TSMC’s Growth Surge: Pioneering Chip Manufacturing and Expanding Horizons

Taiwan Semiconductor Manufacturing (NYSE: TSM) stands as a titan in the tech industry. As the world’s largest contract manufacturer, it produces chips for key players such as Apple, Nvidia, Broadcom, and Advanced Micro Devices.

With a commanding market share of 62% in third-party chip manufacturing and around 90% in advanced chip production, TSMC plays a vital role in the global economy and is central to the surge in artificial intelligence (AI).

The company’s strong performance in the third quarter has propelled its valuation above $1 trillion, demonstrating the success of its global diversification strategy.

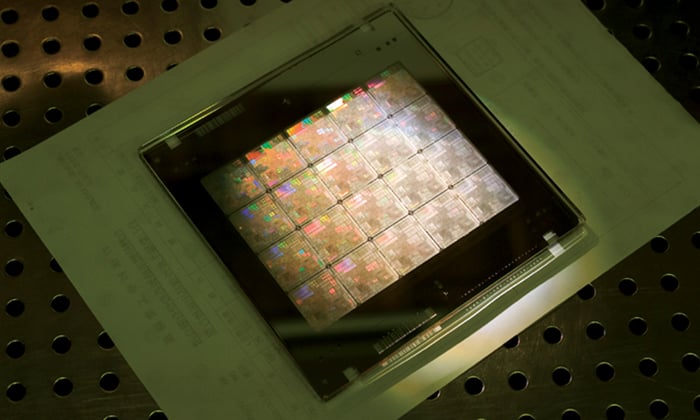

![]()

Image source: Getty Images

Progress at TSMC’s Arizona Facility

TSMC’s operations rely heavily on its base in Taiwan, which presents geopolitical risks, especially concerns about a possible Chinese invasion. To mitigate these risks, TSMC is actively diversifying its operations outside Taiwan.

Recent updates indicate that production yields from TSMC’s Arizona plant exceed those from similar facilities in Taiwan by 4 percentage points. This improvement is crucial for TSMC, allowing access to $6.6 billion in grants from the CHIPS Act, plus $5 billion in loans for two additional factories planned for the site, expected to be operational by 2030.

Higher production yields also mean enhanced profit margins and a reduced payback period for the Arizona plant. Notably, the facility is already manufacturing chips for Apple.

This progress strengthens TSMC’s position relative to major competitors like Samsung and Intel. Samsung recently acknowledged delivery delays in key memory chips during its earnings report. Conversely, Intel has undergone significant restructuring, converting its foundry into a subsidiary, which may limit new investment options as its original projections falter.

Is TSMC a Good Investment?

With over a dozen facilities worldwide and a rapidly growing business, TSMC is positioned for sustained growth, particularly as AI demand continues to rise. The U.S. enacted the CHIPS Act to emphasize the importance of domestic semiconductor production amidst rising tensions with China over Taiwan.

The Arizona plant’s promising results, combined with TSMC’s compelling revenue figures—39% revenue growth, a 47.5% operating margin, and a 54% increase in earnings per share—suggest that it is outperforming competitors like Samsung and Intel in expanding production capacity.

As Nvidia faces strong demand for its Blackwell platform and Apple‘s iPhone generates excitement, TSMC’s momentum appears likely to continue in the upcoming quarters.

If the Arizona hub proves successful, TSMC may cement its leadership in the chip foundry market for years to come. This stock remains a strong buy.

Seize the Opportunity for Potential Gains

Have you ever felt you missed out on acquiring top stocks? Here’s your chance to reconsider.

Our expert analysts occasionally recommend a “Double Down” stock—companies poised for substantial growth. If you’re concerned about having missed your investment chance, now is an ideal time to buy.

- Amazon: A $1,000 investment from our 2010 recommendation is now worth $21,217!*

- Apple: A $1,000 investment from 2008 has grown to $44,153!*

- Netflix: If you invested $1,000 back in 2004, it would have ballooned to $403,994!*

Currently, we’re giving “Double Down” alerts for three remarkable companies, and such opportunities may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Jeremy Bowman has positions in Broadcom. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.