AI Replaces Tariff Drama as Market Focus Shifts

The spotlight in the market now rests on artificial intelligence, as Nvidia recently highlighted.

Throughout the year, Trump’s trade war dominated discussions, but this week signaled a shift.

Wall Street appears ready to move past the trade war narrative.

While the issue will persist with ongoing tariff changes, it has diminished in importance for investors.

This week, a significant ruling by the U.S. International Trade Court invalidated many of Trump’s 2025 tariffs.

The ruling specifically affected tariffs enacted under the International Emergency Economic Powers Act (IEEPA), including:

- The fentanyl-linked import duties

- The 10% baseline reciprocal tariff

- The “Liberation Day” tariffs

The removal of these tariffs will have immediate economic implications.

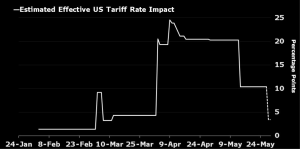

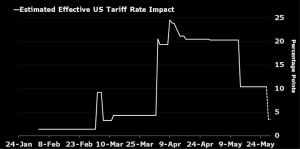

As a result, the average effective tariff rate in the U.S. drops from 13% to 6%, returning to early 2024 levels.

Declining Tariffs and Economic Growth Prospects

Just two months ago, tariffs were nearly at 30%, sparking fears of inflation and economic downturn.

Now, following a series of changes and this recent court ruling, tariffs are back to a manageable level.

While the Trump administration may seek new tax routes under different frameworks, these efforts are likely to face legal constraints. Most experts predict the recent ruling will be upheld on appeal.

For now, while trade war headlines persist, their immediate real-world impact is lessening.

In economic terms, every 1-point increase in tariff rates results in:

- A 0.14% decrease in GDP

- A 0.09% increase in inflation

A shift from 3% to 30% could lead to a 4-point drop in GDP and a 2.5-point rise in inflation, which would be significant.

However, at a 6% rate, the impacts diminish to:

- A 0.4-point drag on GDP

- A 0.3-point increase in inflation

This lower impact is manageable, especially given factors such as:

- Growing investments in technology

- Strong labor market performance

- Stable consumer demand

Even if tariff rates rise slightly, the overall economic consequences will remain limited.

The clarity brought by reduced tariff fears is beneficial for market confidence.

Thus, while the trade narrative continues to circulate, it no longer disturbs the market dynamics significantly.

Nvidia Sets the Stage for AI-Driven Growth

The focus has shifted to artificial intelligence as Nvidia reported impressive earnings, reflecting strong demand for AI technology.

The company projects $45 billion in revenue next quarter, potentially leading to an economic impact of $360 billion to $450 billion due to increased investments in AI.

Investors are clearly more interested in AI developments than in tariff debates.

In conclusion, the trade war narrative remains, but its influence is waning.

The recent court ruling has changed the landscape, making tariff risks less impactful and more predictable.

In 2025, growth will be driven by AI, as exemplified by Nvidia’s performance, while the tariff story fades into the background.

This is the new opportunity that investors are now focusing on.