The Dominance of TSMC in the Semiconductor Market

Taiwan Semiconductor Manufacturing Company (NYSE:TSM), also known as TSMC, is currently the linchpin of the global economy. The significance of semiconductors in today’s electronic devices cannot be overstated, ranging from smartphones to automobiles and even household appliances like refrigerators. The recent chip shortage has impacted 169 different industries, leading to governments, including the USA, introducing the Chips Act and making substantial investments in this sector. TSMC, with its unparalleled array of advanced nodes, stands as the undisputed leader in this vital domain. Despite facing historical challenges to Taiwanese independence, TSMC is currently trading at an attractive valuation.

TSMC’s Competitive Edge in the Semiconductor Space

When it comes to competition, Samsung (OTCPK:SSNLF) emerges as the primary contender to TSMC. However, TSMC maintains a significant lead in advanced chips, with Samsung primarily engaging in price competition with less advanced chips. Moreover, TSMC’s market share in the advanced foundry market stands at an impressive 66%, owing to the reliability and high quality of its semiconductors. Notably, TSMC has faced challenges with its 3nm chips, allowing Apple (AAPL) to negotiate prices for its iPhone 15 Pro model, although TSMC has been selected to produce chips for the upcoming iPhone 16. While Samsung remains an alternative to TSMC for 4nm and 5nm chips, it would need to lead in 2nm or 1.4nm chips to pose a legitimate threat – a feat that seems insurmountable given TSMC’s vast knowledge advantage and superior capacity.

On the other hand, Intel holds promise, especially considering the imperative for a competitive semiconductor manufacturer in the U.S. and Europe. However, TSMC’s extensive experience and expertise, underscored by reports of Intel outsourcing some of its products to TSMC, firm up TSMC’s formidable competitive advantage.

The far-reaching impact of TSMC’s advanced chips across various sectors, from smartphones and laptops to automotive and artificial intelligence, underscores the crucial role played by the company. A testament to its significance is the fact that several companies, including Broadcom (AVGO), NVIDIA (NVDA) and AMD (AMD), heavily rely on TSMC’s products. Without TSMC, the global economy would face dire consequences, with the automotive industry’s struggles during the chip shortage serving as a striking example. Even governments are cognizant of TSMC’s pivotal role, as they acknowledge the company’s unparalleled pricing power and the formidable barriers to entry in producing chips at or near TSMC’s standard.

The dependence on TSMC’s products is only poised to expand in the future, reflecting the early stages of this transformative cycle.

TSMC’s Financial Strength and Performance

Amid discussions about TSMC’s robust gross margin, its net income margin of over 40% stands out as particularly impressive. Despite being situated in a capital-intensive industry, TSMC’s ample room for high profitability is evident, bolstered by its substantial competitive advantage due to the significant wage differential between the Western world and Taiwan. TSMC’s commendable balance sheet, featuring $48 billion in cash and a modest $29 billion in long-term debt, exudes financial robustness. The forthcoming Q4 results are anticipated to reaffirm the company’s strong financial position, with its net income surpassing long-term debt as of December 2022.

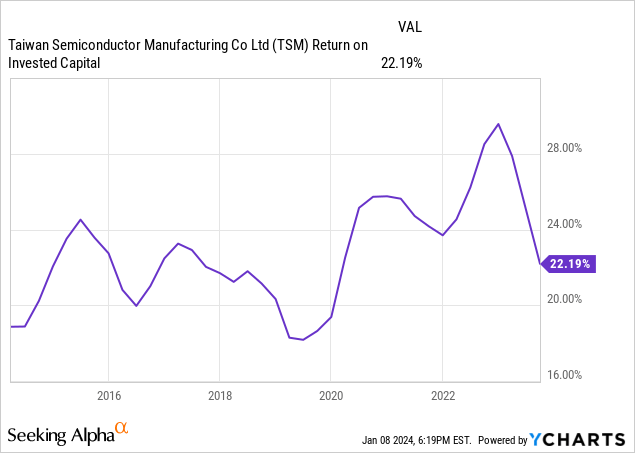

TSMC’s Capital Allocation and ROIC

TSMC’s robust ROIC underlines the company’s formidable competitive advantages, enabling it to generate well above-average returns on capital. With a low cost of debt at 1.5% and a cost of equity of approximately 11%, TSMC enjoys an impressive ROIC-WACC spread of 12%. The company’s substantial investments in R&D, constituting around 8% of sales, yield promising outcomes, as evidenced by the owner earnings, comprising a dividend yield of 1.80% and a 5-year EPS growth rate of 20.51%, culminating in owner earnings of 22.31%. TSMC also stands as a compelling dividend growth stock, with a dividend growth rate of 12.61% per year since 2012.

The Ripe Investment in Taiwan Semiconductor Manufacturing Company (TSMC)

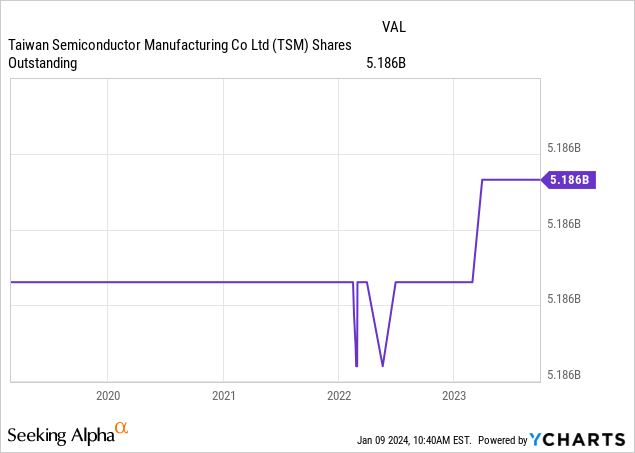

Existing shareholders have reason to rejoice as TSMC has maintained almost the same number of shares outstanding for the past 5 years, indicating no excessive SBC and no shareholder dilution. A remarkably favorable circumstance indeed.

