NVIDIA Corporation (NVDA) and Taiwan Semiconductor Manufacturing Company Limited (TSMC) have both experienced significant stock price increases, with NVDA rising 59.9% and TSMC climbing 62% over the past year. This growth is attributed to robust demand for AI technology, expanding data centers, and easing trade tensions. Analysts predict TSMC will report revenues of $34.6 billion to $35.8 billion for Q1 2026, a 25.5% increase year-over-year, and expect NVIDIA’s revenues to be approximately $65 billion for Q4 2026.

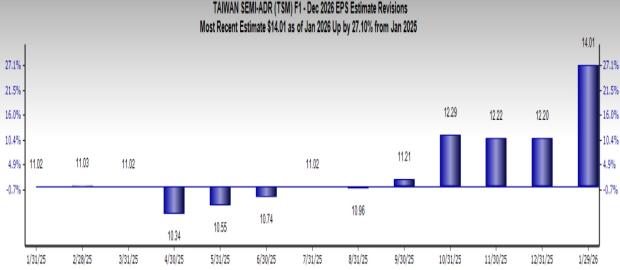

TSMC forecasts a gross profit margin of 63% to 65% for Q1 2026, up from 62.3% in Q4 2025, and is expected to see a 46.2% increase in quarterly earnings growth. NVIDIA is also positioned for growth with anticipated earnings growth rates of 70.8% for the current quarter and 55.9% for the year. Today’s consensus estimates suggest TSMC’s earnings per share could grow by 27.1% year-over-year, while NVIDIA expects a 10.7% increase.

Analysts project a short-term price target of $408 for TSMC, indicating a potential 19.2% increase from its last close. For NVIDIA, the average target is $254.81, suggesting a potential upside of 33.1% from its closing price of $191.52.