The Rise of Stocks Poised to Benefit from Trump’s Presidency

The Magnificent Seven stocks have captured the spotlight recently. With share prices soaring and total market capitalization exceeding $1 trillion, investor interest is high. Now, with Donald Trump potentially returning to the White House, a fresh wave of stocks—including some from the Magnificent Seven—may see significant gains. On his first day, Trump promised to refrain from imposing new tariffs, sparking optimism among investors concerned about trade disruptions.

Several notable stocks, including Tesla, Inc. (TSLA), Coinbase Global, Inc. (COIN), MicroStrategy Incorporated (MSTR), and Robinhood Markets, Inc. (HOOD), are positioned to benefit from Trump’s policies. Here’s an analysis of why these stocks warrant attention.

Tesla: Bullish Trends and a Strong Market Presence

Since the election on November 5, Tesla’s stock has surged by 69.6%, bringing its market capitalization to approximately $1.4 trillion. The positive dynamic between Trump and Elon Musk, who is now co-head of the Department of Government Efficiency, has bolstered investor confidence in the electric car company.

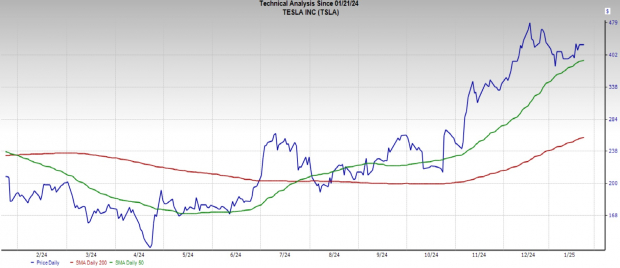

Many expect Musk to leverage regulatory changes to advance Tesla’s low-cost robotaxi initiative and roll out driverless cars with minimal government barriers. Analysts are predicting earnings growth of 7% in the current quarter, followed by a remarkable 60% next quarter. Tesla stocks are currently trading above both the short-term 50-day and long-term 200-day moving averages, a clear sign of a bullish trend (read more: Tesla Stock Surges Post-Trump Win: Consider Buying for 2025?).

Image Source: Zacks Investment Research

Coinbase: Significant Earnings Growth on the Horizon

Coinbase operates a popular cryptocurrency exchange and has seen its stock price rise by 52.3% since November 5, now boasting a market capitalization of $74 billion. Trump’s crypto-friendly administration has played a key role in boosting confidence, particularly following the appointment of Paul Atkins, a crypto supporter, to the Securities and Exchange Commission.

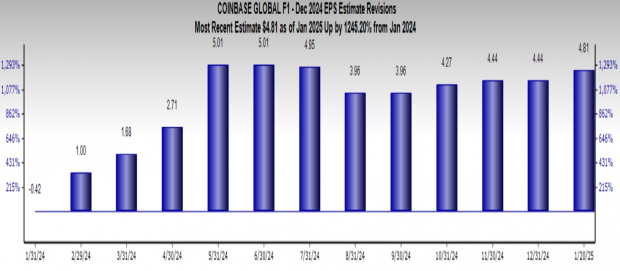

Enhanced transaction volumes, improvements in utility, and partnerships involving USDC are expected to accelerate COIN’s growth. The earnings growth rate for this year is projected at an impressive 1,410.81%, with earnings per share (EPS) expected to jump by 1245.2% from last year. The Zacks Consensus Estimate points to an EPS of $4.81.

Image Source: Zacks Investment Research

MicroStrategy: A Strategic Bet on Bitcoin

MicroStrategy has also benefited from Trump’s commitment to build a strategic Bitcoin (BTC) reserve and promote crypto-friendly policies. Since the election, its shares have risen 74.1%, leading to a market capitalization of $97.7 billion. The company’s strategy of increasing its BTC holdings in light of Trump’s victory has garnered attention from investors.

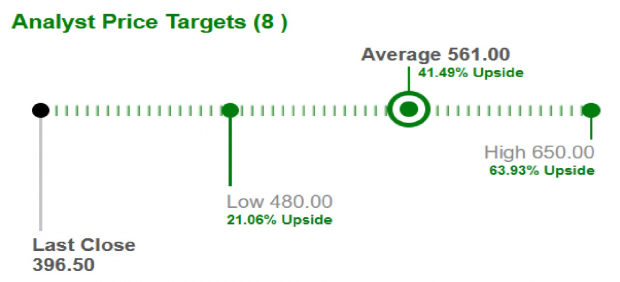

The company’s recent inclusion in the Nasdaq 100 has improved its liquidity, which may further support its BTC acquisition strategy. Analysts have increased their short-term price target for MSTR stock by 41.5% to $561, up from $396.50 (read more: Palantir or MicroStrategy: Better Buy in Nasdaq 100 for 2025).

Image Source: Zacks Investment Research

Robinhood Markets: Riding High on Growth

Robinhood Markets has experienced an astonishing 92.9% increase in its shares since election day, with its market capitalization climbing to $42.6 billion. The online brokerage benefits directly from Trump’s policies, particularly as his administration aims to expand access to trading in cryptocurrencies.

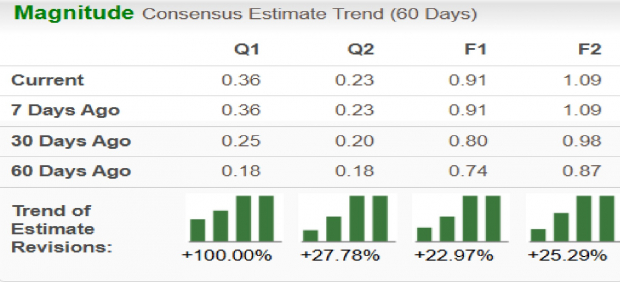

The company’s ambitious expansion plans and the diversification of its products continue to drive robust revenue growth. Robinhood’s expected earnings growth rate for this year stands at 249.2%. Over the last 60 days, the Zacks Consensus Estimate for earnings has risen by 23%.

Image Source: Zacks Investment Research

Tesla stock has a Zacks Rank #3 (Hold), while Coinbase and Robinhood Markets hold a Zacks Rank #1 (Strong Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

Discover 7 Top Stocks for the Coming 30 Days

Just released: Experts have identified 7 elite stocks from over 220 Zacks Rank #1 Strong Buy stocks, labeling them “Most Likely for Early Price Pops.”

Since 1988, the complete list has consistently outperformed the market, achieving an average annual gain of +24.1%. It’s wise to give these 7 handpicked stocks your immediate consideration.

Want to stay updated with the latest recommendations from Zacks Investment Research? Today, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Tesla, Inc. (TSLA): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.