Taiwan Semiconductor’s Stock Rises 19.7%: What’s Next for Investors?

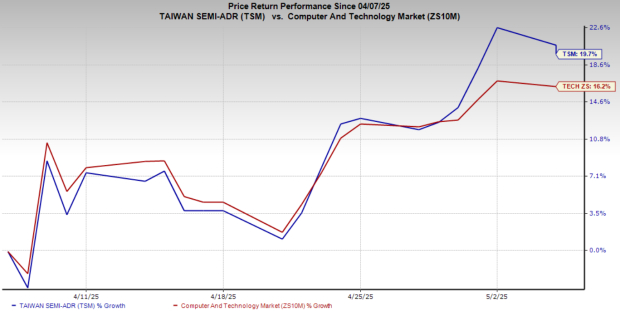

Taiwan Semiconductor Manufacturing Company (TSM) has experienced a remarkable 19.7% increase in its share price over the past month, significantly outperforming the broader Zacks Computer and Technology sector, which rose by 16.2% in the same timeframe.

Image Source: Zacks Investment Research

With this strong performance, investors may wonder whether to cash out or hold onto their stock.

Factors Behind TSM’s Stock Surge

The recent growth of Taiwan Semiconductor is linked to increasing market optimism. Speculation regarding advancements in U.S.-China trade negotiations significantly improved investor sentiment in late April. Prolonged trade tensions had previously hindered global economic predictions and corporate earnings expectations due to tariffs and trade restrictions.

Positive hints about a potential trade deal suggested reduced tensions, lower tariffs, and improved international trade. This optimistic outlook increased investor confidence, driving a rally in the equity market as fears of economic instability lessened, and expectations for global growth strengthened.

Semiconductor stocks, including Taiwan Semiconductor Manufacturing, Broadcom, Inc. (AVGO), Marvell Technology, Inc. (MRVL), and NVIDIA Corporation (NVDA), witnessed notable gains, following a substantial selloff after the Trump administration’s tariff announcement on April 2. Over the last month, Broadcom’s shares soared by 30.5%, while Marvell Technology and NVIDIA increased by 21.2% and 16.3%, respectively.

Given Taiwan Semiconductor’s long-term growth prospects paired with renewed investor optimism, the stock appears to be a viable hold at this juncture.

AI Growth Enhances TSM’s Outlook

Leading the semiconductor foundry sector, Taiwan Semiconductor is benefiting from its technological edge and production capabilities. The ongoing surge in artificial intelligence (AI) has placed the company at the forefront of a long-term growth cycle.

As the preferred manufacturing partner for AI accelerators, including GPUs and customized chips developed by NVIDIA, Marvell Technology, and Broadcom, TSM is well-positioned. By 2024, AI-related revenues are expected to triple, making up a mid-teen percentage of TSM’s total revenue, with forecasts suggesting they could double again by 2025—a remarkable 40% compound annual growth rate over the next five years.

TSM kicked off 2025 with impressive first-quarter results, reporting a 35% year-over-year revenue increase to $25.53 billion, while net income soared by 53% to nearly $11 billion. This strong performance was fueled by high demand for its 3nm and 5nm nodes, which accounted for almost 58% of total wafer revenues.

Moreover, TSM’s first-quarter earnings per share (EPS) jumped by 53.6% to $2.12, surpassing the Zacks Consensus Estimate of $2.03. The stock has beaten earnings expectations for the past four quarters, averaging a surprise of 6.9%.

Taiwan Semiconductor Manufacturing Company Ltd. Price, Consensus, and EPS Surprise

Taiwan Semiconductor Manufacturing Company Ltd. price-consensus-eps-surprise-chart | Taiwan Semiconductor Manufacturing Company Ltd. Quote

Taiwan Semiconductor is not merely increasing its revenue but also expanding its operations significantly to meet the surging demand for advanced chips driven by AI. The company plans to invest between $38 billion and $42 billion in capital expenditures in 2025, a substantial increase over its $29.8 billion investment in 2024. Approximately 70% of this expenditure will focus on advanced manufacturing processes to keep TSM competitive.

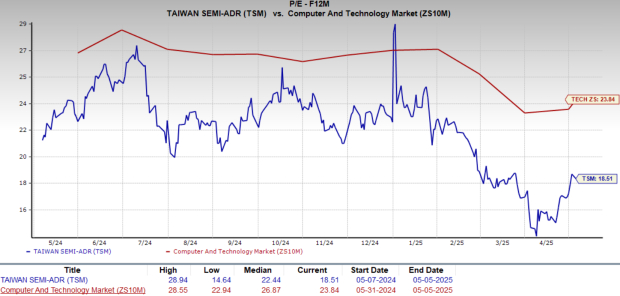

TSM Stock Offers Competitive Valuation

Currently, Taiwan Semiconductor Manufacturing trades at a forward 12-month price-to-earnings (P/E) ratio of 18.51, which is below the sector average of 23.84. This attractive valuation, combined with the company’s strong growth outlook, provides a compelling entry point for investors interested in the semiconductor sector.

Image Source: Zacks Investment Research

TSM’s P/E ratio remains lower than other semiconductor firms, such as Broadcom, Marvell Technology, and NVIDIA, which currently have P/E ratios of 27.74, 20.95, and 24.8, respectively.

Near-Term Challenges for TSM

Despite its strengths, Taiwan Semiconductor Manufacturing faces notable near-term challenges. Rising energy costs in Taiwan, following a 25% electricity rate hike in 2024, present a significant hurdle, particularly as advanced manufacturing nodes require more power.

Weakness in key markets such as PCs and smartphones is also concerning, as growth in these sectors is projected to remain in the low single digits in 2025. This limited growth may restrict TSM’s overall expansion, even with increasing AI demand.

Furthermore, rising operational expenses from its overseas expansions into Arizona, Japan, and Germany pose additional challenges. While these new facilities are strategically valuable, they are expected to dilute gross margins by 2-3% annually over the next three to five years, owing to higher labor and utility costs and lower initial utilization rates.

Geopolitical tensions, especially between the U.S. and China, further complicate TSM’s outlook. As a company with considerable revenue exposure to China, potential export restrictions and supply-chain disruptions could impact operations.

Conclusion: Maintain Position in TSM Stock

In summary, Taiwan Semiconductor Manufacturing Company presents a compelling case for holding onto its stock, given its strong market position, growth opportunities in AI, and appealing valuation. However, investors should remain aware of the near-term risks that could impact future performance.

# Taiwan Semiconductor Manufacturing: Navigating Challenges While Holding Steady

Manufacturing’s technological leadership and strategic investments position Taiwan Semiconductor Manufacturing Company (TSMC) as a strong contender in the semiconductor industry. Nevertheless, several short-term challenges—including rising costs, tariff disputes, and geopolitical tensions—call for a cautious approach. For the moment, maintaining a hold on TSM Stock appears to be the most sensible strategy, enabling investors to leverage its industry leadership while managing immediate uncertainties.

Currently, TSMC holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Identifies Top Stock Poised for Significant Growth

A team of experts from Zacks has unveiled five stocks with the highest likelihood of achieving a +100% gain in the upcoming months. Among those, Director of Research Sheraz Mian has singled out one Stock expected to see the greatest increase.

This top pick is recognized as one of the most innovative financial firms, supported by a rapidly expanding customer base exceeding 50 million and a diverse array of cutting-edge solutions. This Stock is well-positioned for significant growth. While not all selected stocks will generate gains, this one has the potential to outperform previous Zacks picks, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: Check Out Our Top Stock And 4 Contenders

Interested in the latest recommendations from Zacks Investment Research? You can currently download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis report

Marvell Technology, Inc. (MRVL): Free Stock Analysis report

Broadcom Inc. (AVGO): Free Stock Analysis report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

This article originally appeared on Zacks Investment Research.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.