Two Small-Cap Stocks Demonstrating Resilience Amid Economic Uncertainty

In times of economic uncertainty, having diverse product lines that serve uncorrelated markets proves beneficial. A strong balance sheet, filled with liquidity, creates a foundation for cautious growth and potential acquisitions. We spotlight two small-cap stocks covered by Zacks that exhibit these characteristics.

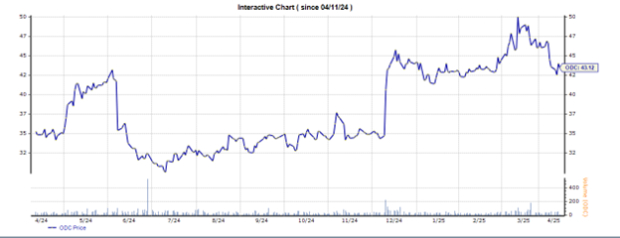

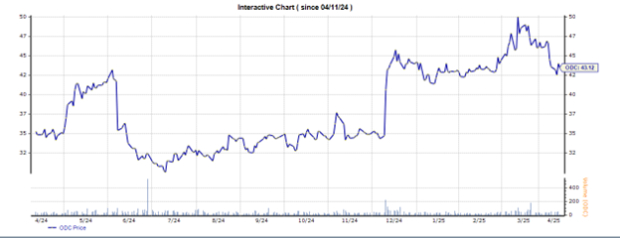

Oil-Dri Corporation (ODC): A Leader in Sorbent Products

Oil-Dri Corporation (ODC) excels in the development, manufacturing, and marketing of sorbent products. Its cat litter division has historically shown resilience to economic downturns. The company’s acquisition of Ultra Pet in May 2024 is expected to boost year-over-year sales in the near term.

Image Source: Zacks Investment Research

Another noteworthy aspect is Oil-Dri’s fluid purification segment, which reported a 17% year-over-year increase, reaching $26.5 million. This segment benefits from the rising demand for renewable diesel in the U.S., supported by new plant openings and government incentives. The U.S. Energy Information Administration anticipates renewable diesel production to grow by 8.7%, reaching 250,000 barrels per day by 2026.

Zacks recently upgraded ODC to an “Outperform” rating due to its solid revenue growth and a 16% increase in EBITDA year over year for the latest quarter. Income investors will appreciate that ODC has consistently raised its dividend by 4.9% annually over the last decade. With most operations based in the U.S. and vertical integration, ODC believes it can mitigate potential negative impacts from tariffs.

Currently, the stock trades at 7.61 times its trailing twelve-month EV/EBITDA, lower than the Zacks sub-industry average of 8.19 times, the sector average of 10.46 times, and the S&P 500 average of 14.66 times. Over the past five years, ODC has seen a high of 12.72 times and a low of 4.81 times, with a median of 7.64 times. Recently, shares have rallied, rising 27.1% in six months and 22% over the past year. In contrast, the Zacks chemical-diversified sub-industry fell 35.9% over the same six-month span.

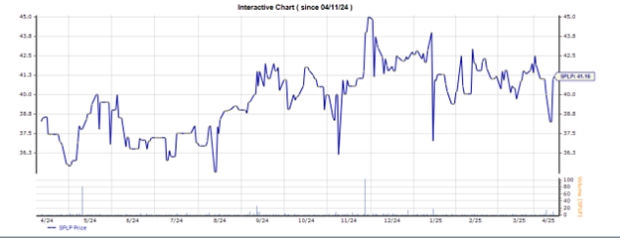

Steel Partners Holdings L.P. (SPLP): A Diversified Global Holding Company

Steel Partners Holdings L.P. (SPLP) represents a diversified global holding company with operations across four key verticals: Industrial (49.9% of sales), Financial (18.4%), Energy (10.5%), and Supply Chain (10%). This diverse portfolio allows SPLP to strategically hedge against fluctuations in commodity prices, interest rates, and global trade dynamics.

Image Source: Zacks Investment Research

The Industrial segment includes manufacturing materials, tubing, building materials, performance materials, electrical products, blades, and metalized film—all focusing on niche markets. The Financial division operates WebBank, an industrial bank, while the Energy segment provides drilling and production services to oil and gas exploration and production companies. The Supply Chain sector, via its subsidiary Modus Link, offers materials sourcing, planning, warehouse management, transportation management, and packaging design.

In its latest quarter, SPLP’s Industrial revenue grew by 8% year over year, with the Supply Chain and Financial Services segments up 9.1% and 2.9% respectively. While Energy revenue increased by 4.7% year-over-year for the quarter, it declined by 19.2% for the full year of 2024. Overall, total revenue rose by 6.6% year-over-year for the quarter.

Adjusted EBITDA for Q4 skyrocketed by 43% to $84.7 million, driven by improved gross margins and operating leverage. The company holds net cash of $62.2 million, factoring in a preferred unit liability of $155.6 million, and has access to a $470 million senior credit agreement.

SPLP’s stock is currently priced at 1.20 times its trailing twelve-month EV/EBITDA, compared to 10.02 times for both the Zacks sub-industry and sector averages, as well as the S&P 500 index. Over the past five years, SPLP has traded between 20.85 times and 1.04 times, with a median of 3.97. The stock trades at 0.62 times its trailing twelve-month price-to-book ratio, compared to 5.04 times for both the Zacks sub-industry and sector averages, and 7.01 times for the S&P 500 index. Shares have increased by 7.1% in the past six months and 9.7% over the last twelve-month period, even as stocks in the Zacks multi-sector conglomerate sub-industry have declined by 15.5%.

The current market betas stand at 1 for SPLP and 0.5 for ODC.

Latest Insights and Recommendations

From a pool of thousands of stocks, Zacks experts have selected five favorites projected to rise by 100% or more in the coming months. Among those, Director of Research Sheraz Mian has identified a standout pick expected to deliver significant upside.

This company, which caters to millennial and Gen Z demographics, generated nearly $1 billion in revenue last quarter alone. A recent pullback makes it an attractive buying opportunity. While not all elite picks guarantee success, this one has the potential to exceed previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged by +129.6% in around nine months.

Free: See Our Top Stock And 4 Runners Up

Steel Partners Holdings L.P. (SPLP): Free Stock Analysis Report

Oil-Dri Corporation of America (ODC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.