“`html

E-Commerce Poised for Growth as 2024 Holiday Sales Surge

Strong Q3 Figures Highlight E-Commerce’s Growing Share of Retail

2024 is shaping up to be a promising year for the e-commerce sector, which continues to capture significant portions of the retail market. According to the latest numbers from the Commerce Department, e-commerce sales increased by 7.4% in the third quarter of 2024 compared to 3Q23, with a sequential rise of 2.6%. Meanwhile, total retail sales saw a modest growth of 2.1% (an increase of 1.3% sequentially).

E-commerce now represents about 16.2% of total U.S. retail sales. As we move into the fourth quarter—historically the strongest for the industry—investors may find this an opportune time to explore stocks in e-commerce. Our top picks for the season include ACV Auctions (ACVA), Amazon (AMZN), and JD.com (JD).

Consumer Trends Shape E-Commerce Landscape

The convenience of online shopping is a major driver of e-commerce volume, especially among Gen-Z consumers who are adapting to a highly digital shopping environment. Raised on the Internet, this demographic is fluent in social media, where influencer-driven marketing is significantly impacting their purchasing decisions. This evolving landscape is influenced by advanced technologies such as augmented reality (AR), virtual reality (VR), and social commerce developments within platforms like the Metaverse.

Record-Breaking Holiday Sales in 2024

As the holiday shopping season progresses, sales figures are impressively strong. Adobe Analytics reported that sales between November 1 and December 31 showed a substantial increase, driven by steep discounting—30.1% off electronics and 28% off toys. Furthermore, mobile shopping accounted for 54.5% of purchases, with consumers spending 8.4% more than in the previous year.

Salesforce also indicates a record-breaking season, with discounts averaging 26% during Cyber Week and an increase of 15% in online sales leading up to the holiday week, followed by a 10% rise afterward. Mobile devices constituted 67-69% of total orders, and wallet usage saw a 10% increase. It’s worth noting that rising supply chain costs curtailed deeper discounts, while 19% of purchases were influenced by artificial intelligence, which saw a 25% rise in usage.

Market Considerations and Industry Dynamics

Growth trends in e-commerce are indeed promising. However, high valuations exist due to favorable sentiment among analysts and the public, necessitating careful investment choices.

The Future of Internet Commerce

As technology evolves, the Internet-Commerce landscape continues to transform. Advances in user devices and sophisticated platforms that combine chatbots and social media enhance consumer experience. With artificial intelligence boosting user satisfaction, the metaverse offers a potential paradigm shift.

Key Trends Influencing the E-Commerce Sector

- The distinction between physical and digital retail is increasingly blurred. Consumers often research online before purchasing in-store or utilize curbside pickup. Retailers are investing in technology for faster delivery, with some using robots, self-driving vehicles, and drones to ease delivery challenges.

- The subscription model is gaining traction, allowing consumers to order repeat-use items conveniently. Retailers typically offer discounts for this option, promoting its appeal. As various products shift to “as-a-service,” this trend is set to grow.

- Direct consumer access is vital for data acquisition, which helps businesses provide personalized experiences. Companies like Amazon leverage AI-driven analytics to optimize customer satisfaction and drive sales. Controlling customer data has become essential for success, with large players also engaging in payment processing.

- Despite fluctuations in the macroeconomic landscape, no immediate recession appears imminent. Rate cuts are sparking improved consumer sentiment. While supply chain and labor issues have eased, global uncertainties still impact foreign exchange for companies with global reach. The digital presence across retailers is becoming increasingly crucial, as e-commerce continues to expand in both product variety and geographic reach.

- Gen-Z is redefining shopping through social commerce, which allows customers to discover and purchase products on social media platforms, often driven by influencers. TikTok, popular among younger users, leads this trend, but Facebook and Instagram are also key players.

Zacks Industry Rank Signals Positive Outlook

The Zacks Internet – Commerce industry shows strong potential, reflecting the dynamic changes and opportunities present in the e-commerce market. As companies adapt to changing consumer behaviors and preferences, the sector continues to flourish.

“`

Insights on Ecommerce Growth: Top Stocks You Should Consider

Within the larger Zacks Retail and Wholesale sector, the Ecommerce industry holds a strong position, currently ranked #70 among 250 Zacks industries. This ranking places it in the top 28%, highlighting promising near-term prospects.

Research indicates that industries within the top half of the Zacks rankings outperform those in the bottom half by more than two-to-one. Consequently, the ecommerce sector’s high ranking reflects a steady improvement in earnings estimates over the past year. Specifically, the aggregate earnings estimate for 2024 has risen by 17.9%, while the 2025 figures, which had declined sharply in March last year, have since bounced back, increasing by 12.6%. Additionally, the rate cuts enacted this year are likely to boost spending and support optimistic forecasts.

Solid Stock Performance in the Ecommerce Sector

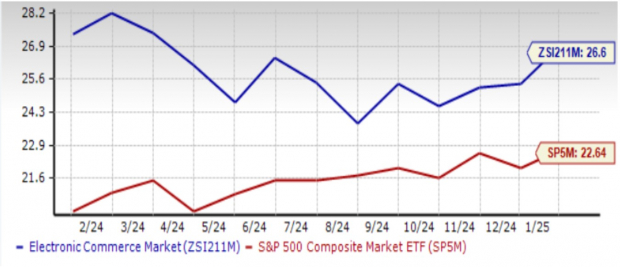

Over the last year, the Zacks Electronic – Commerce Industry has performed closely alongside both the broader Retail and Wholesale sector and the S&P 500, typically trading at a premium to both. Specifically, this industry saw a significant collective gain of 43.5%, exceeding the 31.8% increase in the Zacks Retail and Wholesale Sector and the 24.8% rise in the S&P 500.

