Twilio’s Stock Faces Short-Term Challenges but Long-Term Growth Remains Strong

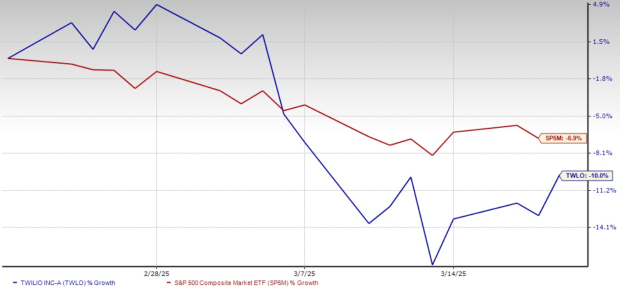

Twilio Inc. (TWLO) has encountered difficulties recently, experiencing a 10% decline over the past month. This performance lags behind the S&P 500, which saw a decrease of 6.9% during the same timeframe. The drop can be attributed to broader market trends along with company-specific issues, particularly concerning its earnings guidance.

Recent Performance and Earnings Guidance

Image Source: Zacks Investment Research

Despite these short-term challenges, Twilio’s long-term growth potential remains promising. The company leads in customer engagement, innovates with artificial intelligence (AI), and implements shareholder-friendly policies, making it a stock worth considering for ongoing investment.

Investors React to Earnings Miss and Guidance

Twilio reported its fourth-quarter results on February 13, 2024, which slightly missed analyst expectations. The non-GAAP EPS was $1.00, compared to the Zacks Consensus Estimate of $1.02. However, revenue reached $1.19 billion, just above predictions.

Twilio Inc. Price, Consensus, and EPS Surprise

Twilio Inc. price-consensus-eps-surprise-chart | Twilio Inc. Quote

The main cause for concern came from the company’s first-quarter 2025 guidance, which projected EPS of 88-93 cents, falling short of the consensus prediction of 95 cents. Additionally, the revenue forecast of $1.13-$1.14 billion signaled a potential sequential decline, raising alarms about diminishing demand and challenges to profitability.

Stay up-to-date with all quarterly releases: see Zacks earnings Calendar.

Although these short-term figures are troubling, they do not overshadow Twilio’s strong underlying fundamentals. The company’s sustained investments in AI and customer engagement, along with a devoted customer base, substantiate its long-term growth trajectory, making it a stock to hold during this tumultuous period.

Leadership in the Customer Engagement Market

Twilio maintains a strong presence in the customer engagement sector by providing real-time, personalized interactions for businesses worldwide. Its AI-driven solutions enhance both efficiency and customer satisfaction. Products like Twilio Verify and Voice Intelligence utilize AI to improve security and deliver valuable insights, automating customer interactions.

Additionally, Twilio Segment, a growing customer data platform, stands as a significant growth catalyst. By consolidating customer data across multiple channels, Segment enables businesses to execute highly targeted marketing campaigns, ultimately driving retention and sales.

As companies increasingly adopt AI for streamlined operations and enriched customer experiences, Twilio’s robust, data-rich platforms are well-positioned to capitalize on this trend. The company’s strategic foothold in the customer engagement market supports its long-term hold status amidst short-term headwinds.

Competitive Advantage through an API-First Strategy

Twilio distinguishes itself from larger competitors such as Cisco (CSCO), Microsoft (MSFT), and Amazon (AMZN) with its application programming interface (API)-first approach. While these industry giants often provide standardized package solutions, Twilio’s customizable APIs allow businesses to create unique communication experiences, offering a competitive edge.

This adaptability has attracted a diverse customer base, from startups to major enterprises, fostering customer loyalty. Moreover, Twilio’s extensive global reach—spanning over 180 countries—positions it favorably against regional competitors. Its comprehensive integration of messaging, voice, email, and video solutions reinforces its role as a trusted provider of customer engagement technologies.

