“`html

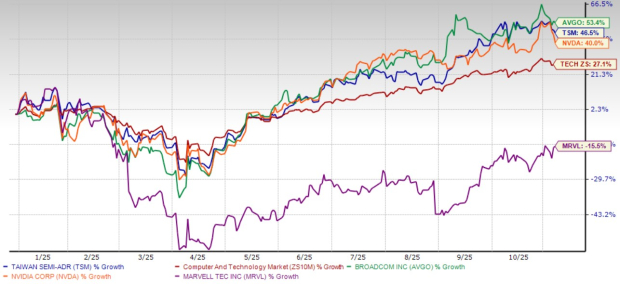

Taiwan Semiconductor Manufacturing Company (TSMC) reported a 46.5% year-to-date increase in share prices as of November 6, 2023, closing at $289.24. The company is benefiting from increased demand for advanced chips, especially for major clients like NVIDIA, Broadcom, and Marvell Technology, resulting in record revenues and profits. TSMC’s revenues surged 41% year-over-year to $33.1 billion in Q3 2025, with earnings per share at $2.92.

In 2024, AI-related revenues are expected to triple, comprising a mid-teen percentage of TSMC’s total revenues, with expectations to double again in 2025 and grow 40% annually over the next five years. For 2025, TSMC plans to invest between $40 billion and $42 billion in capital expenditures to maintain its competitive edge, focusing 70% on advanced manufacturing processes.

Despite robust growth, TSMC faces near-term challenges due to softness in major markets like PCs and smartphones, and geopolitical tensions concerning U.S.-China relations. The company has a Zacks Rank of #3 (Hold) and anticipates fourth-quarter revenues between $32.2 billion and $33.4 billion, with full-year 2025 revenues estimated at $120.49 billion.

“`