Market Volatility: A Steady Return for S&P 500 Investors

If you’re feeling optimistic about the market now, congratulations—you’ve navigated a tumultuous period.

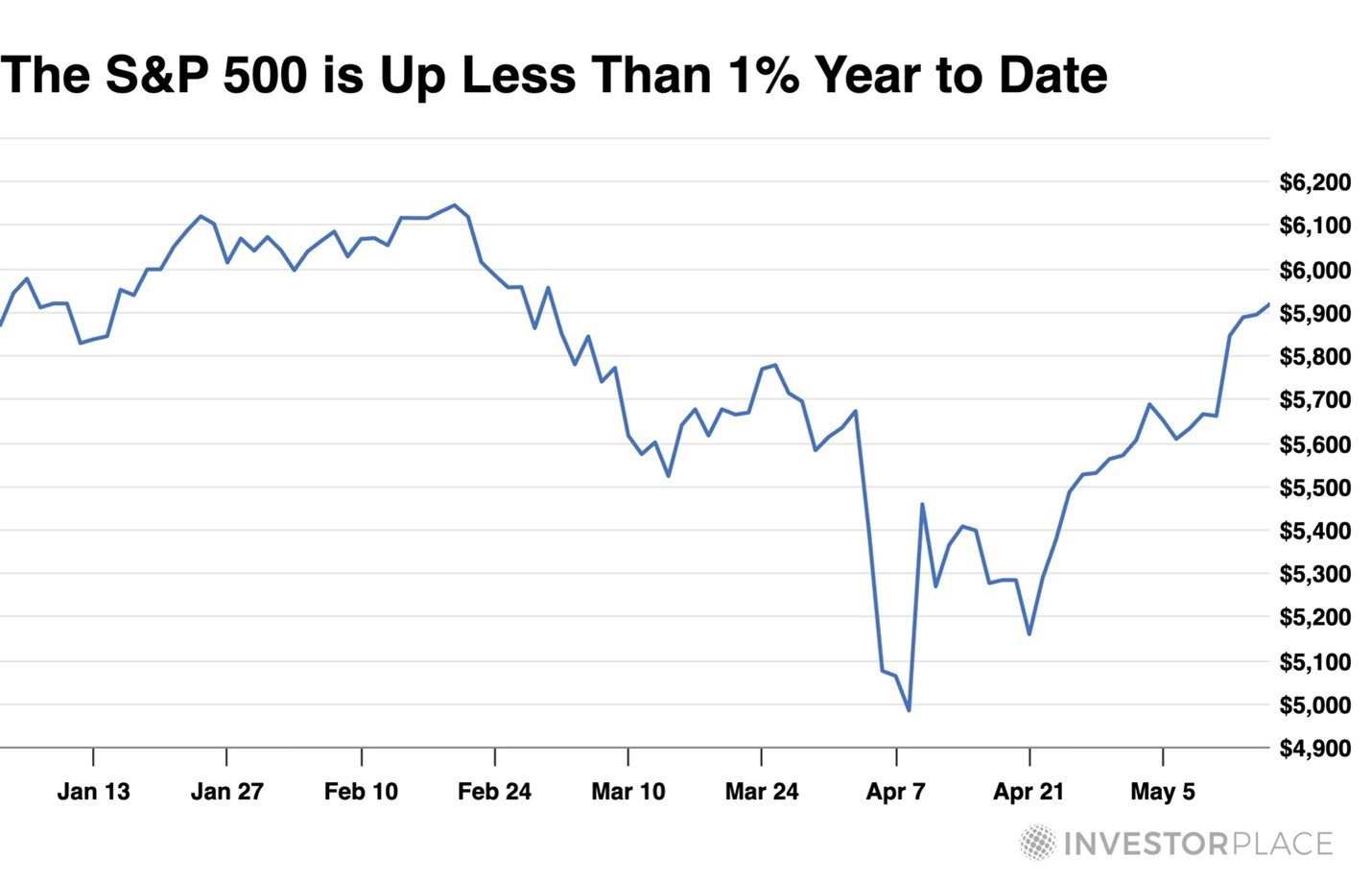

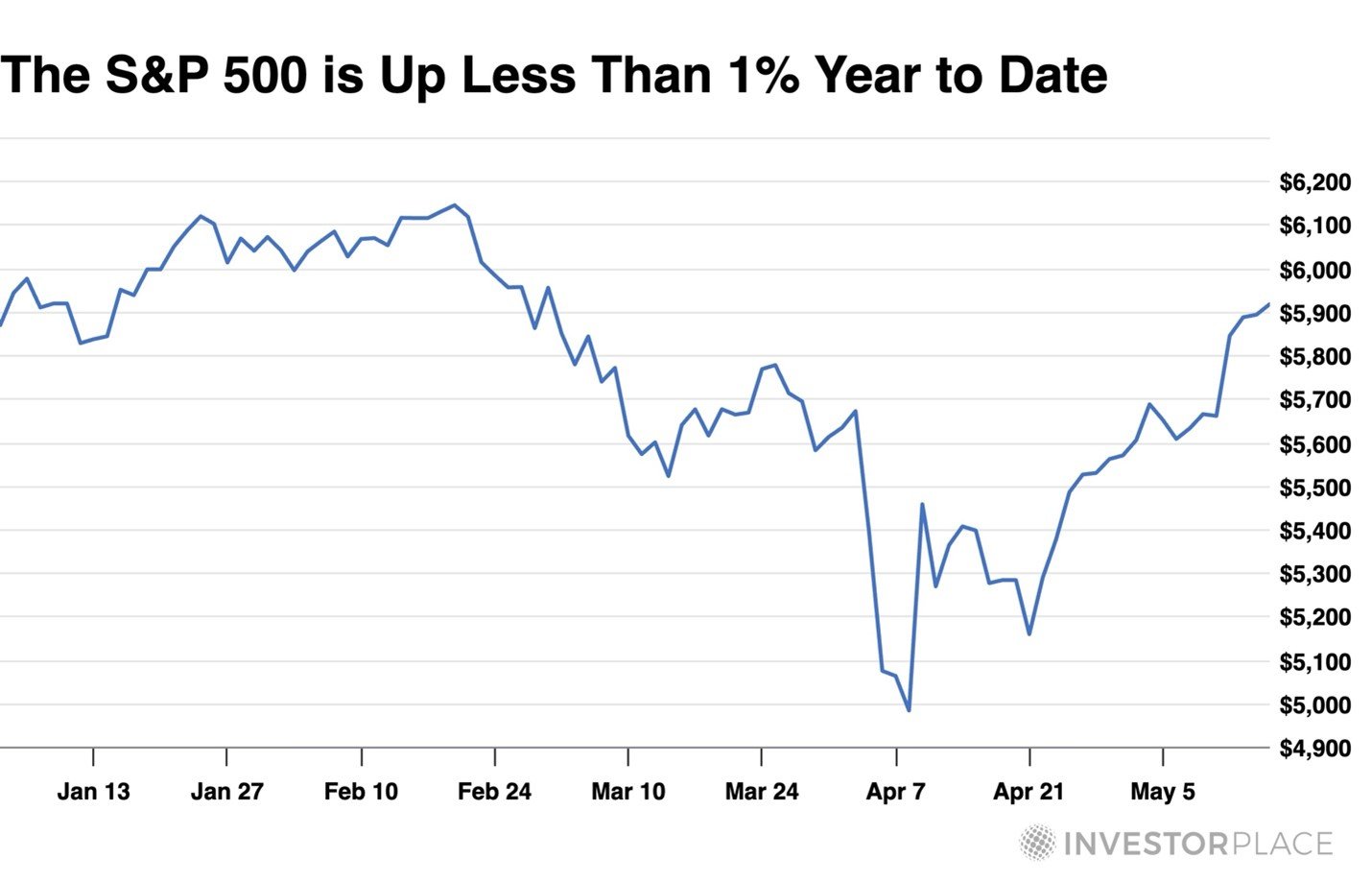

After a significant selloff, the S&P 500 has returned to a flat position for the year. While this may not appear as a triumph, it certainly feels like a victory given the steep declines we faced.

