Trump’s Trade Policy Shift Sparks Stock Market Rally

On Wednesday, President Donald Trump unveiled a more lenient stance on trade, resulting in a major rally within the stock market. However, portfolio managers and analysts remain cautious.

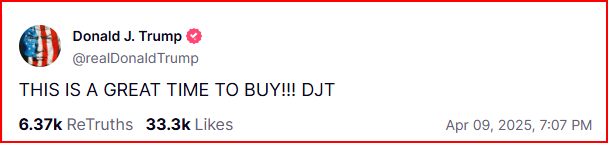

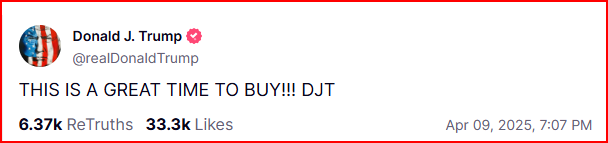

Market Reaction: Investor anxiety over the escalating trade war and a concerning selloff in the U.S. government bond market has been palpable. Trump’s post on Truth Social announced a 90-day pause along with a reduced Reciprocal Tariff of 10%, which alleviated some of these fears. This announcement stands in stark contrast to his “Liberation Day” tariff announcement on April 2, where he proposed much steeper tariffs.

Despite his criticism of China for its perceived disrespect to global markets and a promised tariff hike on Chinese imports to 125%, Trump has indicated a more conciliatory approach toward other countries. This pivot, reinforced by coordinated remarks from Treasury Secretary Scott Bessent and other officials, helped reassure investors concerned about the potential for a global trade war and an economic downturn.

Additionally, Trump suggested that some U.S. companies may be exempt from these tariffs, stating, “We’ll take a look at that.”

The market’s response to these developments was positive. The “Magnificent Seven” tech stocks, which previously struggled during the tariff selloff, saw substantial gains. Tesla stock TSLA surged nearly 23%, leading the rally. Meanwhile, Nvidia‘s NVDA shares climbed close to 19%. Apple Inc. AAPL rose over 15%, while Meta Platforms META increased nearly 15%. Amazon AMZN jumped about 12%, and Microsoft MSFT gained over 10%. Lastly, Alphabet Inc. GOOG, GOOGL climbed nearly 10%.

See also: Trump Media Surges After Hours Following A 21% Rally, Enriching POTUS By $410 Million—Official Trump Memecoin also Gains

Looking Ahead: While the market reacted optimistically, analysts caution that the path forward remains fraught with uncertainty. Christopher Smart, managing partner of Arbroath Group, noted that there is still a “bumpy road ahead with a lot of uncertainty around tariffs,” as reported by The Wall Street Journal.

Similarly, Jake Schurmeier, portfolio manager at Harbor Capital, expressed that although the pause in tariffs is reassuring, it does not eliminate the lingering uncertainty. “We likely go higher for a few days, but I think permanent damage has been done,” Schurmeier told Fortune.

Mark Hamrick, senior economic analyst at Bankrate, highlighted that investors are cautiously processing the “word of a cease-fire,” but the true outcome heavily relies on the results of negotiations between the U.S. and other countries. Treasury Secretary Scott Bessent mentioned that negotiations would be tailored to each country but provided limited details on how discussions would proceed or what a favorable resolution might look like.

Image via Shutterstock

Disclaimer: This content was partially produced using AI tools and reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs