Trading Smart: Navigating Uncertainty in Trump’s New Term

Avoid costly trading mistakes during Trump’s first 100 days.

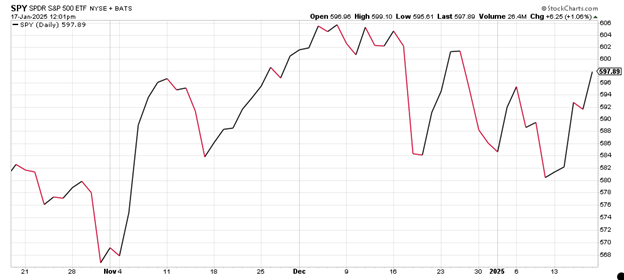

Editor’s Note: When Donald Trump was announced the winner of the 2024 presidential election last November, Wall Street responded with a rally. However, as his inauguration approached, the markets lost much of those gains.

This downturn was largely due to uncertainty about the direction of Trump’s second presidency. But what if you could turn that uncertainty into profits during his first 100 days?

My colleague, Jeff Clark, is hosting The Most Profitable 100 Days of Your Life event tomorrow at 1 p.m. Eastern Time, discussing how the volatility during this period could be financially beneficial. Click here to reserve your spot.

I’ll now hand it over to Jeff.

In the aftermath of Donald Trump’s victory on November 4, without the distraction of widespread protests or legal disputes, markets rallied in excitement.

Traders were optimistic about Trump’s promises of deregulation and energy independence, alongside a business-focused administration.

Potential challenges posed by the Biden administration suddenly appeared to be opportunities under Trump.

However, in the two months since the election, the market reversed those gains.

Below, you can see the performance chart of the S&P 500 (SPX) from election day through January 17.

So, what caused this shift?

The answer lies in a well-known investor saying: “The market hates uncertainty.”

As we approach the start of Trump 2.0, many questions remain unanswered:

- Will tariffs lead to higher inflation?

- How will the Federal Reserve respond?

- Can Trump secure more tax cuts?

- Will he successfully boost advancements in AI, electric vehicles, and cryptocurrency?

- How will global leaders respond to changes in U.S. politics?

- Could Elon Musk and the Department of Government Efficiency (DOGE) achieve a $2 trillion cut in federal spending? What consequences might follow?

- What conflicts might arise in Congress, considering Trump faced impeachment twice previously?

With so many unknowns, political upheaval can create wild market fluctuations.

During Trump’s first 100 days, which promise significant government and economic changes, investors could experience turbulent times.

However, for those prepared to navigate it, these 100 days may present unique profit opportunities.

Understanding how to trade during periods of volatility is the key.

Volatility Equals Opportunities for Savvy Traders

Trading during volatile times can be challenging for emotional investors.

For over 42 years, I have developed strategies for navigating such market conditions.

For instance, I accurately predicted the 2008 financial crisis and assisted my readers in achieving triple-digit gains 25 times between 2007 and 2009.

I repeated this success during the pandemic downturn in 2020 and the tech market collapse in 2022, alerting my subscribers to potential downturns, helping them protect gains, and recommending profitable trades.

Seeing volatility as a source of profits has enabled me to make over 1,000 winning trade recommendations throughout my career, helping everyday investors seize opportunities often overlooked by others.

Unfortunately, many investors miss these opportunities.

Volatility tends to generate feelings of excitement and fear, emotions that should not guide investment decisions.

When investors react emotionally, they often make mistakes that can lead to losses.

A prime example occurred in Trump’s first 100 days in 2017.

In January 2017, Trump issued an executive order mandating that all U.S. pipeline projects use American-made steel. This announcement spurred traders to flock to United States Steel (X), pushing its price up nearly 30% in under a month. However, deeper analysis revealed the company was not performing well, and the order took longer to implement than anticipated.

Consequently, U.S. Steel’s stock price plummeted just three months later.

Strategizing for Profit Amid Potential Market Chaos

Veteran investors often rely on tried-and-true strategies instead of getting swept up by hot trends. This approach can lead to significant gains.

Using my method, traders could have made a bullish trade on January 25, the day following the executive order announcement, and tripled their money.

Additionally, by identifying bearish patterns, these same traders could have tripled their profits once again during market downturns.

How You Can Capitalize on Market Movements

Much like eight years ago, we can expect a chaotic market during Trump’s first 100 days in office.

Many investors react impulsively to headlines or trending news—this is not an effective strategy. Instead, keen traders recognize these fluctuations as potential profit-making opportunities.

Regardless of personal views, I am eager about the trading prospects that Trump’s next term may bring.

I’m so enthusiastic that I will host a live session on Wednesday, January 22, at 1 p.m. ET. In this session, I will reveal how I prepare myself and my readers for The Most Profitable 100 Days of Your Life.

You won’t want to miss this opportunity. I’ll be discussing weekly chances to multiply your wealth—transformative possibilities for many.

Be sure to reserve your spot now.

Best regards and happy trading,

Jeff Clark

Editor, Market Minute

P.S. After trading through 11 presidential inaugurations, I can confidently say this is a rare opportunity. The last comparable moment occurred in 1933 with FDR’s presidency.

So please, sign up here to gain insights from my experience. Your investment portfolio and future will benefit.

Furthermore, if you opt-in for VIP text alerts, you will receive my exclusive report Trump Surge Stocks: Three Hot Tickers to Put on Your Watchlist Today at no charge. This report is yours to keep, regardless of whether you join me on Wednesday, January 22, at 1 p.m. ET.

“`