AI Market Growth: Key Stocks to Consider for Investors

The artificial intelligence (AI) market is experiencing significant growth. According to recent estimates from the United Nations, the global AI market is projected to reach $4.8 trillion by 2033, a substantial increase from $183 billion in 2023.

Key Investment: Nvidia

For investors aiming to capitalize on AI stocks, Nvidia (NASDAQ: NVDA) stands out as a key player. Its competitive edge largely stems from its CUDA developer suite, which allows customization of its chips for specialized applications.

Nvidia is a leading manufacturer of AI graphics processing units (GPUs), controlling approximately 70% to 95% of the market share. With forecasts suggesting the AI chip market could exceed $400 billion in annual sales over the next five years, Nvidia maintains a strong foothold in this burgeoning market.

Experts highlight that Nvidia’s chips currently outperform most competitors. However, competition is intensifying. Understanding the CUDA developer suite reveals why Nvidia’s leadership in the industry is likely to persist, despite increasing competition. CUDA, established in 2006, enables developers to build applications tailored to Nvidia’s offerings, creating a dependency that complicates customer transitions to other vendors.

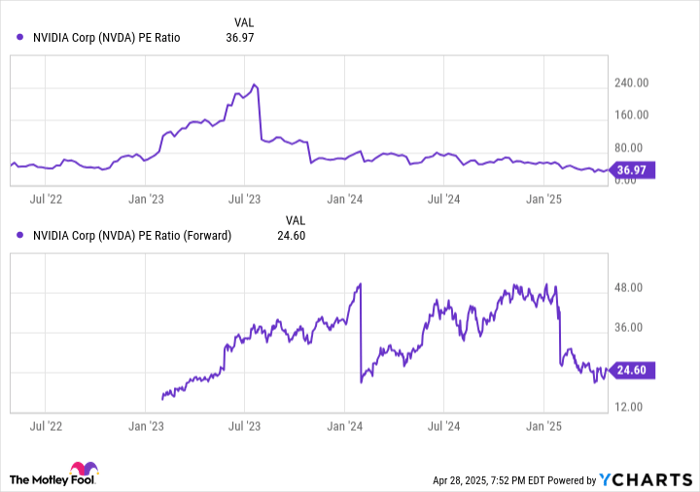

Despite its industry dominance, Nvidia’s stock is trading at 25 times forward earnings, making shares relatively accessible for investors.

NVDA PE Ratio data by YCharts.

Emerging Opportunity: SoundHound AI

If diversifying your investments is a priority, consider SoundHound AI (NASDAQ: SOUN). With a market capitalization of approximately $4 billion, SoundHound presents significant growth potential compared to Nvidia’s valuation of $2.7 trillion.

SoundHound focuses on AI solutions related to sound, offering applications for industries such as automotive and retail. Their technology enhances AI-driven customer interactions, like those found at drive-throughs or in vehicles equipped with virtual assistants.

SOUN PS Ratio data by YCharts.

Although SoundHound’s stock currently trades at a high price-to-sales ratio of 39, revenue forecasts indicate nearly a doubling of sales this year, with total sales still under $100 million. The voice AI market is expected to exceed $40 billion by 2032, providing ample growth room for SoundHound to validate its current valuation amidst potential market volatility.

Conclusion: Nvidia and SoundHound as Strategic Investments

For most investors, Nvidia is a solid choice to gain exposure to the AI sector. Meanwhile, SoundHound represents a compelling option for those seeking additional growth potential.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.