However, a stagnant market isn’t inherently a sign of strength. Let’s reflect on the start of 2025. Did you expect the market’s position in May to be where it is now?

If someone had mentioned in January that we would only be up less than 1% by May, would you have been satisfied, or would it have seemed like a warning sign?

At this moment, we find ourselves in surprisingly good spirits.

This brings us to a common psychological bias—anchoring.

As expectations decline rapidly alongside prices, returning to a neutral state can feel like a significant win. It’s crucial to avoid letting this sentiment cloud your judgement.

In the world of investing, merely surviving market fluctuations isn’t sufficient for success.

Those who thrive are often the ones who know how to adapt to volatility and leverage it for wealth growth—while other investors may hesitate or act impulsively.

Many investors view volatility like a storm: they choose to hide, wait, and hope for clearer skies. Worse yet, some panic and sell off their positions.

Conversely, savvy investors understand how to adjust their strategies to harness the storm’s energy to advance more effectively. Here’s how to achieve that.

Predicting Historical Market Volatility

“I just want to point out for the record…. JEFF CLARK WAS RIGHT ABOUT EVERYTHING.”

This statement reflects a conversation I had with a colleague about master trader Jeff Clark.

She was referencing Jeff’s accurate forecast that the first 100 days of the Trump administration would bring volatility to the market, providing profitable opportunities for his subscribers.

In January, Jeff noted:

“It’s official: Under President Trump’s leadership, the market is shaping up to be a minefield for passive investors and a gold mine for savvy traders. While headlines swirl with discussion about new tariffs, AI advancements, and global trade upheavals, one truth remains: The most lucrative opportunities belong to those who recognize volatility for what it really is—a catalyst for potentially explosive gains.”

He correctly anticipated the turbulence ahead.

