Services Sector Flies High

During the bustling afternoon hours on Tuesday, Services stocks are the shining stars, lifting the sector by 0.5%. Within this realm, MGM Resorts International (MGM) and Dominos Pizza Inc. (DPZ) are standout performers, boasting gains of 4.1% and 3.7% respectively. The iShares U.S. Consumer Services ETF (IYC) mirrors this trend, lofting 0.5% today and a robust 7.84% year-to-date. MGM Resorts and Dominos Pizza aren’t slouching either, up 3.76% and 17.39% respectively, year-to-date. This duo collectively makes up a significant 0.5% slice of the underlying holdings within IYC.

Tech & Communications: Rising Titans

On another front, the Technology & Communications sector is a force to reckon with, posting a respectable 0.4% gain. Seagate Technology Holdings PLC (STX) and Western Digital Corp (WDC) lead the charge, marking impressive gains of 9.1% and 5.4% respectively. The Technology Select Sector SPDR ETF (XLK) closely follows these stocks, holding steady today and accumulating an 8.54% year-to-date growth. Seagate Technology Holdings PLC and Western Digital Corp are no strangers to success either, with 13.49% and 30.74% growth respectively, year-to-date. Together, STX and WDC form a sizable 0.4% portion of the underlying assets under XLK’s umbrella.

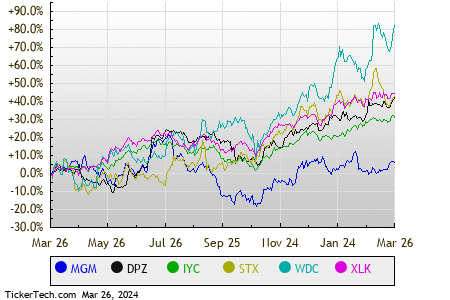

When we delve into a retrospective view comparing these equities on a trailing twelve-month scale, a dynamic price performance chart emerges, each symbol representing an entity clearly marked for easy reference. This visual aid encapsulates the market’s ebbs and flows succinctly.

Keeping tabs on the broader landscape, the S&P 500 components across different sectors paint a vivid picture of Tuesday’s afternoon sessions. While five sectors enjoy an upswing, three sectors battle the red tides.

| Sector | % Change |

|---|---|

| Services | +0.5% |

| Technology & Communications | +0.4% |

| Consumer Products | +0.3% |

| Financial | +0.2% |

| Industrial | +0.1% |

| Healthcare | 0.0% |

| Materials | -0.1% |

| Energy | -0.5% |

| Utilities | -0.8% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

For Further Exploration:

Dive into historical PE Ratios

Fascinating RIDV Videos

Discover the Top Ten Hedge Funds Holding NFX

In the realm of market musings, it’s essential to remember that opinions shared are the writer’s own and may not always mirror those of Nasdaq, Inc.