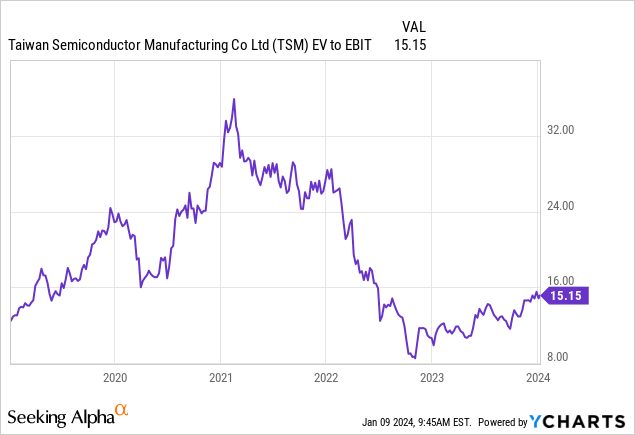

Assessing TSMC’s Valuation

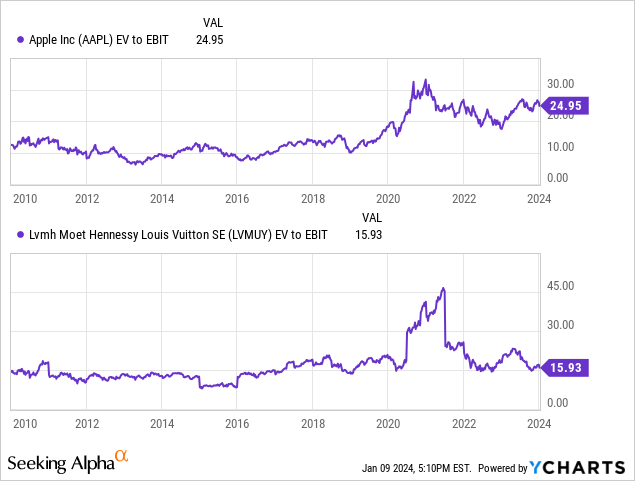

The EV/EBIT multiple, akin to the one favored by Warren Buffett, portrays TSMC’s 15x multiple as reasonably valued with the potential to be attractively valued. The 5-year EBIT CAGR is an impressive 20.58%, and the 10-year CAGR stands at 16.84%. These growth rates typically justify a higher multiple.

Comparing TSMC’s current valuation to that of Apple and LVMH (OTCPK:LVMHF) – two companies of similar quality, which were available at 15x EV/EBIT a few years ago – it becomes evident that the potential for future returns is promising. Apple has yielded a total return of 2,765.48% since 2010, while LVMH has accrued a total return of 839.56%, both easily outpacing the S&P 500 (SPY) from a comparable starting position as TSMC today.

Evaluating Risks

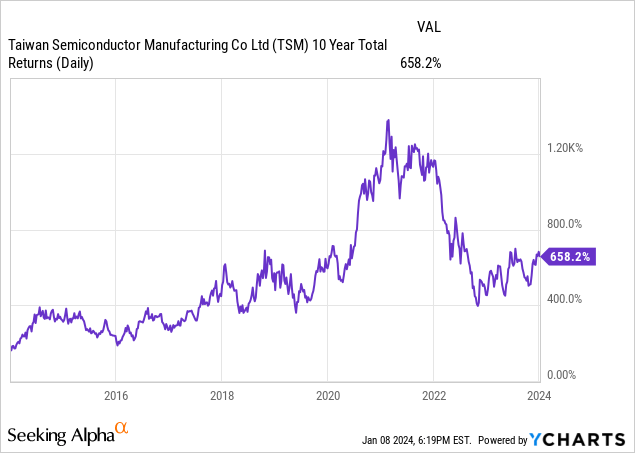

The political and geopolitical risk, coupled with trade tensions, poses an obvious threat to TSMC. However, historical evidence demonstrates that investors who braved this risk have reaped considerable rewards over the past decade. This situation has created a tremendous opportunity for investors, potentially leading to higher multiples if TSMC were an American company. It is often the risks that are acknowledged that are mitigated the most effectively.

Another diminished risk is the concentration risk. In the most recent 20-F, the shift to HPC has reduced the concentration of TSMC’s top 10 customers to 68% of net revenue, down from 74% in FY21, signaling a positive trend likely to persist.

Moreover, the risk associated with TSMC’s reliance on only six companies for 95% of its wafer needs highlights the company’s dependency on external entities for raw materials. Additionally, the role of ASML Holding N.V (ASML) in the production and design of semiconductors is crucial to TSMC’s operations.

In Conclusion

It’s quite an intriguing fact that while Saudi Arabia controls about 12% of the oil market, a driving force of the global economy for decades, TSMC commands a 66% market share in what could be the future driver of the global economy. The significance of this company cannot be overstated, and it’s evident that politicians worldwide acknowledge this, evident in their actions. Surprisingly, many investors are either unaware of this company’s importance and reputation or are apprehensive about investing due to the surrounding dynamics.

Clearly, TSMC presents an attractively valued investment proposition, and the fundamental question now is: what comes next? While various scenarios are plausible, a peaceful resolution appears the most likely. A peaceful resolution benefits both the U.S. and China, and it is in China’s best interest to make decisions conducive to their country and people.