Twilio’s Stock Takes a Hit After Earnings Report, But Long-Term Potential Remains Strong

Twilio Inc. TWLO experienced a significant stock drop of 15% following its fourth-quarter 2024 earnings announcement. This decline is largely attributed to a slight earnings miss and cautious future guidance. The company’s non-GAAP EPS was reported at $1.00, slightly below the Zacks Consensus Estimate of $1.02, while revenues reached $1.19 billion, beating expectations by a narrow margin.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

First-Quarter Guidance Disappoints Investors

For the first quarter of 2025, management guided for an EPS of 88 to 93 cents, which is below the consensus estimate of 95 cents, causing concern among investors. Additionally, revenue projections for this period, estimated between $1.13 and $1.14 billion, indicate a potential decline from the previous quarter, raising short-term worries about demand and profitability.

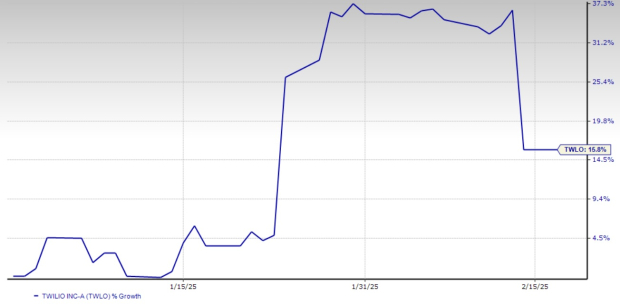

Despite this downturn, Twilio remains up 15.9% year to date, although the drop has erased much of its earlier gains from 2024. It’s important to note that such short-term fluctuations do not reflect the strong fundamentals and strategic positioning supported by AI-driven growth catalysts, making Twilio an attractive buy at these levels.

Year-to-Date Price Return Performance

Image Source: Zacks Investment Research

Twilio’s Leading Role in Customer Engagement

In the realm of communications and customer engagement, Twilio stands out as a key player, enabling real-time, personalized interactions for businesses globally. A major long-term growth driver for Twilio is its commitment to artificial intelligence (AI). With tools like Twilio Verify and Voice Intelligence, the company allows businesses to automate customer interactions, enhancing both efficiency and satisfaction.

Moreover, Twilio Segment, the customer data platform, is gaining momentum. By consolidating customer data from various points of contact, Segment aids businesses in running personalized, data-driven marketing campaigns, a vital strategy in today’s customer-centric environment.

With AI adoption on the rise, Twilio’s ability to deliver data-rich, AI-enhanced customer solutions positions it favorably against competitors, offering significant long-term growth potential.

Staying Competitive Against Tech Giants

Despite competition from major companies like Cisco CSCO, Microsoft MSFT, and Amazon AMZN, Twilio has carved out a niche with its developer-friendly and highly customizable API ecosystem. Unlike competitors that offer uniform solutions, Twilio empowers businesses to develop tailored communication and engagement experiences through its API-first model.

Twilio’s extensive global reach, spread across more than 180 countries, further distinguishes it from more localized competitors. This broad presence, paired with deep capabilities across messaging, voice, email, and video, positions Twilio as a reliable provider for businesses seeking comprehensive customer engagement tools.

Solid Financial Performance

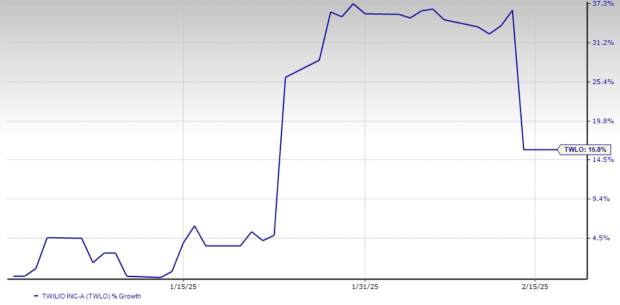

Twilio’s fourth-quarter results may have missed analyst expectations on earnings, but they still showed a healthy year-over-year growth of 16.3%. The revenues for this quarter surged by 11%, highlighting the company’s ongoing growth trajectory.

Trends in Quarterly Revenue Growth

Image Source: Twilio Inc.

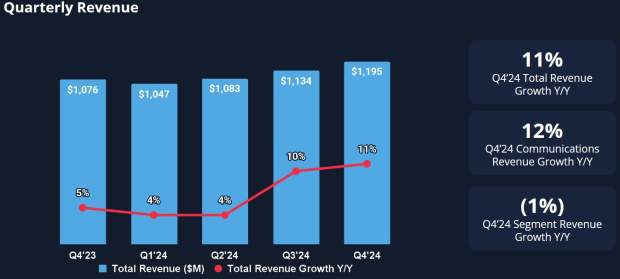

The company’s dollar-based net expansion rate was 106% in the fourth quarter, a slight increase from 105% in the previous quarter and up from 102% a year ago. As of December 31, Twilio also saw its active customer accounts rise to over 325,000 from 320,000 at the end of the third quarter.

Trends in Dollar-Based Net Expansion Rate

Image Source: Twilio Inc.

Twilio’s financial strength is further demonstrated by its robust balance sheet. By the end of the fourth quarter of 2024, the company held $2.38 billion in cash, cash equivalents, and short-term marketable securities. It also generated a strong operating cash flow of $716.2 million and free cash flow of $657.5 million during the year.

For shareholders, the company repurchased $2.33 billion in stock in 2024, completing its previously authorized $3 billion buyback plan. In January 2025, Twilio’s board approved an additional share repurchase program worth $2 billion, valid until December 31, 2027. This strategy underscores Twilio’s commitment to returning value to its investors.

Conclusion: Consider Buying TWLO Stock

The sharp decline in Twilio’s stock following its earnings report appears to be an overreaction to short-term guidance concerns. The company is on track for sustainable profitability and continues to maintain strong revenue growth, specifically in high-margin AI and customer engagement solutions.

Given the favorable conditions surrounding AI, a unique product offering, increasing enterprise adoption, strong cash flow, and active share buybacks, Twilio presents a solid opportunity for investors. Buying this dip could prove beneficial as TWLO is well-prepared for future growth.

Only $1 to Access All Zacks Buys and Sells

We’re serious.

In a surprising offer years ago, we provided members 30 days of access to all our picks for just $1, with no further obligations.

While many took advantage of this unique chance, others hesitated, thinking it was too good to be true. Our intent is clear: we want you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 256 positions with double- and triple-digit gains in 2024 alone.

Looking for the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

For more information on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.