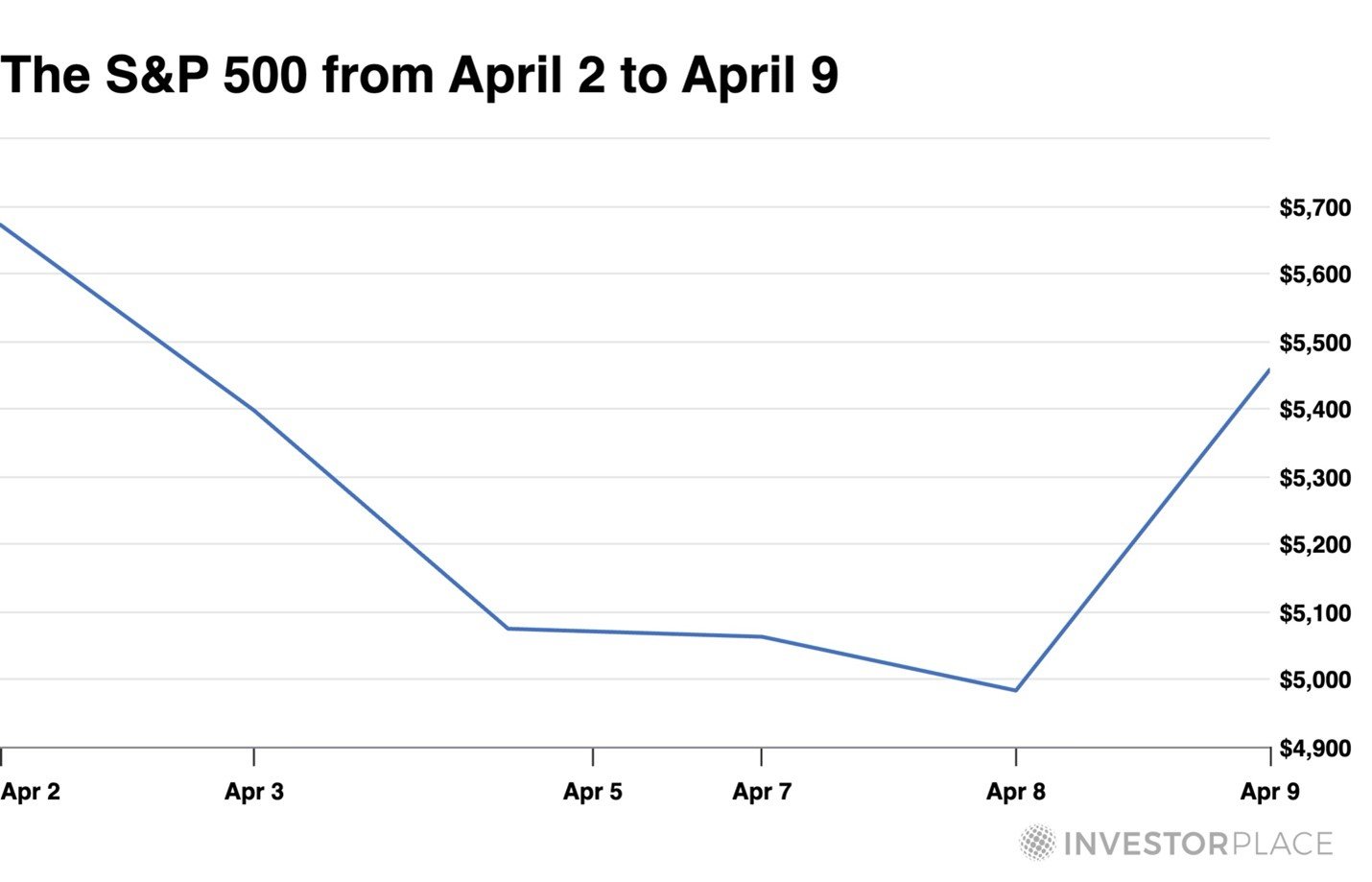

On April 4, shortly after Trump’s “Liberation Day” press conference, the S&P saw a drop of 2,231 points—the third largest point loss recorded. Just five days later, the market rebounded with a 2,962-point gain, marking the largest point increase in S&P history.

As noted earlier, the market is currently almost flat for the year. Buy-and-hold investors have had to maintain composure during this extreme volatility.

In contrast, Jeff and his readers have strategically capitalized on these market fluctuations, securing profits without needing to sell a single share.

Effective Strategies for Income Generation in Volatile Markets

Understanding Cash-Secured Puts

Jeff operated a money management firm for over two decades, focusing on options trading. His firm catered to high-net-worth clients who had elevated expectations.

His reputation grew not through speculative plays but via strategic and conservative use of options for income generation and risk management.

Here’s how he explains his methodology.

“Most traders want quick recommendations on which calls or puts to buy. They aim to speculate on market movements, which is understandable. However, for those serious about generating income, mastering the sale of uncovered puts is essential.”

“This strategy truly stands out as the best income-producing tactic available today.”

Mechanics of Selling Cash-Secured Puts

Jeff employs a method called selling cash-secured puts. This involves receiving payment upfront in exchange for committing to buy a stock he favors, but only under predefined terms.

He determines the maximum decline in the stock’s price and specifies a deadline.

If the stock meets his criteria by the set date, he buys it at a discount, allowing him to profit from both the purchase and the initial premium collected. Alternatively, if the stock does not reach his target price, he retains the premium—both outcomes prove advantageous.

This strategy enables investors to maintain their preferred long-term positions while generating cash to cover various expenses, even during market fluctuations.

In volatile conditions, when prices fluctuate significantly, this approach can produce stable, repeatable income, regardless of market direction.

Looking Ahead: Preparing for Market Volatility

Despite recent market rallies, Jeff cautions that significant volatility lies ahead.

In the event of another market shock, what can investors expect?

If market performance merely returns to neutrality, many investors might find themselves stagnant, generating no returns.

Contrarily, those who adopt Jeff’s strategy will continue to collect cash.

This distinction emphasizes the difference between merely weathering market storms and actively profiting from them.

Jeff elaborates on this strategy in a new free video, providing insights into optimizing income streams.

Given this year’s tumultuous events, merely returning to break-even may seem like a victory for many.

However, for those nearing or in retirement, achieving break-even isn’t sufficient; they require ongoing income, consistency, and peace of mind.

No matter the market narrative, adopting proven strategies for income generation remains crucial.

Wishing you a productive weekend,

Luis Hernandez

Editor in Chief, InvestorPlace