Investing in Stability: Visa and Novartis Stand Out for Dividend Investors

Dividend investors typically seek reliable companies that will continue to pay and increase their distributions. While dividend cuts can happen due to various business challenges, some companies appear well-equipped to maintain their payouts. This article explores why Visa (NYSE: V) and Novartis (NYSE: NVS) are positioned for long-term success and steady dividends.

1. Visa’s Strong Dividend Performance

Visa has an impressive history as a dividend-paying company since going public in 2008. Each year, it has increased its dividend payouts.

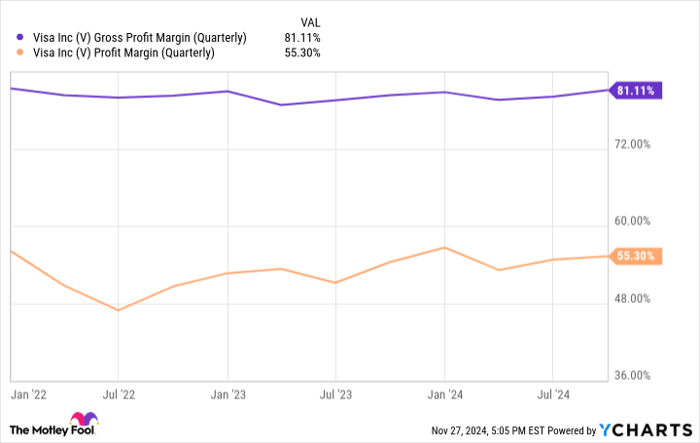

The company’s financial strength allows it to sustain these dividends. Visa generates steady and growing revenue, earnings, and free cash flow. With millions of credit card transactions happening daily, Visa earns a small percentage from each transaction. Its gross margins hover around 80%, and the company nets approximately $0.50 for every dollar in revenue.

V Gross Profit Margin (Quarterly) data by YCharts.

This profitability is significant for a large enterprise like Visa. It can efficiently handle additional transactions with minimal cost, leading to strong margins.

Moreover, Visa’s network of banks, cardholders, and merchants creates a valuable ecosystem that grows in worth as it expands. This networking effect limits serious competition and helps Visa maintain its leadership in the market.

As the financial industry evolves, Visa adapts, opening doors for continued growth. With many transactions still conducted outside its digital scope, the shift toward cashless payments bodes well for future opportunities.

2. Novartis: A Leader in Pharmaceuticals

Novartis continues to thrive in the pharmaceutical industry, where demand for essential drugs remains high. The company has a history of producing high-revenue “blockbuster” drugs, consistently working on innovations to replace those that are losing sales due to patent expirations or competition.

Recent financial results for Novartis showcase this strength. In the third quarter, revenue rose by 9% year-over-year to $12.8 billion, while earnings per share increased by 18% to $2.06. Free cash flow mirrored this growth, reaching approximately $6 billion.

Notably, Novartis streamlined its operations in the past year by spinning off its generic and biosimilar unit, Sandoz, and reducing its clinical-stage pipeline by 40%. This choice allows Novartis to concentrate its efforts on higher-growth projects.

With several dozen programs still in development, Novartis is well-positioned to secure further regulatory approvals, thus maintaining its revenue and earnings trajectory. Additionally, the company boasts a remarkable record of 27 consecutive years of dividend increases.

Investors can enjoy a competitive dividend yield of 3.65% from Novartis, significantly higher than the S&P 500 average yield of 1.32%. This commitment to returning value to shareholders suggests that Novartis remains a stable choice for dividend investors.

Seize This Opportunity in the Market

Have you ever felt like you missed out on investing in top-performing stocks? Our expert analysts are currently issuing a “Double Down” recommendation on stocks they believe are poised for significant growth. Now may be a perfect time to reconsider investing before these opportunities pass you by:

- Nvidia: an investment of $1,000 would have grown to $358,460 since our recommendation in 2009!*

- Apple: a $1,000 investment in 2008 would be worth $44,946 today!*

- Netflix: if you invested $1,000 in 2004, you would have $478,249 now!*

Currently, we’re highlighting three “Double Down” stocks that could be your next big opportunity.

Discover the three “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.