Consumer Sentiment Plummets: Insights on Economic Resilience

Current consumer perceptions of the economy are quite negative, as highlighted by the University of Michigan’s recent Consumer Sentiment report, which indicates a deteriorating outlook.

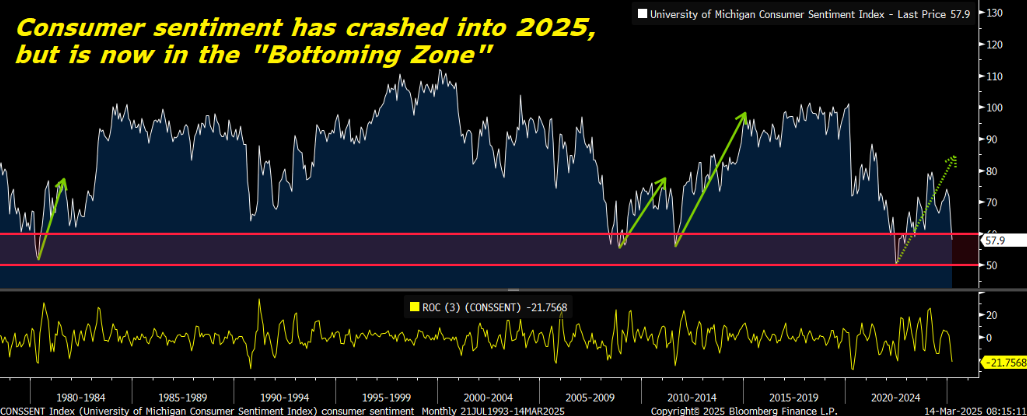

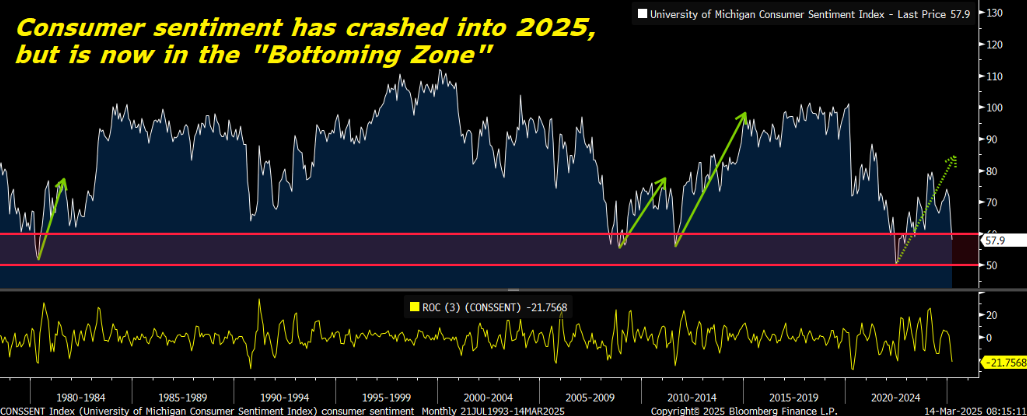

Consumer sentiment is in steep decline. The university’s headline index fell from 64.7 in February to 57.9 in March, marking its lowest point since November 2022. Moreover, the Current Conditions Index decreased to 63.5, the lowest since September 2024. Meanwhile, the Expectations Index plummeted to 54.2, its lowest since July 2022.

This downward trend is not new; it has been ongoing throughout the year. Over the past three months, consumer sentiment has sunk by 21%, the largest decline recorded since the height of the COVID-19 pandemic in summer 2020.

These figures are concerning.

However, there’s a distinction between perception and reality.

So, is the situation really as dire as it seems?

Gross domestic product (GDP) growth remains positive at 2.3%. Consumer spending shows stability, and unemployment stands low at 4.1%. Inflation is decreasing, currently around 2.8%. Additionally, wage growth is robust, approximately 4.3%, significantly surpassing inflation rates. Corporate profits are also on the rise, as seen during the fourth-quarter earnings season, with over 75% of the S&P 500 companies exceeding consensus estimates.

Despite ongoing trade tensions and policy uncertainties, the economy appears to be on solid ground.

Although consumer sentiment is bleak at the moment, the actual economic climate looks relatively stable. This could change, but presently, conditions seem normal.

We believe consumer sentiment is likely to improve over the next few months—and as it does, stocks should follow suit.

Is the Bottom Approaching?

Consumer sentiment is currently facing significant pressure due to tariff issues, federal spending cuts, and policy challenges. However, we expect these factors to alleviate in the upcoming months.

It is our view that these current policy moves by the Trump administration are strategically planned to open doors for future initiatives, including substantial tax cuts and deregulatory measures, which could positively influence consumer sentiment.

We believe that the current downturn in sentiment is mainly due to short-term policy hurdles. As the administration shifts its focus in the coming months, we anticipate a rebound in consumer confidence.

Supporting this view, the Consumer Sentiment Index from the University of Michigan has dropped to levels that historically signify the “bottoming zone.”

Since 1980, consumer sentiment has fluctuated significantly, but it consistently hits lows between 50 and 60 during downturns. For instance, in 1980, during a strict Federal Reserve rate hike, it reached a low of 52. In 2008, amid the financial crisis, it dipped to 55, while in 2011, during the European debt crisis, it fell to 56, and it hit 50 during the height of inflation in 2022.

With the consumer sentiment index now below 58, we may indeed be in the bottoming zone.

If this indeed marks the bottom, it could be a very favorable time to purchase stocks.

Historically, significant rebounds in consumer sentiment from this zone have often coincided with major market recoveries, as seen in the early 1980s, post-Great Financial Crisis, in 2012/13, and recently between 2023/24.

Final Observations on Consumer Sentiment

Wall Street is experiencing high volatility at present.

This week, the S&P 500 has entered correction territory, declining 10% from recent peaks in one of its swiftest downturns in history. Similarly, the Nasdaq is down 15% from its recent highs, and the Russell 2000 has witnessed a nearly 20% plunge.

Nevertheless, if our analysis regarding consumer sentiment hitting a low proves accurate, it’s likely that stocks will follow suit – suggesting that the current market volatility may create a valuable buying opportunity.

That’s why we encourage our subscribers to consider investing in stocks now.

Which sectors should investors focus on for optimal buying opportunities?

The technology sector, particularly artificial intelligence (AI), has garnered significant attention as a major growth area. This evolution has already led to impressive investment returns, with gains of approximately 990% for Palantir (Stock-ticker”>PLTR) and 400% for Nvidia (Stock-ticker”>NVDA) in just two years. This sector still holds further growth potential.

However, the challenge is that the AI market is becoming increasingly crowded. Therefore, we are actively exploring the next significant breakthrough in the industry.

We believe we may have identified what we refer to as AI 2.0—a development potentially much larger than the advancements witnessed during the current AI boom.

Explore the next generation of AI that has the potential for even greater profit than today’s leading technology firms.

As of the publication date, Luke Lango did not hold any positions in the securities mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by subscribing to our Daily Notes. Check out the most recent issues on your Innovation Investor or Early Stage Investor subscriber site.