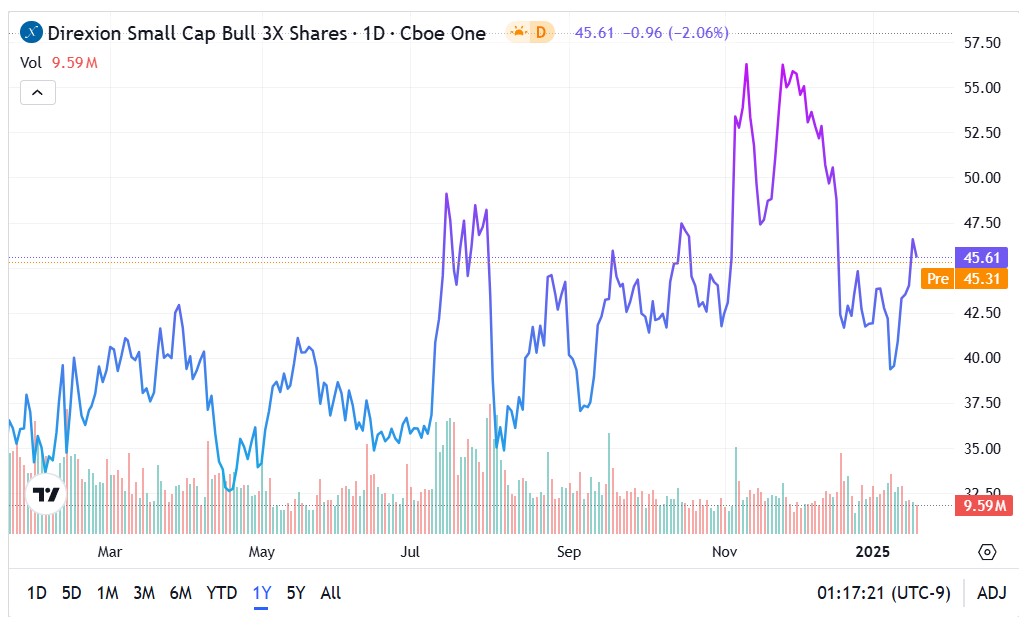

Exploring Direxion ETFs: Given the current market volatility, investors may find themselves weighing the potential of ultra-leveraged exchange-traded funds (ETFs). The Direxion Daily Small Cap Bull 3X Shares TNA aims to achieve 300% of the daily performance of the Russell 2000 index, providing aggressive investors an avenue to capture price gains without having to buy call options.

Additionally, bearish investors have the option to purchase shares of the Direxion Daily Small Cap Bear 3X Shares TZA, avoiding the complexities of dealing with put options.

While these Direxion 3X ETFs are accessible, they come with notable risks associated with volatility. According to Direxion’s guidelines, these leveraged ETFs are intended for promotion of trading activity for no more than a single day.

The TNA ETF: Recent market sentiment has shown a lift, despite the TNA ETF’s fluctuating performance. Over the past month, TNA has accrued nearly 8% in value, recently surpassing its 200-day moving average (DMA).

- Currently, the 50 DMA represents the next level of resistance, positioned just above $48, proving crucial for bullish strategies.

The TZA ETF: The Daily Small Cap Bear ETF has entered a turbulent phase, having dropped over 45% in the last year. Despite this, an economic downturn could spark renewed interest in the fund.

- For investors focused on TZA, maintaining a price above the psychologically significant $10 mark is crucial.

- Support currently sits at the 50 DMA, with an upside target positioned near $15 where the 200 DMA resides.

Featured image by Gerd Altmann from Pixabay.

Market News and Data brought to you by Benzinga APIs