Technology Sector Leads Market with Significant Gains

The Technology & Communications sector is outperforming other sectors, rising by 1.2% at midday Tuesday. Cadence Design Systems Inc (Symbol: CDNS) and F5 Inc (Symbol: FFIV) are major contributors to this growth, with notable increases of 12.4% and 9.3%, respectively. The Technology Select Sector SPDR ETF (Symbol: XLK), which tracks this sector, mirrors this performance, climbing 1.2% today and an impressive 21.66% year-to-date. In comparison, Cadence Design Systems Inc has gained 4.34% this year, while F5 Inc has seen a robust 33.33% rise. Together, these two companies account for roughly 1.0% of XLK’s holdings.

Trailing closely is the Industrial sector, which is up 0.2%. Among the key players in this segment, Leidos Holdings Inc (Symbol: LDOS) and Corning Inc (Symbol: GLW) report gains of 9.7% and 6.9%, respectively. The Industrial Select Sector SPDR ETF (XLI) closely follows this sector, recording a 0.1% increase in midday trading, with a strong 20.36% jump year-to-date. Notably, Leidos Holdings Inc has surged 73.07% in 2023, while Corning Inc has increased by 67.19%. LDOS represents about 0.6% of XLI’s underlying holdings.

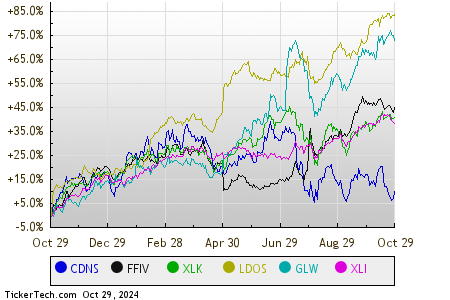

To understand their performances better, the following chart illustrates the stock price changes over the trailing twelve months, with each stock represented by a different color indicated in the legend below:

Below is a snapshot of how the S&P 500 components within various sectors are performing during Tuesday afternoon trading. Currently, three sectors are in the green, while six are experiencing declines.

| Sector | % Change |

|---|---|

| Technology & Communications | +1.2% |

| Industrial | +0.2% |

| Healthcare | +0.1% |

| Services | -0.2% |

| Financial | -0.3% |

| Consumer Products | -0.7% |

| Materials | -0.9% |

| Energy | -1.3% |

| Utilities | -1.6% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

• HLGN Stock Predictions

• OPP Videos

• SLRC Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.