One-Year Price Performance

Image Source: Zacks Investment Research

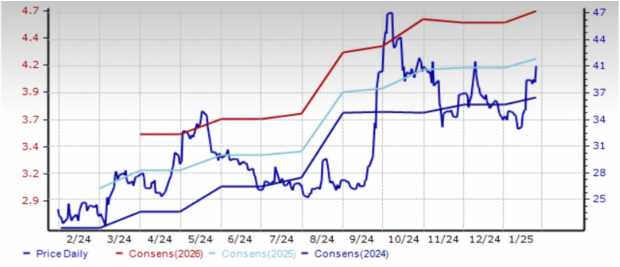

Current Valuation Signals Overvaluation

This industry has historically traded at a premium compared to both the sector and the S&P 500. At present, its price-to-forward 12 months’ earnings (P/E) stands at 26.6X, representing a 17.5% premium over the S&P 500 and a 4.5% premium over the broader retail sector, which are priced at 22.64X and 25.45X, respectively. It is notable that the industry is trading just slightly above its own median valuation of 25.42X, indicating potential overvaluation.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Three Promising Stocks to Explore

The upbeat outlook has created various stock options to consider, given the diversification within the ecommerce industry regarding business models and geographical presence. To guide your choices, we’ve identified three attractive stocks based on our proprietary ranking system.

ACV Auctions Inc. (ACVA): Hailing from Buffalo, New York, ACV operates a digital marketplace that connects buyers and sellers of wholesale vehicles. They provide numerous services related to vehicle sales, ensuring buyers can make informed decisions. However, ACV’s growth is somewhat hampered by a shortage of used vehicle inventory and a weaker retail market. Despite these challenges, they are expanding operations and services, positioning themselves well for growth. Analysts forecast a staggering 160% growth for 2024 and an exceptional 517% for 2025, with revenue expected to grow by 32% in 2024 and 24% in 2025. ACV’s stock has surged 54% over the past year, making it a strong buy rated Zacks #1 stock.

Price & Consensus: ACVA

Image Source: Zacks Investment Research

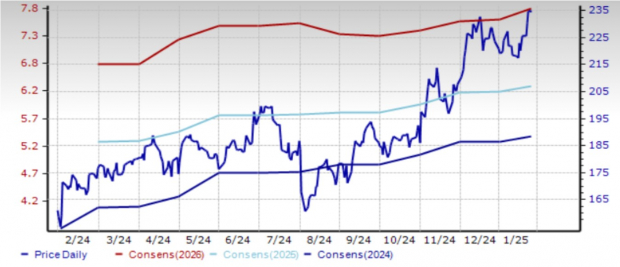

Amazon, Inc. (AMZN): Based in Seattle, Amazon is a global leader in online marketplaces, propelled by its Prime loyalty program, which boosts sales across various categories. Acquiring Whole Foods Market in 2017 has also fortified Amazon’s physical presence. Its size and reach allow it to offer competitive prices, with a steadily growing Prime user base contributing to subscription revenue. Analysts are optimistic about Amazon’s projected growth, anticipating a revenue increase of 10.9% and earnings growth of 82.4% in 2024. Over the past year, Amazon’s shares have risen 45.6% and hold a Zacks Rank of #2 (Buy).

Price & Consensus: AMZN

Image Source: Zacks Investment Research

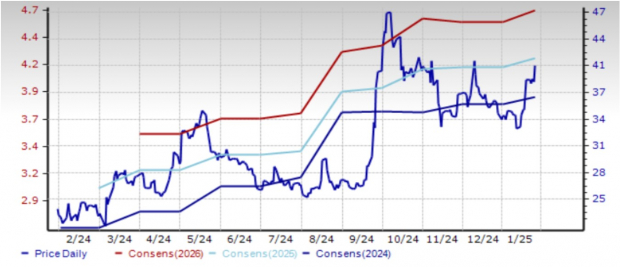

JD.com, Inc. (JD): Operating out of Beijing, JD provides extensive ecommerce services alongside logistics and asset management solutions. As consumer sentiment improves in China, JD is set to benefit from enhanced user experiences aimed at increasing engagement. Strong sales from general merchandise, driven by promotions like Singles Day, have bolstered both revenue and earnings. Analysts expect JD to show earnings growth of 31.7% in 2024 and 8.8% in 2025. With a Zacks Rank of #2, shares of JD have appreciated by 73.6% over the past year.

Price & Consensus: JD

Image Source: Zacks Investment Research

Expert Insights on Promising Stocks

The Zacks Research team has pinpointed five stocks they believe have the best chance of doubling in value within the next few months. Among these candidates, Sheraz Mian, Director of Research, has identified one stock he believes is set to soar. This innovative financial firm, with a burgeoning customer base exceeding 50 million, is positioned for significant future gains. While not every selection will be a winner, this stock could potentially surpass past successful picks from Zacks, like Nano-X Imaging, which achieved a remarkable 129.6% rise in less than nine months.

For more insights and recommendations, download Zacks’ top stock picks for the next month.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

ACV Auctions Inc. (ACVA): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.