Financial Stability and Commitment to Shareholders

Even with the recent earnings miss, Twilio demonstrates robust financial performance. In the fourth quarter, the company reported a 16.3% year-over-year increase in EPS, alongside an 11% rise in revenue, underscoring the resilience of its business model.

Twilio’s dollar-based net expansion rate improved to 106%, up from both 105% in the previous quarter and 102% year-over-year, indicating strong customer retention and upselling efforts. The number of active customer accounts rose to over 325,000 as of December 31, 2024, compared to 320,000 previously, illustrating ongoing customer acquisition success.

The company’s financial position remains strong, with $2.38 billion in cash and equivalents as of December 31, 2024. Twilio also generated $657.5 million in free cash flow in 2024, along with $716.2 million in operating cash flow, highlighting its financial health and readiness to support growth initiatives.

Twilio’s dedication to returning value to shareholders adds to its attraction. The company repurchased $2.33 billion in shares in 2024, completing its $3 billion buyback program. In January 2025, the board sanctioned a new share repurchase plan of $2 billion, effective until December 31, 2027, reflecting management’s confidence in the company’s long-term potential.

Attractive Valuation Presents Investment Opportunity

In light of the recent stock sell-off, Twilio’s valuation has become more appealing. The stock trades at a forward price-to-sales (P/S) ratio of 3.22, which is significantly lower than the Zacks Internet – Software industry average of 4.94. This suggests that much of the recent caution surrounding the stock is already factored into the price, making Twilio a compelling hold for investors with a longer-term outlook.

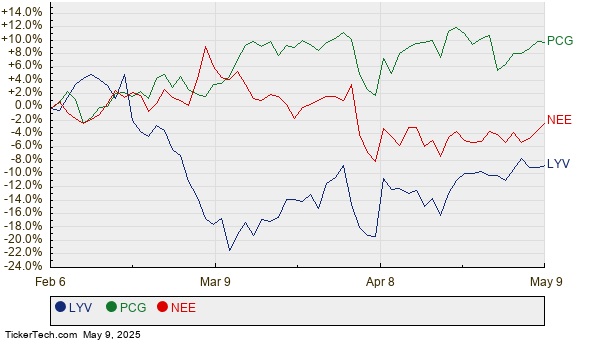

Twilio Forward 12-Month P/S Ratio

Image Source: Zacks Investment Research

Conclusion: Hold TWLO Stock During Current Volatility

While Twilio grapples with immediate challenges arising from disappointing guidance and broader technology sector weaknesses, its long-term growth factors remain solid. The company’s leadership in customer engagement, expanding AI capabilities, and financial soundness position it for sustainable growth.

Given its favorable valuation and strategic market positioning, investors are encouraged to maintain their Twilio holdings for the time being.

Twilio Positioned for Growth Despite Market Pressures

Current analysis suggests that Twilio Inc. (TWLO) is a solid investment choice. The company is strategically positioned to benefit from long-term trends in customer engagement and artificial intelligence, even amid short-term market challenges. Presently, Twilio holds a Zacks Rank of #3 (Hold), indicating a stable outlook.

For those interested, you can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top Semiconductor Stock

A new semiconductor stock has caught attention. It is currently just 1/9,000th the size of NVIDIA, which has experienced a remarkable surge of over 800% since Zacks recommended it. While NVIDIA remains robust, this new chip company shows significant potential for future growth.

This semiconductor firm is poised to benefit from rising demand for artificial intelligence, machine learning, and Internet of Things technologies. The global semiconductor manufacturing market is forecasted to grow substantially, from $452 billion in 2021 to an estimated $803 billion by 2028.

To explore more, you can see this stock now for free.

If you’re keen on the latest expert stock recommendations, Zacks Investment Research has made available “7 Best Stocks for the Next 30 Days.” Click here to download this free report.

Also available for free stock analysis are:

This information was originally published on Zacks Investment Research.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.