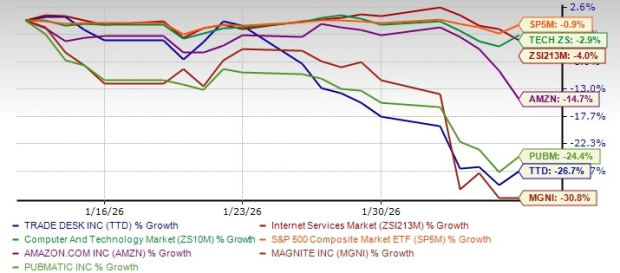

The Trade Desk (TTD) has experienced a significant decline, with its stock price plummeting 26.7% over the past month as of October 2026. This drop is notable in the context of a broader downturn, as the Zacks Internet Services industry has fallen by 4%, while the Computer & Technology sector and S&P 500 have lost 2.9% and 0.9%, respectively. Key competitors, including Amazon, PubMatic, and Magnite, have also reported double-digit losses during this period, indicating widespread challenges in the digital advertising sector.

TTD’s decline is attributed to multiple factors, including rising operational costs, slowing revenue growth, and increased competition in the Connected TV space. In the last reported quarter, total operating costs surged by 17% year over year to $457 million, driven primarily by investments in enhancing their platform capabilities. Analysts remain cautious, noting that macroeconomic headwinds could further pressure revenue growth.

Currently, TTD holds a Zacks Rank #4 (Sell), prompting recommendations for investors to either reduce their exposure or await a better entry point. The company’s valuation stands at a price/book multiple of 5.03, lower than the industry average of 7.84.