Midday Market Update: Technology & Utilities Struggle in Afternoon Trading

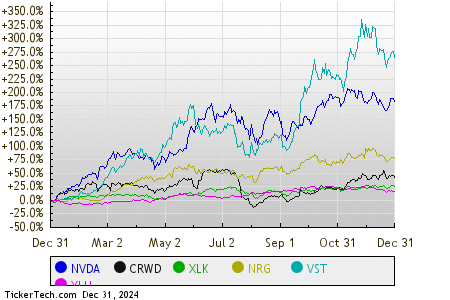

As of midday Tuesday, the Technology & Communications sector is facing challenges, showing a 0.5% decline. Notably, NVIDIA Corp (Symbol: NVDA) and CrowdStrike Holdings Inc (Symbol: CRWD) lead this drop, with losses of 2.3% and 2.1%, respectively. The Technology Select Sector SPDR ETF (Symbol: XLK), which tracks this sector, is down 0.9% today but remains up 21.47% for the year. In contrast, NVDA boasts a remarkable 171.23% increase year-to-date, while CRWD has risen by 33.90%. Together, they represent around 14.4% of XLK’s total holdings.

The Utilities sector is also struggling, registering a 0.4% loss. The most significant declines among large Utility stocks come from NRG Energy Inc (Symbol: NRG) and Vistra Corp (Symbol: VST), which have dropped by 2.2% and 1.5%, respectively. The Utilities Select Sector SPDR ETF (XLU), which closely follows this sector, mirrors the trend with a 0.4% decrease today, although it is still up by 22.66% year-to-date. NRG Energy has increased by 77.39% this year, while Vistra Corp has surged by an astounding 260.50%. Collectively, these companies make up about 5.6% of XLU’s underlying assets.

To better illustrate the stock performance in the last twelve months, here’s a chart comparing these stocks and ETFs:

Below is a snapshot showing how various S&P 500 sectors are performing in the afternoon, with four sectors reporting gains while three are in the red.

| Sector | % Change |

|---|---|

| Energy | +1.2% |

| Materials | +0.2% |

| Consumer Products | +0.1% |

| Healthcare | +0.1% |

| Services | -0.0% |

| Financial | 0.0% |

| Industrial | -0.2% |

| Utilities | -0.4% |

| Technology & Communications | -0.5% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

– Industrial Stocks Hedge Funds Are Buying

– OIBR Options Chain

– Top Ten Hedge Funds Holding GTEK

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.