Trump and Powell’s Clash: A Financial Rivalry Worth Watching

Throughout American history, significant rivalries have shaped our national discourse. Coca-Cola versus Pepsi, the Yankees battling the Red Sox, and Microsoft fighting Apple are just a few instances. In some ways, the nation’s foundation rests on such feuds.

The infamous rivalry between Aaron Burr and Alexander Hamilton culminated in tragedy, with Burr shooting Hamilton, while the Lincoln-Douglas debates fundamentally influenced America’s future concerning slavery. In this historical context, the current tension between President Trump and Federal Reserve Chair Jerome Powell is noteworthy.

While the stakes may not involve literal duels or grand debates, investors and market analysts closely monitor every social media post and casual remark from the President, concerned about how this conflict over monetary policy could impact the economy and their investments.

In today’s Market 360, I will discuss the latest developments in the Trump-Powell situation from this past week. I will analyze the reasons behind Trump’s criticisms and present my perspective on why he may have valid concerns. Additionally, I’ll share strategies for positioning your portfolio regardless of shifts in tariffs, interest rates, or market direction.

Trump’s War of Words

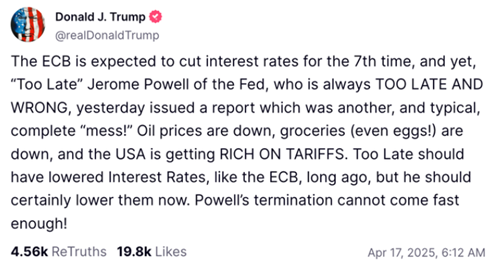

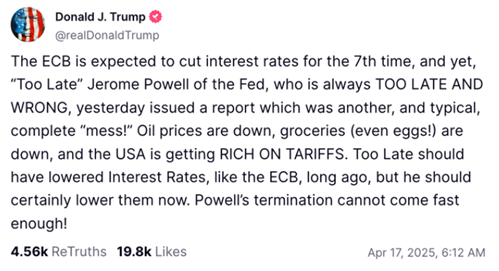

Beginning last Thursday, President Trump has expressed strong criticism of the Federal Reserve and Jerome Powell via his social media platform, Truth Social, even suggesting that Powell’s “termination” couldn’t come soon enough.

The heated rhetoric continued over the weekend and resulted in the stock market opening negatively on Monday. Trump’s remarks unsettled investors, causing major indices to drop by approximately 2.4% to 2.5%.

However, by Tuesday afternoon, Trump softened his stance, stating that he had “no intention of firing” Powell and attributing media exaggeration to the conflict. Following this clarification, stocks recovered overnight, leading to a market surge on Wednesday.

So, what prompted this shift in Trump’s tone? Sources indicate that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick advised caution, reminding him that the U.S. economy—and by extension, the stock market—had significant challenges to tackle, particularly the tariff situation.

Trump later indicated, “I would like to see Powell be a little more active in terms of his idea to lower interest rates. It’s a perfect time to lower rates. If he doesn’t, is it the end? No, it’s not, but it would be good timing.” He also hinted that he might reduce tariffs on China by as much as 65%, significantly down from previous highs of 145%.

These comments sparked a three-day stock rally, with the S&P 500 rising over 6% this week.

What’s Behind the Feud

It appears that Trump is increasingly attuned to market sentiment, which is a positive sign. However, this back-and-forth raises questions given that Trump appointed Powell and his term does not expire until May 2026. What drives this discord?

The dynamic between Trump and Powell reflects their different priorities. Trump is focused on economic growth, believing that lower interest rates will foster that. In contrast, Powell is more concerned about controlling inflation, cautioning against rate cuts that could exacerbate inflationary pressures. Notably, Powell has indicated that tariffs could perpetuate inflation, complicating potential rate reductions.

Reducing interest rates might stimulate short-term economic growth but risks igniting future inflation. Powell has affirmed that the Federal Reserve will not succumb to political pressures. However, I believe Trump raises a valid point that Powell might be overly cautious, especially as inflation seems to be declining. Delaying action could hinder economic progress unnecessarily.

The recent Beige Book survey from the Fed mentioned that economic activity is stable, though concerns about tariffs linger and there are signs of price increases.

It’s important to consider the broader picture of global interest rates, as the European Central Bank (ECB) has reduced rates by 0.25% for the seventh consecutive time. Given the recessions in France and Germany, I anticipate further reductions from the ECB this year.

Consequently, it may soon be necessary for the Federal Reserve to adapt accordingly. I maintain that the Fed will likely implement at least four rate cuts this year, potentially starting in May during the Federal Open Market Committee (FOMC) meeting.

According to CME’s FedWatch Tool, there’s over a 90% likelihood that there will be no immediate change in rates. However, by mid-June, the chances of a quarter-point rate cut increase to over 60%.

Key Strategies to Navigate Upcoming Market Changes

Understanding Market Dynamics

Market trends often favor lower interest rates. A shift in the Federal Reserve’s monetary policy can cause stock prices to rise significantly. I anticipate that we will see such rate cuts sooner rather than later. In the interim, investors should focus on acquiring strong stocks supported by robust fundamentals.

Stocks with solid financial backing tend to remain resilient during periods of market turbulence. Moreover, these stocks are typically the first to rebound when market conditions stabilize.

Preparing for Financial Changes

Investors should be aware of a significant financial change looming on the horizon. This development is unlike anything I’ve encountered in over four decades of market experience.

This situation does not stem from Federal Reserve decisions, government policies, tariffs, or similar factors.

In response, I am dedicated to equipping you with the knowledge necessary to navigate these changes effectively.

That’s why I have prepared a detailed presentation, which outlines everything you need to understand and the best strategies to not just survive, but excel in light of these upcoming shifts.

For further information, click here.

Sincerely,

Louis Navellier

Editor, Market 360